PNC Bank 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

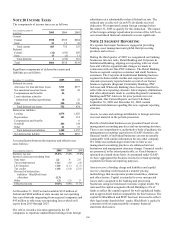

102

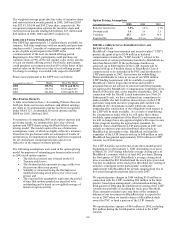

The weighted-average grant-date fair value of incentive share

and restricted stock awards granted in 2005, 2004 and 2003

was $53.81, $54.46 and $44.23 per share, respectively. We

recognized compensation expense for incentive share and

restricted stock awards totaling $44 million, $25 million and

$20 million in 2005, 2004 and 2003, respectively.

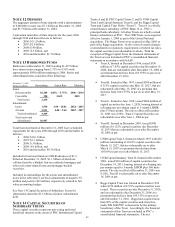

EMPLOYEE STOCK PURCHASE PLAN

Our ESPP has approximately 1.5 million shares available for

issuance. Full-time employees with six months and part-time

employees with 12 mo nths of continuous employment with

us are eligible to participate in the ESPP at the

commencement of the next six-month offering period.

Beginning in June 2003, participants could purchase our

common stock at 95% of the fair market value on the last day

of each six-month offering period. Previously, participants

could purchase our common stock at 85% of the lesser of fair

market value on the first or last day of each offering period.

No charge to earnings is recorded with respect to the ESPP.

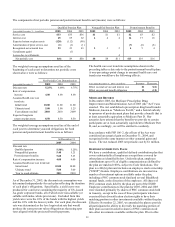

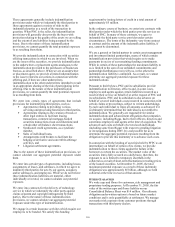

Shares issued pursuant to the ESPP were as follows:

Year ended December 31 Shares Price Per Share

2005 138,754 $51.74 and 58.74

2004 156,753 50.43 and 54.57

2003 361,064 35.87 and 51.99

PRO FORMA EFFECTS

A table is included in Note 1 Accounting Policies that sets

forth pro forma net income and basic and diluted earnings

per share as if compensation expense had been recognized

under SFAS 123, as amended, for stock options and the

ESPP for 2005, 2004 and 2003.

For purposes of computing 2005 stock option expense and

pro forma results, we estimated the fair value of stock

options and ESPP shares using the Black-Scholes option

pricing model. The model requires the use of numerous

assumptions, many of which are highly subjective in nature.

Therefore, the pro forma results are estimates of results of

operations as if compensation expense had been recognized

for all stock-based compensation plans and are not

indicative of the impact on future periods.

The following assumptions were used in the option pricing

model for purposes of estimating pro forma results as well

as 2005 stock option expense.

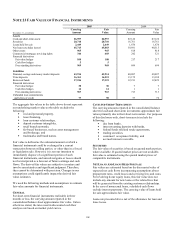

• The risk-free interest rate is based on the US

Treasury yield curve,

• The dividend yield represents average yields over

the previous three-year period,

• Volatility is measured using the fluctuation in

month-end closing stock prices over a five-year

period, and

• The expected life assumption represents the period

of time that options granted are expected to be

outstanding and is based on a weighted average of

historical option activity.

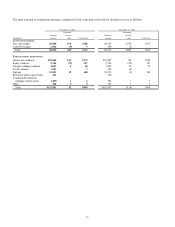

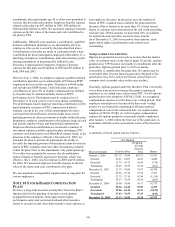

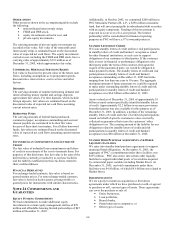

Option Pricing Assumptions

Year ended December 31 2005 2004 2003

Risk-free interest rate 3.8% 3.4% 3.1%

Dividend yield 3.8 3.6 3.5

Volatility 25.7 28.9 30.9

Expected life 4.8 yrs. 4.9 yrs. 5.0 yrs.

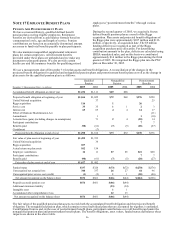

2002 BLACKROCK LONG-TERM RETENTION AND

INCENTIVE PLAN

BlackRock’ s long-term retention and incentive plan (“LTIP”)

permits the grant of up to $240 million in deferred

compensation awards (the “LTIP Awards”), subject to the

achievement of certain performance hurdles by BlackRock no

later than March 2007. If the performance hurdles are

achieved, up to $200 million of the LTIP Awards will be

funded with up to 4 million shares of BlackRock Class A

common stock to be surrendered by PNC and distributed to

LTIP participants in 2007, less income tax withholding.

Shares attributable to value in excess of our $200 million

LTIP funding requirement will be available to support

BlackRock’ s future long-term retention and incentive

programs but are not subject to surrender until the programs

are approved by BlackRock’ s Compensation Committee of its

Board of Directors and, as the majority shareholder, PNC. In

connection with the Merrill Lynch transaction (see Note 26

Subsequent Event), we have confirmed our commitment to

make available the full 4 million shares for use in the LTIP

and future long-term incentive programs and clarified with

BlackRock the circumstances under which any shares

remaining after satisfaction of our obligations with respect to

the LTIP will be made available. As a result of establishing

the circumstances under which we will make these shares

available, upon completion of the Merrill Lynch transaction,

we will no longer have any approval rights with respect to any

future program meeting the agreed upon standards. In

addition, shares distributed to LTIP participants in 2007 will

include an option to put such distributed shares back to

BlackRock at fair market value. BlackRock will fund the

remainder of the LTIP Awards with up to $40 million in cash.

BlackRock has granted approximately $230 million in LTIP

Awards, net of forfeitures.

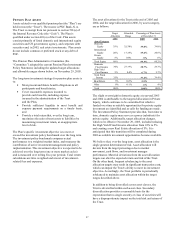

The LTIP Awards vest at the end of any three-month period

beginning on or after January 1, 2005 and ending on or prior

to March 30, 2007 during which the average closing price of

BlackRock’ s common stock is at least $62 per share. During

the first quarter of 2005, BlackRock’ s average closing stock

price exceeded the $62 threshold and the stock price provision

was met. In addition to the stock price threshold, the vesting of

awards is contingent on the participants’ continued

employment with BlackRock for periods ranging from two to

five years through the payment date in early 2007.

We reported pretax charges in 2004 totaling $110 million in

connection with the LTIP, including $96 million in the third

quarter, based upon management’ s determination during the

third quarter of 2004 that the likelihood of vesting of the LTIP

Awards was probable of reaching the stock price threshold.

These amounts included a pro rata share of the estimated

dilution of our investment in BlackRock that is expected to

occur in 2007 when we transfer shares of BlackRock stock

owned by PNC to fund a portion of the LTIP Awards.

We reported pretax expense of $64 million in 2005, including

$16 million during the fourth quarter, related to the LTIP

Awards.