PNC Bank 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

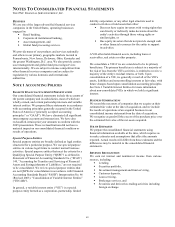

RECENT ACCOUNTING PRONOUNCEMENTS

In February 2006, the FASB issued SFAS 155, “Accounting

for Certain Hybrid Financial Instruments-an amendment of

FASB Statements No. 133 and 140,” that permits fair value

remeasurement of certain hybrid financial instruments,

clarifies the scope of SFAS 133, “Accounting for Derivative

Instruments and Hedging Activities” regarding interest-only

and principal-only strips, and provides further guidance on

certain issues regarding beneficial interests in securitized

financial assets, concentrations of credit risk and qualifying

special purpose entities. SFAS 155 is effective for all

instruments acquired or issued as of the first fiscal year

beginning after September 15, 2006 and may be applied to

certain other financial instruments held prior to the adoption

date. Earlier adoption is permitted as of the beginning of an

entity’ s fiscal year providing the entity has not yet issued

financial statements. We do not expect the adoption of SFAS

155 to have a material impact on our consolidated financial

statements.

In November 2005, the FASB issued FASB Staff Position

No. (“FSP”) FAS 115-1, "The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain

Investments." This FSP clarified and reaffirmed existing

guidance as to when an investment is considered impaired,

whether that impairment is other than temporary, and the

measurement of an impairment loss. Certain disclosures

about unrealized losses on available for sale debt and equity

securities that have not been recognized as other-than-

temporary impairments are required under FSP 115-1. The

FSP is effective for fiscal years beginning after December 15,

2005. As the FSP reaffirms existing guidance, we do not

expect this FSP to have a significant impact on our

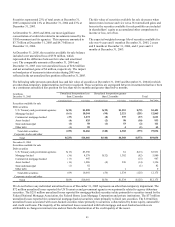

consolidated financial statements. At December 31, 2005,

the total unrealized losses in the securities available for sale

portfolio was $373 million compared with total unrealized

losses of $125 million at December 31, 2004.

In June 2005, the Emerging Issues Task Force (“EITF”) of

the FASB issued EITF Issue 04-5, “Determining Whether a

General Partner, or the General Partners as a Group, Controls

a Limited Partnership or Similar Entity When the Limited

Partners Have Certain Rights.” EITF 04-5 provides that the

general partner(s) is presumed to control the limited

partnership, unless the limited partners possess either

substantive participating rights or the substantive ability to

dissolve the limited partnership or otherwise remove the

general partner(s) without cause (“kick-out rights”). Kick-out

rights are substantive if they can be exercised by a simple

majority of the limited partners voting interests. The

guidance applies to limited partnerships formed or modified

after June 29, 2005, and to existing limited partnerships no

later than January 1, 2006. The adoption of this guidance is

not expected to have a material impact on our consolidated

financial statements.

In May 2005, the FASB issued SFAS 154, “Accounting

Changes and Error Corrections – a replacement of APB

Opinion No. 20 and FASB Statement No. 3.” SFAS 154

generally requires retrospective application to prior periods’

financial statements of all voluntary changes in accounting

principle and changes required when a new pronouncement

does not include specific transition provisions. This standard

applies to PNC beginning January 1, 2006.

In December 2004, the FASB issued SFAS 123 (Revised

2004), “Share -Based Payment” (“SFAS 123R”). SFAS 123R

replaces SFAS 123 and supersedes APB 25. SFAS 123R

requires compensation cost related to share-based payments to

employees to be recognized in the financial statements based

on their fair value. In April 2005, the SEC issued a rule which

delayed the required effective date to the beginning of an

entity’ s fiscal year which begins after June 15, 2005.

Accordingly, we will adopt SFAS 123R effective January 1,

2006, using the modified prospective method of transition.

This method requires the provisions of SFAS 123R be applied

to new awards and awards modified, repurchased or cancelled

after the effective date. In November, 2005 the FASB issued

FSP No. FAS 123R-3, “Transition Election Related to

Accounting for the Tax Effects of Share -Based Payment

Awards.” This FSP provides a transition election for

calculating the pool of excess tax benefits available to absorb

tax deficiencies recognized subsequent to the adoption of

SFAS 123R which may be made up to one year from the initial

adoption of SFAS 123R. Based on our review of the

provisions of SFAS 123R and because we previously adopted

the fair value recognition provisions of SFAS 123 on January

1, 2003, we do not expect the adoption of the revised standard

to have a significant impact on our consolidated financial

statements.

The American Jobs Creation Act of 2004 (the “AJCA”)

created a one-time opportunity for US companies to repatriate

undistributed earnings from foreign subsidiaries at a

substantially reduced federal tax rate. The reduced rate is

achieved via an 85% dividends received deduction. To qualify

for this deduction, repatriation of foreign earnings was to be

completed by December 31, 2005. In December 2004, the

FASB issued FSP 109-2, “Accounting and Disclosure

Guidance for the Foreign Earnings Repatriation Provision

within the American Jobs Creation Act of 2004”, which

requires that the total effect on income tax expense be

disclosed in the enterprise’ s financial statements for the period

when the evaluation is completed. The impact of the foreign

earnings repatriation provision of the AJCA on our

consolidated financial statements is discussed in Note 20

Income Taxes.

Also in December 2004, the FASB issued SFAS 153,

“Exchanges of Nonmonetary Assets, an amendment of APB

Opinion No. 29, Accounting for Nonmonetary Transactions.”

SFAS 153 amends the APB 29 exception to fair value

measurement for nonmonetary exchanges to apply only to

those exchanges which lack commercial substance, as defined

in the standard. SFAS 153 was effective for nonmonetary asset

exchanges that we entered into on or after July 1, 2005. The

application of this guidance did not have a material impact on

our consolidated financial statements in 2005.