PNC Bank 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

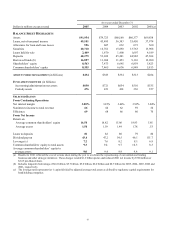

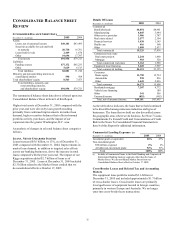

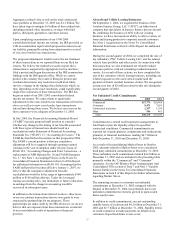

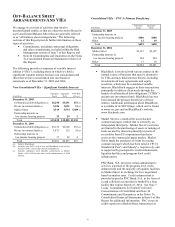

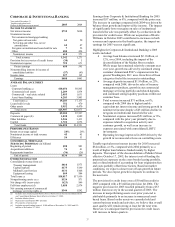

SECURITIES

Details Of Securities Amortized Fair

In millions Cost Value

December 31, 2005 (a)

SECURITIES AVAILABLE FOR SALE

Debt securities

U.S. Treasury and government

agencies $3,816 $3,744

Mortgage-backed 13,794 13,544

Commercial mortgage-backed 1,955 1,919

Asset-backed 1,073 1,063

State and municipal 159 158

Other debt 87 86

Corporate stocks and other 196 196

Total securities available for sale $21,080 $20,710

December 31, 2004

SECURITIES AVAILABLE FOR SALE

Debt securities

U.S. Treasury and government

agencies $4,735 $4,722

Mortgage-backed 8,506 8,433

Commercial mortgage-backed 1,380 1,370

Asset-backed 1,910 1,901

State and municipal 175 176

Other debt 33 33

Corporate stocks and other 123 125

Total securities available for sale $16,862 $16,760

S

ECURITIES

H

ELD TO

M

ATURITY

Debt securities

Asset-backed $1 $1

Total securities held to maturity $1 $1

(a) Securities held to maturity at December 31, 2005 were less than $.5

million.

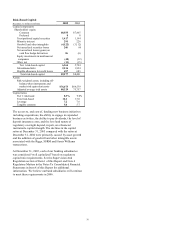

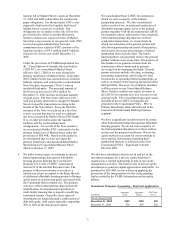

Securities represented 23% of total assets at December 31,

2005 compared with 21% at December 31, 2004. The

increase in total securities compared with December 31,

2004 was primarily due to the acquisition of Riggs and

normal portfolio activity.

At December 31, 2005, the securities available for sale

balance included a net unrealized loss of $370 million, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2004 was a net

unrealized loss of $102 million. The increase in the net

unrealized loss at December 31, 2005 reflected the impact on

bond prices of increases in interest rates during 2005 partially

offset by the sales of securities during the second quarter of

2005 as discussed below.

We evaluate our portfolio of securities available for sale in

light of changing market conditions and other factors and,

where appropriate, take steps intended to improve our

overall positioning. In late April and early May 2005 we

sold $2.1 billion of securities available for sale and

terminated $1.0 billion of resale agreements that were most

sensitive to extension risk due to rising short-term interest

rates. We also purchased $2.1 billion of securities with

higher yields and lower extension risk. These transactions

resulted in realized net securities and other losses of

approximately $31 million, which are included in our results

of operations for 2005.

The fair value of securities available for sale decreases when

interest rates increase and vice versa. Further increases in

interest rates in 2006, if sustained, will adversely impact the

fair value of securities available for sale going forward

compared with the fair value at December 31, 2005. Net

unrealized gains and losses in the securities available for sale

portfolio are included in shareholders’ equity as accumulated

other comprehensive income or loss, net of tax.

The expected weighted-average life of securities available

for sale was 4 years and 1 month at December 31, 2005

compared with 2 years and 8 months at December 31, 2004.

We estimate that at December 31, 2005 the effective

duration of securities available for sale is 2.7 years for an

immediate 50 basis points parallel increase in interest rates

and 2.4 years for an immediate 50 basis points parallel

decrease in interest rates. Comparable amounts at

December 31, 2004 were 2.7 years and 2.3 years,

respectively.

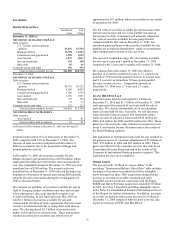

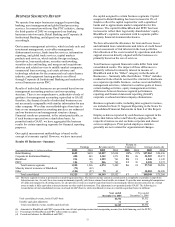

LOANS HELD FOR SALE

Education loans held for sale totaled $1.9 billion at

December 31, 2005 and $1.1 billion at December 31, 2004

and represented the majority of our loans held for sale at

each date. We classify substantially all of our education

loans as loans held for sale. Generally, we sell education

loans when the loans are placed into repayment status.

Gains on sales of education loans totaled $19 million for

2005, $30 million for 2004 and $20 million for 2003. These

gains are reflected in the other noninterest income line item

in our Consolidated Income Statement and in the results of

the Retail Banking segment.

Our liquidation of institutional loans held for sale resulted in

net gains in excess of valuation adjustments of $7 million in

2005, $52 million in 2004 and $69 million in 2003. These

gains are reflected in the corporate services line item in our

Consolidated Income Statement and in the results of the

Corporate & Institutional Banking business segment. This

liquidation has now been completed.

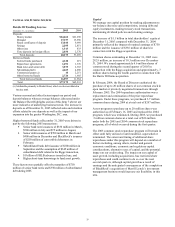

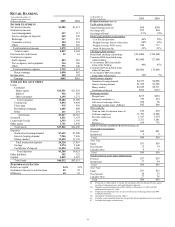

OTHER ASSETS

The increase of $1.9 billion in “Assets -Other” in the

preceding “Summarized Balance Sheet Data” table includes

the impact of increases in goodwill and other intangible

assets arising from three 2005 acquisitions along with an

increase in accounts receivable. Goodwill and other

intangible assets recorded in connection with the Riggs,

SSRM and Harris Williams acquisitions totaled $1.0 billion

in 2005. See Note 9 Goodwill and Other Intangible Assets

in the Notes To Consolidated Financial Statements in Item 8

of this Report for further information. In addition, accounts

receivable included in other assets increased $.6 billion at

December 31, 2005 compared with the prior year-end, due

in part to increases at PFPC and BlackRock.