PNC Bank 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

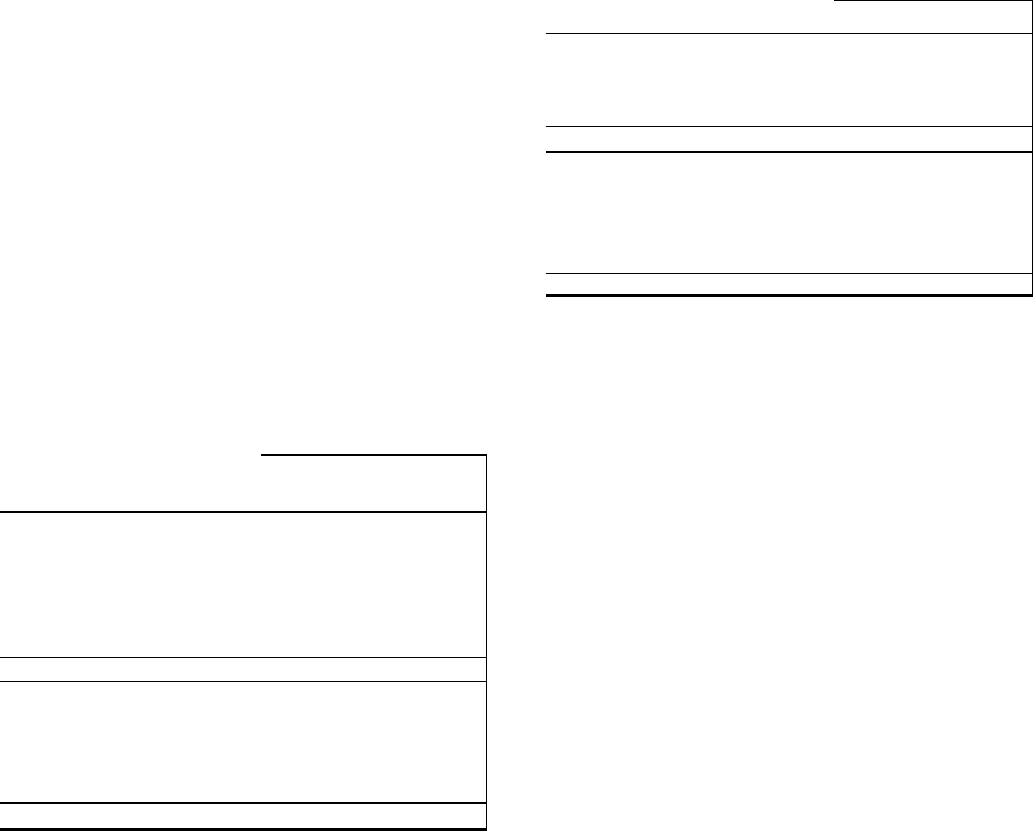

OFF-BALANCE SHEET

ARRANGEMENTS AND VIES

We engage in a variety of activities that involve

unconsolidated entities or that are otherwise not reflected in

our Consolidated Balance Sheet that are generally referred

to as “off-balance sheet arrangements.” The following

sections of this Report provide further information on these

types of activities:

• Commitments, including contractual obligations

and other commitments, included within the Risk

Management section of Item 7 of this Report, and

• Note 24 Commitments and Guarantees in the Notes

To Consolidated Financial Statements in Item 8 of

this Report.

The following provides a summary of variable interest

entities (“VIEs”), including those in which we hold a

significant variable interest but have not consolidated and

those that we have consolidated into our financial

statements as of December 31, 2005 and 2004.

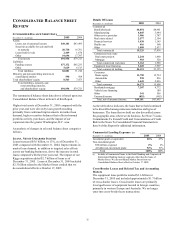

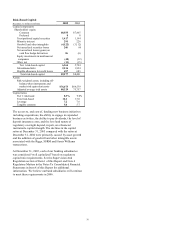

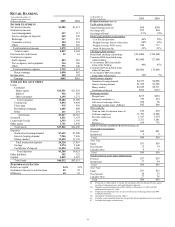

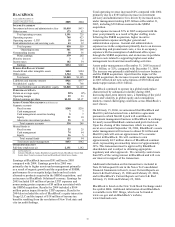

Non-Consolidated VIEs – Significant Variable Interests

In millions

Aggregate

Assets

Aggregate

Debt

PNC Risk

of Loss

December 31, 2005

Collateralized debt obligations (a) $6,290 $5,491

$51 (b)

Private investment funds (a) 5,186 1,051

13 (b)

Market Street 3,519 3,514

5,089 (c)

Partnership interests in

low income housing projects 35 29

2

Total $15,030 $10,085

$5,155

December 31, 2004

Collateralized debt obligations (a) $3,152 $2,700

$33 (b)

Private investment funds (a) 1,872 125

24 (b)

Partnership interests in

low income housing projects

37

28

4

Total $5,061 $2,853

$61

(a) Held by BlackRock.

(b) Includes both PNC’ s risk of loss and BlackRock’ s risk of loss,

limited to PNC’ s ownership interest in BlackRock.

(c) Includes off-balance sheet liquidity commitments to Market

Street of $4.6 billion and other credit enhancements of $444

million.

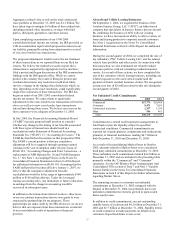

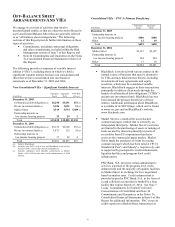

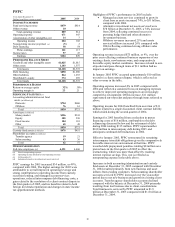

Consolidated VIEs – PNC Is Primary Beneficiary

In millions

Aggregate

Assets

Aggregate

Debt

December 31, 2005

Partnership interests in

low income housing projects $680

$680

Other 12

10

Total $692

$690

December 31, 2004

Market Street $2,167

$2,167

Partnership interests in

low income housing projects 504

504

Other 13

10

Total $2,684

$2,681

• BlackRock is involved with various entities in the

normal course of business that may be deemed to

be VIEs and may hold interests therein, including

investment advisory agreements and equity

securities, which may be considered variable

interests. BlackRock engages in these transactions

principally to address client needs through the

launch of collateralized debt obligations (“CDOs”)

and private investment funds. BlackRock has not

been deemed the primary beneficiary of these

entities. Additional information about BlackRock

is available in its SEC filings, which can be found

at www.sec.gov and on BlackRock’ s website,

www.blackrock.com.

• Market Street is a multi-seller asset-backed

commercial paper conduit that is owned by an

independent third party. Market Street’ s activities

are limited to the purchasing of assets or making of

loans secured by interests primarily in pools of

receivables from US corporations that desire

access to the commercial paper market. Market

Street funds the purchases or loans by issuing

commercial paper which has been rated A1/P1 by

Standard & Poor’ s and Moody’ s, respectively, and

is supported by pool-specific credit enhancement,

liquidity facilities and program-level credit

enhancement.

PNC Bank, N.A. provides certain administrative

services, a portion of the program-level credit

enhancement and the majority of liquidity facilities

to Market Street in exchange for fees negotiated

based on market rates. Credit enhancement is

provided in part by PNC Bank, N.A. in the form of

a cash collateral account that is funded by a loan

facility that expires March 25, 2010. See Note 7

Loans, Commitments To Extend Credit and

Concentrations of Credit Risk and Note 24

Commitments and Guarantees in the Notes To

Consolidated Financial Statements in Item 8 of this

Report for additional information. PNC views its

credit exposure to Market Street transactions as