PNC Bank 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

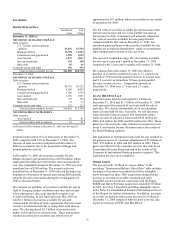

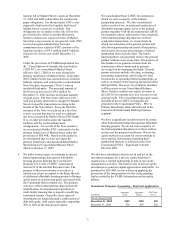

Aggregate residual value at risk on the total commercial

lease portfolio at December 31, 2005 was $1.1 billion. We

have taken steps to mitigate $.6 billion of this residual risk,

including residual value insurance coverage with third

parties, third party guarantees, and other actions.

Upon completing examination of our 1998-2000

consolidated federal income tax returns, the IRS provided us

with an examination report which proposed increases in our

tax liability, principally arising from adjustments to several

of our cross-border lease transactions.

The proposed adjustments would reverse the tax treatment

of these transactions as we reported them on our filed tax

returns. We believe the method we used to report these

transactions is supported by appropriate tax law and have

filed a protest and begun discussions of the IRS examination

findings with the IRS appeals office. While we cannot

predict with certainty the result of filing the protest and

resultant discussions, any resolution would most likely

involve a change in the timing of tax deductions which, in

turn, depending on the exact resolution, could significantly

impact the economics of these transactions. The IRS has

begun an audit of our 2001-2003 consolidated federal

income tax returns. We expect them to again make

adjustments to the cross-border lease transactions referred to

above as well as to new cross-border lease transactions

entered into during those years. We believe our reserves for

these exposures were adequate at December 31, 2005.

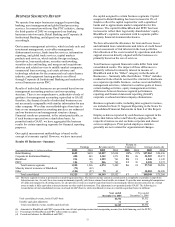

In July 2005, the Financial Accounting Standards Board

(“FASB”) issued a proposed staff position to consider

whether any change in the timing of tax benefits associated

with these types of transactions should result in a

recalculation under Statement of Financial Accounting

Standards No. (“SFAS”) 13, “Accounting for Leases.” The

FASB has had further discussions on this proposal in 2006.

The FASB’ s current position is that any cumulative

adjustment will be recognized through opening retained

earnings in the year of adoption under the provisions of

SFAS 154, “Accounting Changes and Error Corrections – a

replacement of APB Opinion No. 20 and FASB Statement

No. 3.” See Note 1 Accounting Policies in the Notes To

Consolidated Financial Statements in Item 8 of this Report

for additional information on SFAS 154. Assuming that the

FASB staff position becomes effective January 1, 2007, we

believe that the cumulative adjustment from the

recalculations would be in the range of approximately $140

million to $160 million after-tax. Under the leveraged

leasing accounting rules, any immediate or future reductions

in earnings from the change in accounting would be

recovered in subsequent years.

In addition to the transactions referred to above, three lease-

to-service contract transactions that we were party to were

structured as partnerships for tax purposes. These

partnerships are under audit by the IRS. However, we do not

believe that our exposure from these transactions is material

to our consolidated results of operations or financial

position.

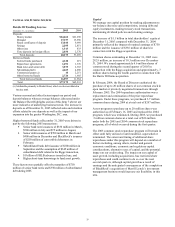

Aircraft and Vehicle Leasing Businesses

On September 1, 2004, we acquired the business of the

Aviation Finance Group, LLC (“AFG”), an Idaho-based

company that specializes in loans to finance private aircraft.

By combining the business of AFG with our existing

business, we have increased our ability to offer a variety of

loans and leasing products to corporate aircraft customers.

See Note 2 Acquisitions in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information.

During the second quarter of 2004, we completed the sale of

our subsidiary, PNC Vehicle Leasing LLC, and the related

vehicle lease portfolio and other assets. In connection with

this transaction, we also terminated our related residual

insurance policies with our remaining residual insurance

carrier. As a result of these actions, we have completed the

exit of the consumer vehicle leasing business, including our

related exposures to the used vehicle market and the

payment of future residual insurance claims. We recognized

a pretax net loss of $3 million related to this sale during the

second quarter of 2004.

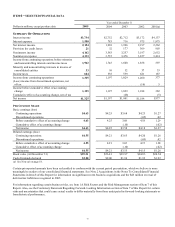

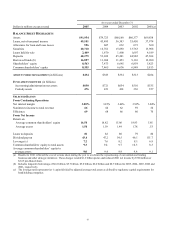

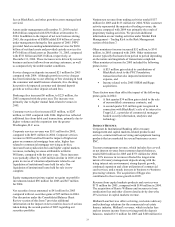

Net Unfunded Credit Commitments

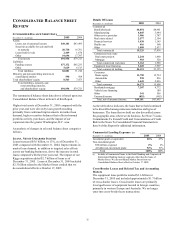

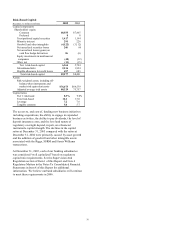

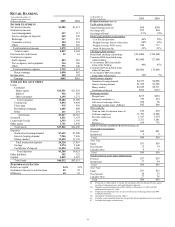

December 31 - in millions 2005 2004

Commercial $27,774 $20,969

Consumer 9,471 7,655

Commercial real estate 2,337 1,199

Other 596 483

Total $40,178 $30,306

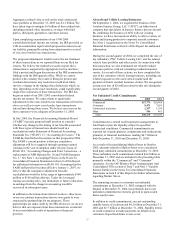

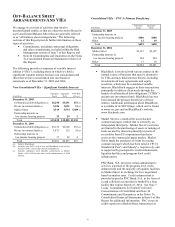

Commitments to extend credit represent arrangements to

lend funds or provide liquidity subject to specified

contractual conditions. Commercial commitments are

reported net of participations, assignments and syndications,

primarily to financial institutions, totaling $6.7 billion at

both December 31, 2005 and December 31, 2004.

As a result of deconsolidating Market Street in October

2005, amounts related to Market Street were considered

third party unfunded commitments at December 31, 2005.

These unfunded credit commitments totaled $4.6 billion at

December 31, 2005 and are included in the preceding table

primarily within the “Commercial” and “Consumer”

categories. See the Off-Balance Sheet Arrangements And

Consolidated VIEs section of Item 7 and Note 3 Variable

Interest Entities in the Notes To Consolidated Financial

Statements in Item 8 of this Report for further information

regarding Market Street.

The remaining increase in consumer net unfunded

commitments at December 31, 2005 compared with the

balance at December 31, 2004 was primarily due to net

unfunded commitments related to growth in open-ended

home equity loans.

In addition to credit commitments, our net outstanding

standby letters of credit totaled $4.2 billion at December 31,

2005 and $3.7 billion at December 31, 2004. Standby letters

of credit commit us to make payments on behalf of our

customers if specified future events occur.