PNC Bank 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

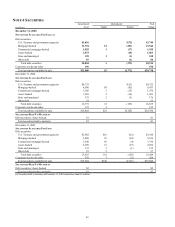

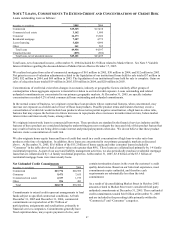

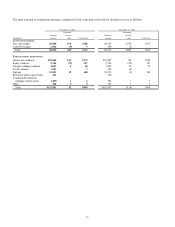

NOTE 12 DEPOSITS

The aggregate amount of time deposits with a denomination

of $100,000 or more was $7.1 billion at December 31, 2005

and $5.7 billion at December 31, 2004.

Contractual maturities of time deposits for the years 2006

through 2010 and thereafter are as follows:

• 2006: $11.2 billion,

• 2007: $2.8 billion,

• 2008: $.4 billion,

• 2009: $.3 billion, and

• 2010 and thereafter: $1.7 billion.

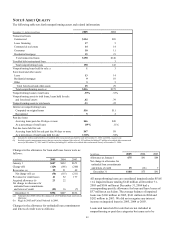

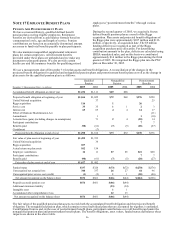

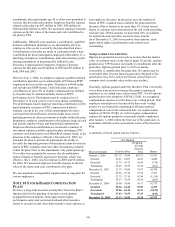

NOTE 13 BORROWED FUNDS

Bank notes at December 31, 2005 totaling $1.437 billion

have interest rates ranging from 2.75% to 4.35% with

approximately $850 million maturing in 2006. Senior and

subordinated notes consisted of the following:

December 31, 2005

Dollars in millions

Outstanding

Stated Rate

Maturity

Senior

Nonconvertible $2,188 4.20% – 5.75% 2006 – 2010

Convertible 250 2.625 2035

Total senior 2,438

Subordinated

Junior 1,538 4.98 – 10.01 2026 – 2033

All other 2,931 4.88 – 9.65 2007 – 2017

Total subordinated 4,469

Total senior and

subordinated $6,907

Total borrowed funds at December 31, 2005 have scheduled

repayments for the years 2006 through 2010 and thereafter as

follows:

• 2006: $10.1 billion,

• 2007: $1.1 billion,

• 2008: $.5 billion,

• 2009: $.9 billion, and

• 2010 and thereafter: $4.3 billion.

Included in borrowed funds are FHLB advances of $1.2

billion at December 31, 2005, $1.1 billion of which are

collateralized by a blanket lien on residential mortgage and

other real estate-related loans and mortgage-backed

securities.

Included in outstandings for the senior and subordinated

notes in the table above are basis adjustments of negative $7

million and positive $32 million, respectively, related to fair

value accounting hedges.

See Note 14 Capital Securities of Subsidiary Trusts for

information about the $1.5 billion of junior subordinated

debt.

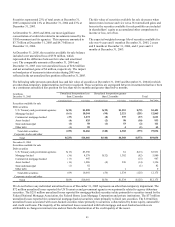

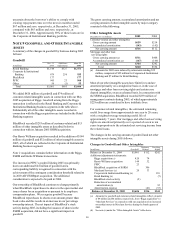

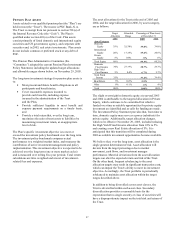

NOTE 14 CAPITAL SECURITIES OF

SUBSIDIARY TRUSTS

These capital securities represent non-voting preferred

beneficial interests in the assets of PNC Institutional Capital

Trusts A and B, PNC Capital Trusts C and D, UNB Capital

Trust I and Capital Statutory Trust II, and the Riggs Capital

Trust and Capital Trust II (the “Trusts”). Trust A is a wholly

owned finance subsidiary of PNC Bank, N.A., PNC’ s

principal bank subsidiary. All other Trusts are wholly owned

finance subsidiaries of PNC. The UNB Trusts were acquired

effective January 1, 2004 as part of the United National

acquisition. The Riggs Trusts were acquired in May 2005 as

part of the Riggs acquisition. In the event of certain changes

or amendments to regulatory requirements or federal tax rules,

the capital securities are redeemable in whole. With the

exception of Riggs Capital Trust, the financial statements of

the Trusts are not included in PNC’ s consolidated financial

statements in accordance with GAAP.

• Trust A, formed in December 1996, issued $350

million of 7.95% capital securities due December 15,

2026, that are redeemable after December 15, 2006 at

a premium that declines from 103.975% to par on or

after December 15, 2016.

• Trust B, formed in May 1997, issued $300 million of

8.315% capital securities due May 15, 2027, that are

redeemable after May 15, 2007 at a premium that

declines from 104.1575% to par on or after May 15,

2017.

• Trust C, formed in June 1998, issued $200 million of

capital securities due June 1, 2028, bearing interest at

a floating rate per annum equal to 3-month LIBOR

plus 57 basis points. The rate in effect at December

31, 2005 was 4.98%. Trust C Capital Securities are

redeemable on or after June 1, 2008 at par.

• Trust D, formed in December 2003, issued $300

million of 6.125% capital securities due December

15, 2033 that are redeemable on or after December

18, 2008 at par.

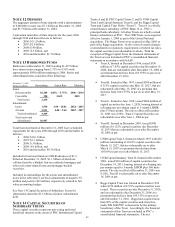

• UNB Capital Trust I, formed in March 1997 with $16

million outstanding of 10.01% capital securities due

March 15, 2027, that are redeemable on or after

March 15, 2007 at a premium that declines from

105.00% to par on or after March 15, 2017.

• UNB Capital Statutory Trust II, formed in December

2001, issued $30 million of capital securities due

December 18, 2031, bearing interest at a floating rate

per annum equal to 3-month LIBOR plus 360 basis

points. The rate in effect at December 31, 2005 was

8.10%. Trust II is redeemable on or after December

18, 2006 at par.

• Riggs Capital Trust was formed in December 1996

when $150 million of 8 5/8% capital securities were

issued. These securities are due December 31, 2026,

and are redeemable after December 31, 2006 at a

premium that declines from 104.313% to par on or

after December 31, 2016. Riggs had acquired more

than 50% of the capital securities and, therefore,

under FIN 46R PNC is deemed to be the primary

beneficiary of the Trust. Accordingly, the financial

statements of this Trust are included in PNC’ s

consolidated financial statements. The net