PNC Bank 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

See Note 21 Segment Reporting in the Notes To

Consolidated Financial Statements in Item 8 of this Report

for a reconciliation of total business segment earnings to

total PNC consolidated earnings as reported on a GAAP

basis, and see Net Interest Income - GAAP Reconciliation

in the Consolidated Income Statement Review section of

Item 7 of this Report for a reconciliation of net income as

reported under GAAP to net interest income presented on a

taxable-equivalent basis.

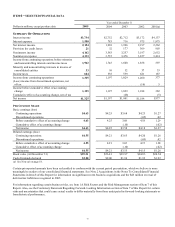

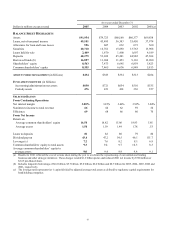

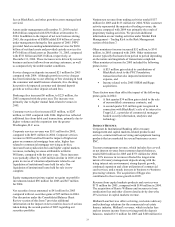

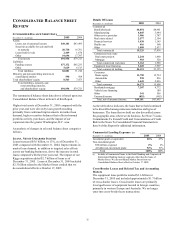

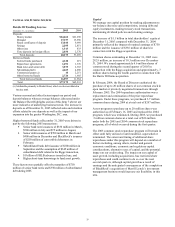

BALANCE SHEET HIGHLIGHTS

Total average assets were $88.5 billion for 2005 compared

with $75.3 billion for 2004. Average interest-earning assets

were $73.0 billion in 2005 compared with $61.8 billion in

2004, an increase of $11.2 billion or 18%. An increase of

$6.4 billion in average loans was the primary factor for the

increase in average interest-earning assets. In addition,

average total securities increased $3.4 billion in 2005

compared with 2004.

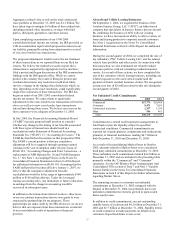

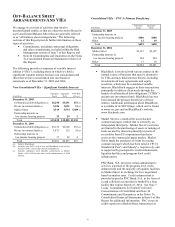

In October 2005, Market Street Funding LLC (“Market

Street”), formerly Market Street Funding Corporation, was

restructured as a limited liability company and entered into a

subordinated Note Purchase Agreement (“Note”) with an

unrelated third party. As a result of the Note issuance, we

reevaluated whether PNC continued to be the primary

beneficiary of Market Street under the provisions of

Financial Accounting Standards Board (“FASB”)

Interpretation No. 46 (Revised 2003), “Consolidation of

Variable Interest Entities” (“FIN 46R”). Based on this

analysis, we determined that we were no longer the primary

beneficiary and deconsolidated Market Street from our

Consolidated Balance Sheet effective October 17, 2005.

You can find additional information on Market Street within

the Off-Balance Sheet Arrangements And VIEs section of

Item 7 of this Report.

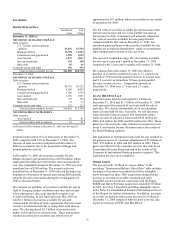

Average total loans were $47.4 billion for 2005 and $40.9

billion in 2004. This increase was driven by continued

improvements in market loan demand and targeted sales

efforts across our banking businesses, as well as the impact

of our expansion into the greater Washington, D.C. area.

The increase in average total loans reflected growth in

commercial loans of approximately $2.4 billion, consumer

loans of approximately $2.0 billion and residential

mortgages of approximately $2.1 billion, partially offset by

a $.5 billion decline in lease financing loans. We sold our

vehicle leasing business in 2004 as described under the

Aircraft and Vehicle Leasing Businesses section of the

Consolidated Balance Sheet Review section of Item 7 of this

Report. Loans represented 65% of average interest-earning

assets for 2005 and 66% for 2004.

Average securities totaled $19.3 billion for 2005 and $15.9

billion for 2004. Of this $3.4 billion increase, $2.5 billion

was attributable to increases in mortgage-backed, asset-

backed and other debt securities. The increase in 2005 also

reflected the impact of Riggs. Securities comprised 26% of

average interest-earning assets for 2005 and 2004.

Average total deposits were $57.6 billion for 2005, an

increase of $7.9 billion over 2004. The increase in average

total deposits was driven primarily by the impact of higher

certificates of deposit, money market account and

noninterest-bearing deposit balances, and by higher

Eurodollar deposits. The increase in 2005 also reflected the

impact of our expansion into the greater Washington, D.C.

area. Average total deposits represented 65% of total

sources of funds for 2005 and 66% for 2004. Average

transaction deposits were $39.5 billion for 2005 compared

with $35.9 billion for 2004.

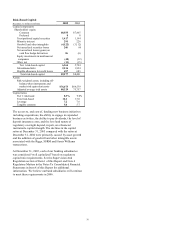

Average borrowed funds were $16.2 billion for 2005 and

$12.5 billion for 2004. The following contributed to this

increase:

• Various issuances of senior and subordinated bank

notes and Federal Home Loan Bank (“FHLB”)

advances throughout 2005, as further detailed

within Capital and Funding Sources in the

Consolidated Balance Sheet Review section of this

Financial Review, along with the comparative

impact of $500 million of subordinated bank notes

issued in December 2004 and $500 million of

senior bank notes issued in September 2004,

• The assumption of approximately $345 million of

subordinated debt in 2005 with the Riggs

acquisition,

• BlackRock’ s issuance of $250 million of

convertible debentures in February 2005, and

• An increase in short-term borrowings to fund asset

growth.

These increases were partially offset by maturing FHLB

advances, senior bank notes, and senior and subordinated

debt in 2004 and 2005.

Shareholders’ equity totaled $8.6 billion at December 31,

2005, compared with $7.5 billion at December 31, 2004.

See the Consolidated Balance Sheet Review section of Item

7 of this Report for additional information.