PNC Bank 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.109

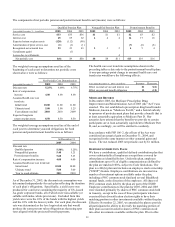

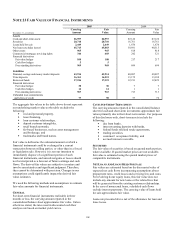

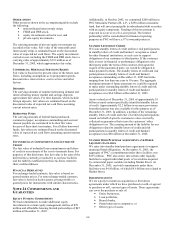

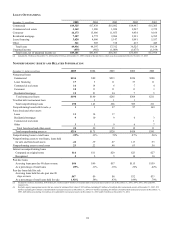

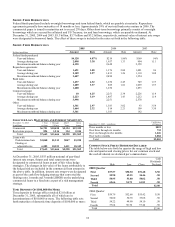

OTHER ASSETS

Other assets as shown in the accompanying table include

the following:

• noncertificated interest-only strips,

• FHLB and FRB stock,

• equity investments carried at cost, and

• private equity investments.

The carrying amounts of private equity investments are

recorded at fair value. Fair value of the noncertificated

interest-only strips is estimated based on the discounted

value of expected net cash flows. The equity investments

carried at cost, including the FHLB and FRB stock, have a

carrying value of approximately $321 million as of

December 31, 2005, which approximates fair value.

COMMERCIAL MORTGAGE SERVICING RIGHTS

Fair value is based on the present value of the future cash

flows, including assumptions as to prepayment speeds,

discount rates, interest rates, cost to service and other

factors.

DEPOSITS

The carrying amounts of noninterest-bearing demand and

interest-bearing money market and savings deposits

approximate fair values. For time deposits, which include

foreign deposits, fair values are estimated based on the

discounted value of expected net cash flows assuming

current interest rates.

BORROWED FUNDS

The carrying amounts of federal funds purchased,

commercial paper, acceptances outstanding and accrued

interest payable are considered to be their fair value

because of their short-term nature. For all other borrowed

funds, fair values are estimated based on the discounted

value of expected net cash flows assuming current interest

rates.

UNFUNDED LOAN COMMITMENTS AND LETTERS OF

CREDIT

The fair value of unfunded loan commitments and letters

of credit is our estimate of the cost to terminate them. For

purposes of this disclosure, this fair value is the sum of the

deferred fees currently recorded by us on these facilities

and the liability established on these facilities related to

their creditworthiness.

FINANCIAL DERIVATIVES

For exchange-traded contracts, fair value is based on

quoted market prices. For nonexchange-traded contracts,

fair value is based on dealer quotes, pricing models or

quoted prices for instruments with similar characteristics.

NOTE 24 COMMITMENTS AND

GUARANTEES

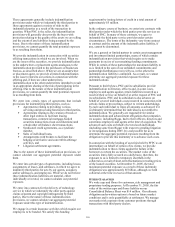

EQUITY FUNDING COMMITMENTS

We had commitments to make additional equity

investments in certain equity management entities of $78

million and affordable housing limited partnerships of $47

million at December 31, 2005.

Additionally, in October 2005, we committed $200 million to

PNC Mezzanine Partners III, L.P., a $350 million mezzanine

fund, that will invest principally in subordinated debt securities

with an equity component. Funding of this investment is

expected to occur over a five-year period. The limited

partnership will be consolidated for financial reporting

purposes as PNC will have a 57% ownership interest.

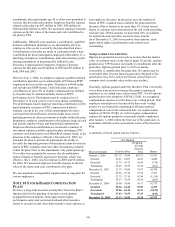

STANDBY LETTERS OF CREDIT

We issue standby letters of credit and have risk participations

in standby letters of credit and bankers’ acceptances issued

by other financial institutions, in each case to support

obligations of our customers to third parties. If the customer

fails to meet its financial or performance obligation to the

third party under the terms of the contract, then upon the

request of the guaranteed party, we would be obligated to

make payment to them. The standby letters of credit and risk

participations in standby letters of credit and bankers’

acceptances outstanding on December 31, 2005 had terms

ranging from less than one year to 10 years. The aggregate

maximum amount of future payments we could be required

to make under outstanding standby letters of credit and risk

participations in standby letters of credit and bankers’

acceptances was $6.4 billion at December 31, 2005.

Assets valued as of December 31, 2005 of approximately $1

billion secured certain specifically identified standby letters

of credit. Approximately $2.2 billion in recourse provisions

from third parties was also available for this purpose as of

December 31, 2005. In addition, a portion of the remaining

standby letters of credit and letter of credit risk participations

issued on behalf of specific customers is also secured by

collateral or guarantees that secure the customers’ other

obligations to us. The carrying amount of the liability for our

obligations related to standby letters of credit and risk

participations in standby letters of credit and bankers’

acceptances was $60 million at December 31, 2005.

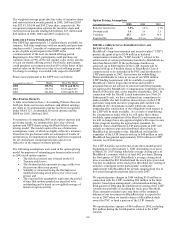

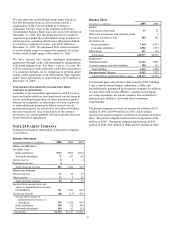

STANDBY BOND PURCHASE AGREEMENTS AND OTHER

LIQUIDITY FACILITIES

We enter into standby bond purchase agreements to support

municipal bond obligations. At December 31, 2005, the

aggregate of PNC’ s commitments under these facilities was

$235 million. PNC also enters into certain other liquidity

facilities to support individual pools of receivables acquired

by commercial paper conduits including Market Street. At

December 31, 2005, our total commitments under these

facilities were $4.8 billion, of which $4.6 billion was related to

Market Street.

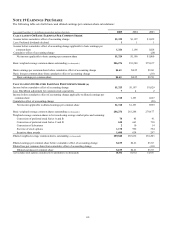

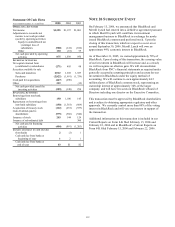

INDEMNIFICATIONS

We are a party to numerous acquisition or divestiture

agreements under which we have purchased or sold, or agreed

to purchase or sell, various types of assets. These agreements

can cover the purchase or sale of:

• Entire businesses,

• Loan portfolios,

• Branch banks,

• Partial interests in companies, or

• Other types of assets.