PNC Bank 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.94

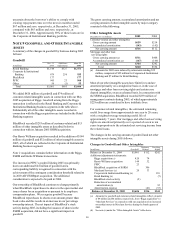

interest expense or noninterest income depending on the

hedged item.

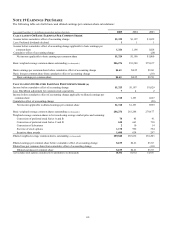

Cash Flow Hedging Strategy

We enter into interest rate swap contracts to modify the

interest rate characteristics of designated commercial loans

from variable to fixed in order to reduce the impact of

interest rate changes on future interest income. We are

hedging our exposure to the variability of future cash flows

for all forecasted transactions for a maximum of 10 years for

hedges converting floating-rate commercial loans to fixed.

The fair value of these derivatives is reported in other assets

or other liabilities and offset in accumulated other

comp rehensive income (loss) for the effective portion of the

derivatives. When the hedged transaction culminates, any

unrealized gains or losses related to these swap contracts are

reclassified from accumulated other comprehensive income

(loss) into earnings in the same period or periods during

which the hedged forecasted transaction affects earnings and

are included in interest income. Ineffectiveness of the

strategy, as defined by risk management policies and

procedures, if any, is reported in interest income .

During the next twelve months, we expect to reclassify to

earnings $8.6 million of pretax net losses, or $5.6 million

after-tax, on cash flow hedge derivatives currently reported in

accumulated other comprehensive income (loss). This

amount could differ from amounts actually recognized due to

changes in interest rates and the addition of other hedges

subsequent to December 31, 2005. These net losses are

anticipated to result from net cash flows on receive fixed

interest rate swaps that would impact interest income

recognized on the related floating rate commercial loans.

As of December 31, 2005 we have determined that there

were no hedging positions where it was probable that certain

forecasted transactions may not occur within the originally

designated time period.

For those hedge relationships that do not qualify for assuming

no ineffectiveness, any ineffectiveness present in the hedge

relationship is recognized in current earnings. The ineffective

portion of the change in value of these derivatives resulted in a

$3 million net loss in 2005 compared with a net loss of $5

million in 2004.

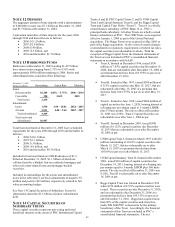

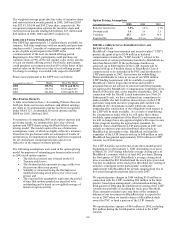

Free-Standing Derivatives

To accommodate customer needs, we also enter into financial

derivative transactions primarily consisting of interest rate

swaps, interest rate caps and floors, futures, swaptions, and

foreign exchange and equity contracts. We manage our

market risk exposure from customer positions through

transactions with third-party dealers. The credit risk

associated with derivatives executed with customers is

essentially the same as that involved in extending loans and

is subject to normal credit policies. We may obtain collateral

based on our assessment of the customer. For derivatives not

designated as an accounting hedge, the gain or loss is

recognized in trading noninterest income.

Basis swaps are agreements involving the exchange of

payments, based on notional amounts, of two floating rate

financial instruments denominated in the same currency, one

pegged to one reference rate and the other tied to a second

reference rate (e.g., swapping payments tied to one-month

LIBOR for payments tied to three-month LIBOR). We use

these contracts to mitigate the impact on earnings of exposure

to a certain referenced interest rate.

We purchase and sell credit default swaps to mitigate the

economic impact of credit losses on specifically identified

existing lending relationships or to generate revenue from

proprietary trading activities. These derivatives typically are

based on the change in value, due to changing credit spreads,

of publicly -issued bonds.

Interest rate lock commitments for, as well as commitments to

buy or sell, mortgage loans that we intend to sell are

considered free-standing derivatives. Our interest rate

exposure on certain commercial mortgage interest rate lock

commitments is economically hedged with pay-fixed interest

rate swaps and forward sales agreements. These contracts

mitigate the impact on earnings of exposure to a certain

referenced rate.

Free-standing derivatives also include positions we take based

on market expectations or to benefit from price differentials

between financial instruments and the market based on stated

risk management objectives.

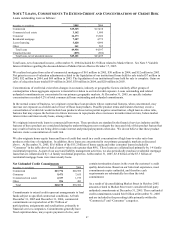

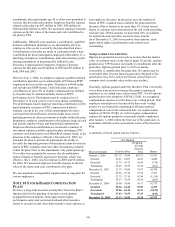

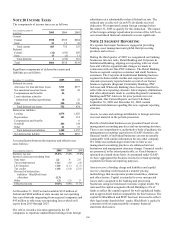

Derivative Counterparty Credit Risk

By purchasing and writing derivative contracts we are exposed

to credit risk if the counterparties fail to perform. Our credit

risk is equal to the fair value gain in the derivative contract.

We minimize credit risk through credit approvals, limits,

monitoring procedures and collateral requirements. We

generally enter into transactions with counterparties that carry

high quality credit ratings.

We enter into risk participation agreements to share some

of the credit exposure with other counterparties related to

interest rate derivative contracts or to take on credit

exposure to generate revenue. Risk participation

agreements entered into prior to July 1, 2003 were

considered financial guarantees and therefore not included

in derivatives. Agreements entered into subsequent to

June 30, 2003 are included in the derivative table that

follows. We determine that we meet our objective of

reducing credit risk associated with certain counterparties

to derivative contracts when the participation agreements

share in their proportional credit losses of those

counterparties.

We generally have established agreements with our major

derivative dealer counterparties that provide for exchanges of

marketable securities or cash to collateralize either party’ s

positions. At December 31, 2005 we held cash and US

government and mortgage-backed securities with a fair value

of $100 million and pledged mortgage-backed securities with

a fair value of $163 million under these agreements.