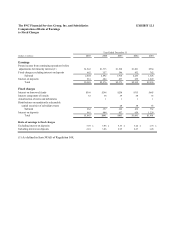

PNC Bank 2005 Annual Report Download - page 281

Download and view the complete annual report

Please find page 281 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of the Agreement pursuant to Section 9.

In the alternative, if Participant’ s employment with the Corporation will terminate prior to the

third (3rd) anniversary of the Grant Date and Participant’ s Unvested Share Units will be forfeited as of

Participant’ s Termination Date pursuant to Section 7.1, the Committee or its delegate may, in their sole

discretion, determine that some or all of such Unvested Share Units will remain in effect post-employment

on such terms and conditions as the Committee or its delegate may provide, and that such Unvested Share

Units will subsequently become Awarded Share Units or be forfeited in accordance with said terms and

conditions; provided, however, that in no event will such terms and conditions violate, or cause a violation

of, Section 409A of the Internal Revenue Code.

8. Change in Control. Notwithstanding anything in the Agreement to the contrary, upon the

occurrence of a Change in Control: (i) if Participant is an employee of the Corporation as of the day

immediately preceding the Change in Control, the Three-Year Continued Employment Performance Goal

will be deemed to have been achieved and the Restricted Period will terminate with respect to all Unvested

Share Units then in effect as of the day immediately preceding the Change in Control; (ii) if Participant’ s

employment with the Corporation terminated prior to the occurrence of the Change in Control but the

Unvested Share Units remained in effect after such termination of employment pursuant to Section 7.4,

Section 7.5 or Section 7.6 and are still in effect pending approval of the vesting of such share units by the

Designated Person specified in Section A.14 of Annex A, then with respect to all Unvested Share Units in

effect as of the day immediately preceding the Change in Control, such vesting approval will be deemed to

have been given, the Three-Ye ar Continued Employment Performance Goal will be deemed to have been

achieved, and the Restricted Period will terminate, all as of the day immediately preceding the Change in

Control, provided, however, in the case of Unvested Share Units that remained in effect post-employment

solely pursuant to Section 7.6(a), that Participant entered into and does not revoke the waiver and release

agreement specified in Section 7.6(a); and (iii) all Deferred Share Units that thereby become Awarded

Share Units will be re leased from the terms and conditions of the Agreement pursuant to Section 9 as soon

as administratively practicable following such date.

9. Release of Agreement Restrictions. To the extent that the Deferred Share Units become

Awarded Share Units and are not forfeited pursuant to Section 7, PNC will release the 200__ Restricted

Award Deferral Account and Deferred Share Units from the terms and conditions of the Agreement and the

200__ Restricted Award Deferral Account will become a regular subaccount under the Plan as soon as

administratively practicable following termination of the Restricted Period.

10. FICA Withholding Taxes. During the term of the Restricted Period, any earnings

credited to Participant’ s Plan Account with respect to the Deferred Share Units in the 200__ Restricted

Award Deferral Account (phantom dividends) will be treated as wages for purposes of the Federal

Insurance Contributions Act (“FICA”) in the year they are credited to Participant and will be subject to

Social Security and Medicare withholding taxes at that time. Otherwise, the Deferred Shares amount will

be treated as wages for FICA purposes and will be subject to Social Security and Medicare withholding

taxes at the time the 200__ Restricted Award Deferral Account and Deferred Share Units are released from

the terms and conditions of the Agreement pursuant to Section 9.

11. Employment. Neither the granting of the Award, the release of the 200__ Restricted

Award Deferral Account and Deferred Share Units from the terms and conditions of the Agreement

pursuant to Section 9, nor any term or provision of the Agreement shall constitute or be evidence of any

understanding, expressed or implied, on the part of PNC or any Subsidiary to employ Participant for any

period or in any way alter Participant’ s status as an employee at will.

12. Subject to the Plan. Except as otherwise provided in the Agreement, the 200__

Restricted Award Deferral Account and Deferred Share Units are in all respects subject to the terms and

conditions of the Plan, which has been made available to Participant and is incorporated herein by

reference.

13. Headings; Entire Agreement. Headings used in the Agreement are provided for