PNC Bank 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

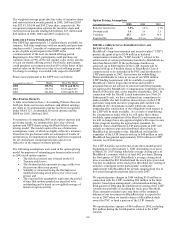

We also enter into credit default swaps under which we

buy loss protection from or sell loss protection to a

counterparty in the event of default of a reference

obligation. The fair value of the contracts sold on our

Consolidated Balance Sheet was a net asset of $3 million at

December 31, 2005. The maximum amount we would be

required to pay under the credit default swaps in which we

sold protection, assuming all reference obligations default

at a total loss, without recoveries, was $396 million at

December 31, 2005. We purchased $343 million notional

of credit default swaps to mitigate the exposure of certain

written credit default swaps at December 31, 2005.

We have entered into various contingent performance

guarantees through credit risk participation arrangements

with terms ranging from less than 1 year to 12 years. We

will be required to make payments under these guarantees

if a customer defaults on its obligation to perform under

certain credit agreements with third parties. Our exposure

under these agreements is approximately $179 million at

December 31, 2005.

CONTINGENT PAYMENTS IN CONNECTION WITH

CERTAIN ACQUISITIONS

A number of the acquisition agreements to which we are a

party and under which we have purchased various types of

assets, including the purchase of entire businesses, partial

interests in companies, or other types of assets, require us

to make additional payments in future years if certain

predetermined goals are achieved or not achieved within a

specific time period. Due to the nature of the contract

provisions, we cannot quantify our total exposure that may

result from these agreements.

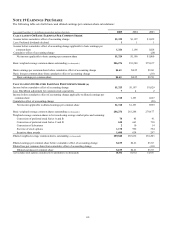

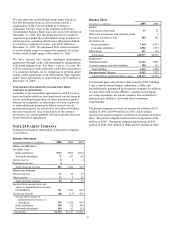

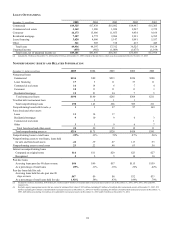

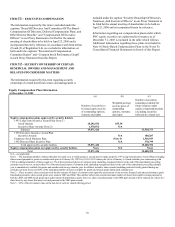

NOTE 25 PARENT COMPANY

Summarized financial information of the parent company

is as follows:

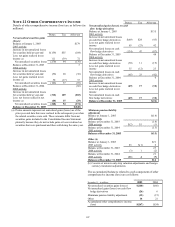

Income Statement

Year ended December 31 - in millions 2005 2004 2003

OPERATING REVENUE

Dividends from:

Bank subsidiaries $717 $895 $874

Non-bank subsidiaries 72 187 68

Interest income 8 4 2

NONonin

terest income 6

Total operating revenue 803 1,086 944

OPERATING EXPENSE

Interest expense 71 42 49

Other expense 11 5 26

Total operating expense 82 47 75

Income before income taxes and

equity in undistributed net income

of subsidiaries 721 1,039 869

Income tax benefits (24) (17) (26)

Income before equity in

undistributed net income of

subsidiaries 745 1,056 895

Bank subsidiaries 396 98 189

Non-bank subsidiaries 184 43 (83)

Net income $1,325 $1,197 $1,001

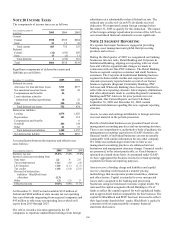

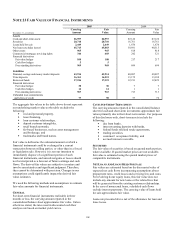

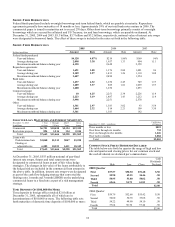

Balance Sheet

December 31

-

in mill

ions

2005

2004

ASSETS

Cash and due from banks $3 $1

Short-term investments with subsidiary bank 8

Securities available for sale 293 383

Investments in:

Bank subsidiaries 7,140 6,414

Non-bank subsidiaries 2,504 1,556

Other assets 237 197

Total

assets

$10,177

$8,559

LIABILITIES

Subordinated debt $1,326 $871

Accrued expenses and other liabilities 288 215

Total liabilities

1,614

1,086

S

HAREHOLDERS

’

E

QUITY

8,563

7,473

Total liabilities and shareholders’ equity $10,177 $8,559

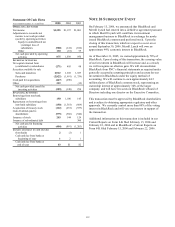

Commercial paper and all other debt issued by PNC Funding

Corp, a wholly owned finance subsidiary, is fully and

unconditionally guaranteed by the parent company. In addition,

in connection with certain affiliates’ commercial mortgage

servicing operations, the parent company has committed to

maintain such affiliates’ net worth above minimum

requirements.

The parent company received net income tax refunds of $19

million in 2005 and $44 million in 2003. Such refunds

represent the parent company’ s portion of consolidated income

taxes. The parent company made income tax payments of $9

million in 2004. The parent company paid interest of $94

million in 2005, $62 million in 2004 and $51 million in 2003.