PNC Bank 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

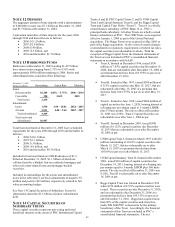

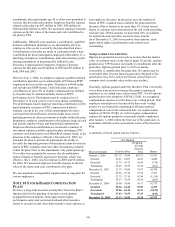

outstanding capital securities of $73 million are

included as junior subordinated debt, and the related

dividends are included in interest expense.

• Riggs Capital Trust II was formed in March 1997

when $200 million of 8 7/8% capital securities were

issued. These securities are due March 15, 2027,

and are redeemable after March 15, 2007 at a

premium that declines from 104.438% to par on or

after March 15, 2017. Riggs had acquired less than

50% of the capital securities and, therefore, under

FIN 46R PNC is not deemed to be the primary

beneficiary. Accordingly, the financial statements

of this Trust are not consolidated into PNC’ s

financial results. Junior subordinated debt of $206

million owed by PNC to this Trust is included in

PNC’ s balance sheet, with the related service cost

included in interest expense. The $50 million of

acquired capital securities are included as securities

available for sale, with the related dividends

included in interest income.

At December 31, 2005, PNC’ s junior subordinated debt of

$1.538 billion included the $73 million of net outstanding

capital securities of Riggs Capital Trust as described above.

The balance represents debentures issued by PNC or our

subsidiary, PNC Bank, N.A., and purchased and held as

assets by the Trusts.

The obligations of the respective parent of each Trust, when

taken collectively, are the equivalent of a full and

unconditional guarantee of the obligations of such Trust

under the terms of the Capital Securities. Such guarantee is

subordinate in right of payment in the same manner as other

junior subordinated debt. There are certain restrictions on

PNC’ s overall ability to obtain funds from its subsidiaries.

For additional disclosure on these funding restrictions,

including an explanation of dividend and intercompany loan

limitations, see Note 4 Regulatory Matters.

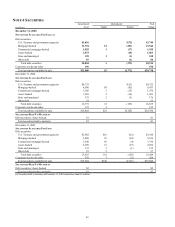

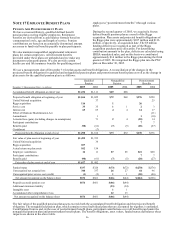

NOTE 15 SHAREHOLDERS’ EQUITY

Information related to preferred stock is as follows:

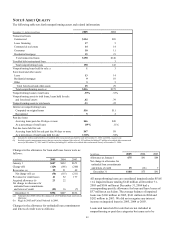

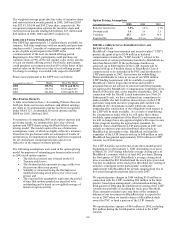

Preferred Shares

December 31

Shares in thousands

Liquidation

value per share 2005 2004

Authorized

$1 par value 17,030 17,057

Issued and outstanding

Series A $40 7 8

Series B 40 2 2

Series C 20 152 163

Series D 20 206 221

Total 367 394

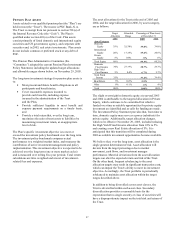

Series A through D are cumulative and, except for Series B,

are redeemable at our option. Annual dividends on Series A,

B and D preferred stock total $1.80 per share and on Series C

preferred stock total $1.60 per share. Holders of Series A

through D preferred stock are entitled to a number of votes

equal to the number of full shares of common stock into

which such preferred stock is convertible. Series A through D

preferred stock have the following conversion privileges: (i)

one share of Series A or Series B is convertible into eight

shares of PNC common stock; and (ii) 2.4 shares of Series C

or Series D are convertible into four shares of PNC common

stock.

During 2000, our Board of Directors adopted a shareholder

rights plan providing for issuance of share purchase rights.

Except as provided in the plan, if a person or group becomes

beneficial owner of 10% or more of PNC outstanding

common stock, all holders of the rights, other than such

person or group, may purchase our common stock or

equivalent preferred stock at half of market value.

We have a dividend reinvestment and stock purchase plan.

Holders of preferred stock and PNC common stock may

participate in the plan, which provides that additional shares

of common stock may be purchased at market value with

reinvested dividends and voluntary cash payments. Common

shares issued pursuant to this plan were: 688,665 shares in

2005, 744,266 shares in 2004, and 799,820 shares in 2003.

At December 31, 2005, we had reserved approximately 38.6

million common shares to be issued in connection with certain

stock plans and the conversion of certain debt and equity

securities.

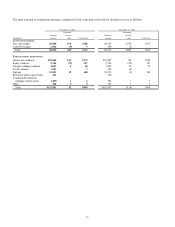

In February 2004, our Board of Directors authorized the

purchase of up to 20 million shares of our common stock in

open market or privately negotiated transactions through

February 2005. The 2004 repurchase authorization was a

replacement and continuation of the prior repurchase

program. Under these programs, we purchased 3.7 million

common shares during 2004 at a total cost of $207 million.

A new program to purchase up to 20 million shares was

authorized as of February 16, 2005 and replaced the 2004

program, which was terminated. The 2005 program will

remain in effect until fully utilized or until modified,

superseded or terminated. During 2005, we purchased .5

million common shares at a total cost of $26 million under

both the 2005 and 2004 common stock repurchase programs,

all of which occurred during the first quarter.

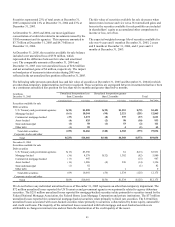

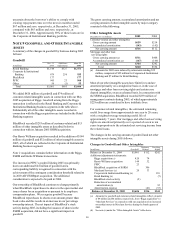

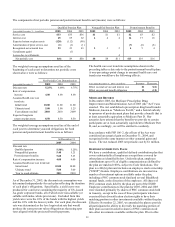

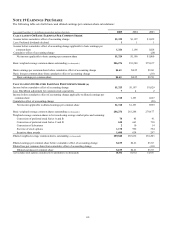

NOTE 16 FINANCIAL DERIVATIVES

We use a variety of derivative financial instruments to help

manage interest rate, market and credit risk and reduce the

effects that changes in interest rates may have on net income,

fair value of assets and liabilities, and cash flows caused by

interest rate volatility. These instruments include interest rate

swaps, interest rate caps and floors, futures contracts, and total

return swaps.

Fair Value Hedging Strategies

We enter into interest rate and total return swaps, interest rate

caps, floors and futures derivative contracts to hedge

designated commercial mortgage loans held for sale,

commercial loans, bank notes, senior debt and subordinated

debt for changes in fair value primarily due to changes in

interest rates. Adjustments related to the ineffective portion of

fair value hedging instruments are recorded in interest income,