PNC Bank 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

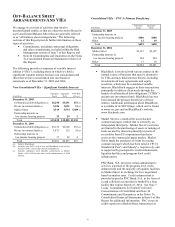

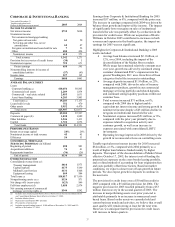

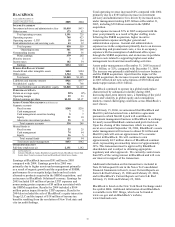

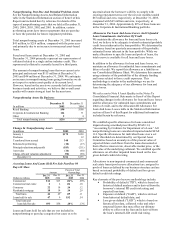

CORPORATE & INSTITUTIONAL BANKING

Year ended December 31

Taxable-equivalent basis

Dollars in millions except as noted

2005

2004

INCOME STATEMENT

Net interest income $732 $698

Noninterest income

Net commercial mortgage banking

Net gains on loan sales 61 50

Servicing and other fees, net of

amortization 62 47

Net gains on institutional loans held for sale

7 52

Other 480 424

Noninterest income 610 573

Total revenue 1,342 1,271

Provision for (recoveries of) credit losses (30) 5

Noninterest expense 722 671

Pretax earnings 650 595

Noncontrolling interests in income of

consolidated entities (57) (43)

Income taxes 227 195

Earnings $480 $443

AVERAGE BALANCE SHEET

Loans

Corporate banking (a) $10,656 $9,865

Commercial real estate 2,289 1,834

Commercial – real estate related 2,055 1,631

Asset-based lending 4,203 3,803

Total loans (a) 19,203 17,133

Loans held for sale 752 470

Other assets 5,952 4,470

Total assets $25,907 $22,073

Deposits $9,382 $7,527

Commercial paper (b) 1,838 1,889

Other liabilities 3,946 3,433

Capital 1,724 1,672

Total funds $16,890 $14,521

PERFORMANCE RATIOS

Return on average capital 28%

26%

Noninterest income to total revenue 45 45

Efficiency 54 53

COMMERCIAL MORTGAGE

SERVICING PORTFOLIO (in billions)

Beginning of period $98 $83

Acquisitions/additions 74 41

Repayments/transfers (36) (26)

End of period $136 $98

OTHER INFORMATION

Consolidated revenue from (c):

Treasury management $410 $373

Capital markets $175 $140

Midland Loan Services $131 $108

Equipment leasing $69 $84

Total loans (d) $18,817 $17,959

Nonperforming assets (d) (e) $124 $71

Net charge-offs (recoveries) $(23) $49

Full-time employees (d) 3,050 2,974

Net carrying amount of commercial

mortgage servicing rights (d) $344 $242

(a) Includes lease financing and Market Street. Market Street was deconsolidated from

our Consolidated Balance Sheet effective October 17, 2005.

(b) Includes Market Street.

(c) Represents consolidated PNC amounts.

(d) Presented as of period end.

(e) Includes nonperforming loans of $108 million at December 31, 2005 and $51

million at December 31, 2004.

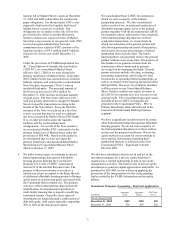

Earnings from Corporate & Institutional Banking for 2005

increased $37 million, or 8%, compared with the prior year.

The increase in earnings compared with 2004 was driven by

balance sheet growth and improved fee income. The impact

of significantly lower net gains on sales of institutional

loans held for sale was partially offset by a reduction in the

provision for credit losses. While our acquisition of Harris

Williams in October 2005 contributed to increases in both

revenues and expenses in the fourth quarter, the impact on

earnings for 2005 was not significant.

Highlights for Corporate & Institutional Banking’ s 2005

results included:

• Average loan balances increased $2.1 billion, or

12%, over 2004, including the impact of the

deconsolidation of the Market Street conduit.

While usage has remained relatively constant year

over year, growth was driven by continued strong

customer demand and PNC’ s expansion into the

greater Washington, D.C. area. Growth in all loan

categories fueled the increase in outstandings.

• Average deposits increased $1.9 billion, or 25%,

compared with 2004, driven by sales of treasury

management products, growth in our commercial

mortgage servicing portfolio and related deposits,

and continued strong liquidity positions within our

customer base.

• Total revenue increased $71 million, or 6%,

compared with 2004 due to higher taxable -

equivalent net interest income and strong growth in

noninterest income despite a $45 million decline in

net gains on institutional loans held for sale.

• Noninterest expense increased $51 million, or 8%,

compared with the prior year primarily due to

expenses related to acquisition activity and

customer growth, as well as an increase in

expenses associated with consolidated LIHTC

investments.

• Operating leverage improved in 2005 driven by the

growth in revenue and a focus on controlling costs.

Taxable-equivalent net interest income for 2005 increased

$34 million, or 5%, compared with 2004 primarily as a

result of higher loan balances funded mainly by higher

deposits. The impact of the deconsolidation of Market Street

effective October 17, 2005, the interest cost of funding the

potential tax exposure on the cross-border leasing portfolio,

and a refined method of accounting for loan origination fees

and costs partially offset these factors. Based on market

conditions, we expect a slower rate of loan growth in future

periods. We also expect growth in deposits to continue in

the near term.

The provision for credit losses was a $30 million credit in

2005 compared with a $5 million provision for 2004. The

negative provision for 2005 resulted primarily from a $53

million loan recovery in the second quarter of 2005. The

increase in nonperforming assets over prior year-end is

attributable primarily to an increase in nonaccrual asset-

based loans. Based on the assets we currently hold and

current business trends and activities, we believe that overall

asset quality will remain strong at least for the near term.

However, we anticipate that the provision for credit losses

will increase in future quarters.