PNC Bank 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 58

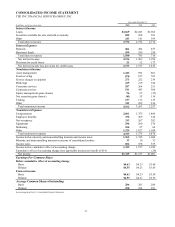

partially offset the decline in net gains on institutional loans

held for sale compared with the prior year.

Equity management net gains on portfolio investments totaled

$67 million for 2004 compared with net losses of $25 million

for 2003.

Net securities gains were $55 million in 2004 compared with

$116 million in 2003. Net securities gains for 2003 included

$25 million related to the liquidation that year of the three

entities formed in 2001 in the PAGIC transactions.

Noninterest revenue from trading activities totaled $113

million for 2004 and $127 million for 2003. We provide

additional information on our trading activities under Market

Risk Management – Trading Risk in the Risk Management

section of this Item 7.

Other noninterest income totaled $289 million for 2004, an

increase of $53 million or 22% compared with 2003. Other

noninterest income typically fluctuates from year to year

depending on the nature and magnitude of transactions

completed. Other noninterest income for 2004 included the

following:

• A $34 million pretax gain related to the sale of our

modified coinsurance contracts as described under

DIG B36 Impact on 2003 Results and 2004 Sale of

Modified Coinsurance Contracts below, and

• A $13 million pretax gain recognized during the

second quarter of 2004 in connection with

BlackRock’ s sale of its interest in Trepp LLC.

In addition to these items, the increase in other noninterest

income for 2004 compared with the prior year included the

recognition of $25 million of private equity dividends in 2004

and the comparative impact of $12 million related to the mid-

2003 adoption of FIN 46.

Partially offsetting the impact of these items on other

noninterest income was a $7 million decline in leasing revenue

resulting from the 2004 sale of our vehicle leasing.

DIG B36 IMPACT ON 2003 RESULTS AND 2004 SALE OF

MODIFIED COINSURANCE CONTRACTS

As required by the FASB, effective October 1, 2003 we

adopted the provisions of Derivatives Implementation Group

Statement 133 Implementation Issue No. B36, “Embedded

Derivatives: Modified Coinsurance Arrangements and Debt

Instruments That Incorporate Credit Risk Exposures That Are

Unrelated or Only Partially Related to the Creditworthiness of

the Obligor under Those Instruments” (“DIG B36”), for our

annuity coinsurance agreements. Our initial adoption of the

provisions of DIG B36 to existing coinsurance agreements as

of October 1, 2003 was reported in our Consolidated Income

Statement as the cumulative effect of an accounting change and

reduced both fourth quarter and full year 2003 net income by

$28 million, or $.10 per diluted share. Subsequent to initial

adoption, other noninterest income increased by $8 million in

the fourth quarter of 2003 as a result of DIG B36.

During the first quarter of 2004, we recognized a $34 million

pretax gain on the sale of our modified coinsurance contracts.

We continue to sell various annuity products from which we

earn commission income as further described under Product

Revenue in Item 7 of this Report.

Noninterest Expense

Total noninterest expense was $3.735 billion for 2004, an

increase of $259 million or 7% compared with $3.476 billion in

2003. The efficiency ratio was 68% for 2004 and 66% for

2003.

Noninterest expense for 2004 included the following:

• Pretax charges totaling $110 million, including $96

million recorded in the third quarter, associated with

the BlackRock LTIP;

• Costs totaling approximately $78 million resulting

from the United National acquisition, including

approximately $11 million of conversion-related and

other nonrecurring costs; and

• A $22 million reduction in the benefit of accretion

related to a discounted PFPC client contract liability

that ended during the second quarter of 2004.

In addition to these items, the increase in noninterest expense

for 2004 compared with 2003 included the impact of the

following items, which had no effect on 2004 consolidated net

income:

• An increase of $30 million related to the mid-2003

adoption of FIN 46, and

• An increase of $22 million in PFPC out-of-pocket and

pass-through expenses which are offset in noninterest

income.

Noninterest expense for 2003 included the impact of the

following items:

• Expenses totaling $120 million recognized in

connection with a subsidiary’ s second quarter 2003

agreement with the DOJ, including $5 million of

related legal and consulting costs;

• Costs totaling $29 million paid in connection with our

2003 liquidation of the three entities formed in 2001

in the PAGIC transactions. The impact of these costs

was mostly offset by related net securities gains

included in noninterest income;

• Distributions on capital securities totaling $28 million;

• Facilities charges totaling $25 million related to leased

space consistent with the requirements of SFAS 146,

“Accounting for Costs Associated with Exit or

Disposal Activities;” and

• A $25 million benefit from the vehicle leasing

settlement during the fourth quarter of 2003.

Apart from the items described above, noninterest expense for

2004 increased $174 million compared with 2003. Higher

expenses in 2004 were primarily attributable to higher sales-

based compensation, stock-based incentive compensation and

marketing costs. These charges more than offset the benefit of