PNC Bank 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

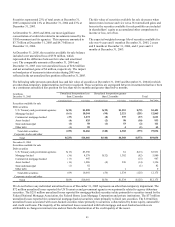

RIGGS NATIONAL CORPORATION

We acquired Riggs National Corporation (“Riggs”), a

Washington, D.C. based banking company, effective May 13,

2005. Under the terms of the agreement, Riggs merged into

The PNC Financial Services Group, Inc. and PNC Bank,

National Association (“PNC Bank, N.A.”) acquired

substantially all of the assets of Riggs Bank, National

Association, the principal banking subsidiary of Riggs. The

acquisition gives us a substantial presence on which to build

a market leading franchise in the affluent Washington, D.C.

metropolitan area. In connection with the acquisition, Riggs

shareholders received an aggregate of approximately $297

million in cash and 6.6 million shares of our common stock

valued at $356 million. Our Consolidated Balance Sheet at

June 30, 2005 included $2.8 billion of loans, net of unearned

income, and $3.5 billion of deposits, including $.8 billion of

brokered certificates of deposit, related to Riggs.

HARRIS WILLIAMS & CO.

On October 11, 2005, we acquired Harris Williams & Co.

(“Harris Williams”), one of the nation’ s largest firms focused

on providing mergers and acquisitions advisory and related

services to middle market companies, including private

equity firms and private and public companies.

2004 ACQUISITIONS

UNITED NATIONAL BANCORP

We acquired United National Bancorp, Inc. (“United

National”) effective January 1, 2004 by merging United

National with and into our subsidiary, PNC Bancorp, Inc.

United National shareholders received an aggregate of

approximately $321 million in cash and 6.6 million shares of

our common stock valued at $360 million. As a result of the

acquisition, we added $3.7 billion of assets, including $.6

billion of goodwill, $2.3 billion of deposits, $1.0 billion of

borrowed funds and $.4 billion of shareholders’ equity to our

Average Consolidated Balance Sheet for the quarter ended

March 31, 2004.

AVIATION FINANCE GROUP

On September 1, 2004, we acquired the business of the

Aviation Finance Group, LLC, an Idaho-based company that

specializes in loans to finance private aircraft. The purchase

agreement calls for a contingent payment at the end of the

fifth anniversary date that may be due if certain loan balances

and profitability targets are exceeded on a cumulative five-

year basis.

NOTE 3 VARIABLE INTEREST ENTITIES

We are involved with various entities in the normal course

of business that may be deemed to be VIEs. We

consolidated certain VIEs as of December 31, 2005 and

2004 for which we were determined to be the primary

beneficiary.

Information about the VIEs in which we hold significant

variable interests but have not consolidated and those VIEs

that we have consolidated in our financial statements

follows:

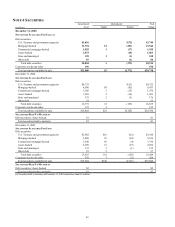

Non-Consolidated VIEs – Significant Variable Interests

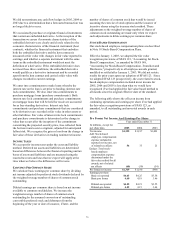

In millions

Aggregate

Assets

Aggregate

Debt

PNC Risk

of Loss

December 31, 2005

Collateralized debt obligations (a) $6,290 $5,491

$51 (b)

Private investment funds (a) 5,186 1,051

13 (b)

Market Street 3,519 3,514

5,089 (c)

Partnership interests in

low income housing projects 35 29

2

Total $15,030 $10,085

$5,155

December 31, 2004

Collateralized debt obligations (a) $3,152 $2,700

$33 (b)

Private investment funds (a) 1,872 125

24 (b)

Partnership interests in

low income housing projects

37

28

4

Total $5,061 $2,853

$61

(a) Held by BlackRock.

(b) Includes both PNC’ s risk of loss and BlackRock’ s risk of loss, limited

to PNC’ s ownership interest in BlackRock.

(c) Includes off-balance sheet liquidity commitments to Market Street of

$4.6 billion and other credit enhancements of $444 million.

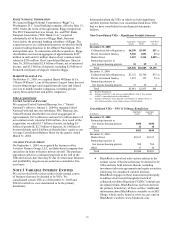

Consolidated VIEs – PNC Is Primary Beneficiary

In millions

Aggregate

Assets

Aggregate

Debt

December 31, 2005

Partnership interests in

low income housing projects $680 $680

Other 12 10

Total $692 $690

December 31, 2004

Market Street $2,167 $2,167

Partnership interests in

low income housing projects 504 504

Other 13 10

Total $2,684 $2,681

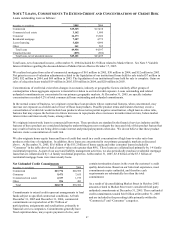

• BlackRock is involved with various entities in the

normal course of business that may be deemed to be

VIEs and may hold interests therein, including

investment advisory agreements and equity securities,

which may be considered variable interests.

BlackRock engages in these transactions principally

to address client needs through the launch of

collateralized debt obligations (“CDOs”) and private

investment funds. BlackRock has not been deemed

the primary beneficiary of these entities. Additional

information about BlackRock is available in its SEC

filings, which can be found at www.sec.gov and on

BlackRock’ s website, www.blackrock.com.