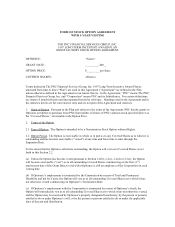

PNC Bank 2005 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

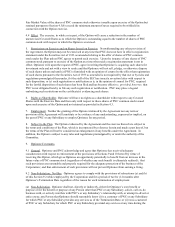

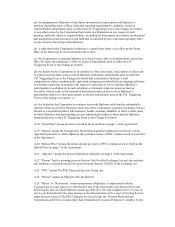

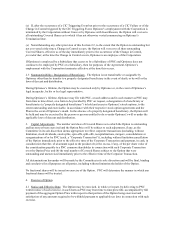

(a) the assignment to Optionee of any duties inconsistent in any respect with Optionee’ s

position (including status, offices, titles and reporting requirements), authority, duties or

responsibilities immediately prior to either the CIC Triggering Event or the Change in Control,

or any other action by the Corporation that results in a diminution in any respect in such

position, authority, duties or responsibilities, excluding for this purpose an isolated, insubstantial

and inadvertent action not taken in bad faith that is remedied by the Corporation promptly after

receipt of notice thereof given by Optionee;

(b) a reduction by the Corporation in Optionee’ s annual base salary as in effect on the Grant

Date, as the same may be increased from time to time;

(c) the Corporation’ s requiring Optionee to be based at any office or location that is more than

fifty (50) miles from Optionee’ s office or location immediately prior to either the CIC

Triggering Event or the Change in Control;

(d) the failure by the Corporation (i) to continue in effect any bonus, stock option or other cash

or equity-based incentive plan in which Optionee participates immediately prior to either the

CIC Triggering Event or the Change in Control that is material to Optionee’ s total

compensation, unless a substantially equivalent arrangement (embodied in an ongoing substitute

or alternative plan) has been made with respect to such plan, or (ii) to continue Optionee’ s

participation in such plan (or in such substitute or alternative plan) on a basis at least as

favorable, both in terms of the amount of benefits provided and the level of Optionee’ s

participation relative to other participants, as existed immediately prior to the CIC Triggering

Event or the Change in Control; or

(e) the failure by the Corporation to continue to provide Optionee with benefits substantially

similar to those received by Optionee under any of the Corporation’ s pension (including, but not

limited to, tax-qualified plans), life insurance, health, accident, disability or other welfare plans

in which Optionee was participating, at costs substantially similar to those paid by Optionee,

immediately prior to the CIC Triggering Event or the Change in Control.

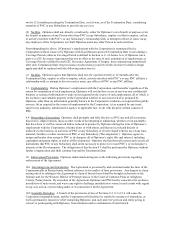

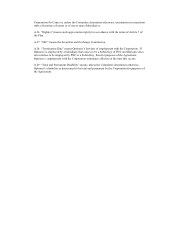

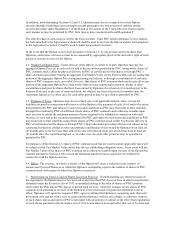

A.18 “Grant Date” means the date set forth as the Grant Date on page 1 of the Agreement.

A.19 “Option” means the Nonstatutory Stock Option granted to Optionee in Section 1 of the

Agreement pursuant to which Optionee may purchase shares of PNC common stock as provided

in the Agreement.

A.20 “Option Price” means the dollar amount per share of PNC common stock set forth as the

Option Price on page 1 of the Agreement.

A.21 “Optionee” means the person identified as Optionee on page 1 of the Agreement.

A.22 “Person” has the meaning given in Section 3(a)(9) of the Exchange Act and also includes

any syndicate or group deemed to be a person under Section 13(d)(3) of the Exchange Act.

A.23 “PNC” means The PNC Financial Services Group, Inc.

A.24 “Retiree” means an Optionee who has Retired.

A.25 “Retire” or “Retirement” means termination of Optionee’ s employment with the

Corporation (a) at any time on or after the first day of the first month coincident with or next

following the date on which Optionee attains age fifty-five (55) and completes five (5) years of

service (as determined in the same manner as the determination of five years of Vesting Service

under the provisions of The PNC Financial Services Group, Inc. Pension Plan) with the

Corporation and (b) for a reason other than termination by reason of Optionee’ s death or by the