PNC Bank 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 59

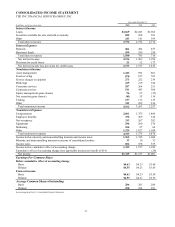

lower pension expense in the comparison and an $87 million

incremental benefit in 2004 from efficiency initiatives.

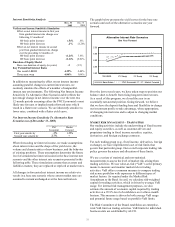

Effective Tax Rate

Our effective tax rate for 2004 was 30.8% compared with

33.7% for 2003. The decrease in the effective tax rate in 2004

was primarily attributable to the following:

• A reduced state and local tax expense due to tax

benefits of $18 million recorded in connection with

New York state and city audits, principally associated

with BlackRock, and

• A $14 million reduction in income tax expense

following our determination in the third quarter of

2004 that we no longer required an income tax reserve

related to bank-owned life insurance.

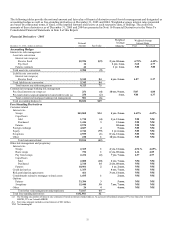

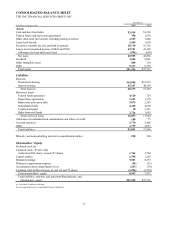

CONSOLIDATED BALANCE SHEET REVIEW

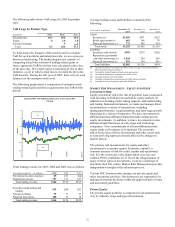

Loans

Loans increased $7.2 billion, or 20%, as of December 31, 2004

compared with December 31, 2003. The increase in total loans

reflected the following:

• Home equity loans increased $2.9 billion, reflecting

organic growth and the purchase of approximately

$660 million of home equity loans in early 2004,

• Demand for commercial loans grew during the year,

reflected in the $2.4 billion increase in this loan

category, and

• Automobile and other consumer loans combined

increased $.8 billion.

The favorable impact of these factors on our loan balances was

partially offset by the effect of the sale of the vehicle leasing

portfolio in 2004. We added $1.9 billion of loans with the

United National acquisition in 2004, as reflected in various

loan categories.

Securities

Total securities at December 31, 2004 were $16.8 billion

compared with $15.7 billion at December 31, 2003. Securities

represented 21% of total assets at December 31, 2004

compared with 23% at December 31, 2003. The increase in

total securities compared with December 31, 2003 was

primarily due to increases in US Treasury and government

agencies and mortgage-backed securities, partially offset by

declines in commercial mortgage-backed and asset- backed

securities.

At December 31, 2004, the securities available for sale balance

included a net unrealized loss of $102 million, which represented

the difference between fair value and amortized cost. The

comparable amount at December 31, 2003 was a net unrealized

gain of $4 million. The impact on bond prices of increases in

interest rates during 2004 was reflected in the net unrealized loss

position at December 31, 2004. The expected weighted-average

life of securities available for sale was 2 years and 8 months at

December 31, 2004 compared with 2 years and 11 months at

December 31, 2003.

Loans Held For Sale

Education loans held for sale totaled $1.1 billion at December

31, 2004, and $1.0 billion at December 31, 2003 and

represented the majority of our loans held for sale at each date.

Loans held for sale remaining from our 2001 institutional

lending repositioning totaled $5 million at December 31, 2004

and $70 million at December 31, 2003.

Asset Quality

Nonperforming assets were $175 million at December 31,

2004, a decline of $153 million from December 31, 2003. The

decline in nonperforming assets reflected the significant

improvement in overall asset quality during 2004. The ratio of

nonperforming assets to total loans, loans held for sale and

foreclosed assets was .39% at December 31, 2004 compared

with .87% at December 31, 2003. The allowance for loan and

lease losses was $607 million and represented 1.40% of total

loans and 424% of nonperforming loans at December 31, 2004.

The comparable amounts were $632 million, 1.74% and 238%,

respectively, at December 31, 2003.

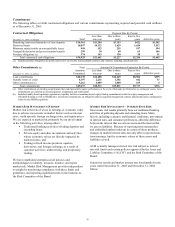

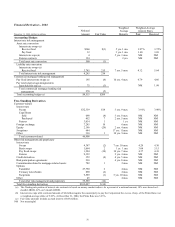

Funding Sources

Total funding sources were $65.2 billion at December 31, 2004

and $56.7 billion at December 31, 2003, an increase of $8.5

billion. This increase reflected the impact of the following

2004 developments:

• Our United National acquisition,

• An 8% increase in checking relationships,

• An increase in time deposits in foreign offices that

reflected our increased use of Eurodollar deposits as a

short-term funding mechanism,

• The issuance of $500 million of 18 month, floating

rate bank notes in September 2004 and $500 million

of 5.25% subordinated bank notes due 2017 in

December 2004, and

• An increase in other short-term borrowings to fund

asset growth.

These increases were partially offset by debt maturities of $2.4

billion during 2004.

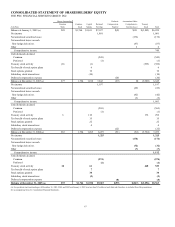

Shareholders’ Equity

The increase of $.8 billion, to $7.5 billion, in total

shareholders’ equity at December 31, 2004 compared with the

prior year-end was primarily attributable to $360 million of

common stock issued as part of the January 2004 United

National acquisition and a higher retention of earnings through

2004 in anticipation of the SSRM acquisition by BlackRock

and the pending acquisition of Riggs. Partially offsetting this

increase was a decline in the fair value of securities available

for sale and cash flow hedge derivatives due to the impact of

rising interest rates that began during the second quarter of

2004 and continued into the latter half of the year. These fair

value changes are captured in the accumulated other

comprehensive income (loss) component of shareholders’

equity.