PNC Bank 2005 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

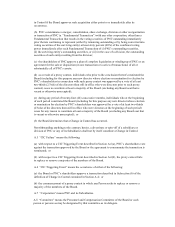

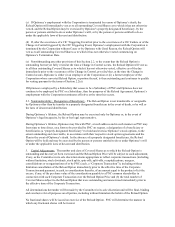

ANNEX A

CERTAIN DEFINITIONS

Except where the context otherwise indicates, the following definitions apply to the Reload

Nonstatutory Stock Option Agreement (“Reload Agreement”) to which this Annex A is attached.

A.1 “Board” means the Board of Directors of PNC.

A.2 “Cause” means:

(a) the willful and continued failure of Optionee to substantially perform Optionee’ s duties with

the Corporation (other than any such failure resulting from incapacity due to physical or mental

illness), after a written demand for substantial performance is delivered to Optionee by the

Board or the CEO that specifically identifies the manner in which the Board or the CEO believes

that Optionee has not substantially performed Optionee’ s duties; or

(b) the willful engaging by Optionee in illegal conduct or gross misconduct that is materially

and demonstrably injurious to PNC or any Subsidiary.

For purposes of the preceding clauses (a) and (b), no act or failure to act, on the part of Optionee,

shall be considered willful unless it is done, or omitted to be done, by Optionee in bad faith and

without reasonable belief that Optionee’ s action or omission was in the best interests of the

Corporation. Any act, or failure to act, based upon the instructions or prior approval of the

Board, the CEO or Optionee’ s superior or based upon the advice of counsel for the Corporation,

shall be conclusively presumed to be done, or omitted to be done, by Optionee in good faith and

in the best interests of the Corporation.

The cessation of employment of Optionee will be deemed to be a termination of Optionee’ s

employment with the Corporation for Cause for purposes of the Reload Agreement only if and

when there shall have been delivered to Optionee, as part of the notice of Optionee’ s

termination, a copy of a resolution duly adopted by the affirmative vote of not less than a

majority of the entire membership of the Board, at a Board meeting called and held for the

purpose of considering such termination, finding on the basis of clear and convincing evidence

that, in the good faith opinion of the Board, Optionee is guilty of conduct described in clause (a)

or (b) above and, in either case, specifying the particulars thereof in detail. Such resolution shall

be adopted only after (1) reasonable notice of such Board meeting is provided to Optionee,

together with written notice that PNC believes that Optionee is guilty of conduct described in

clause (a) or (b) above and, in either case, specifying the particulars thereof in detail, and (2)

Optionee is given an opportunity, together with counsel, to be heard before the Board.

A.3 “CEO” means the chief executive officer of PNC.

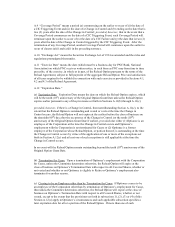

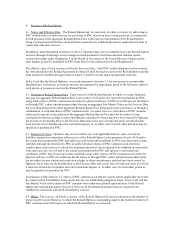

A.4 “Change in Control” means a change of control of PNC of a nature that would be required

to be reported in response to Item 6(e) of Schedule 14A of Regulation 14A (or in response to any

similar item on any similar schedule or form) promulgated under the Exchange Act, whether or

not PNC is then subject to such reporting requirement; provided, however, that without

limitation, a Change in Control shall be deemed to have occurred if:

(a) any Person, excluding employee benefit plans of the Corporation, is or becomes the

beneficial owner (as defined in Rules 13d-3 and 13d-5 under the Exchange Act or any successor

provisions thereto), directly or indirectly, of securities of PNC representing twenty percent

(20%) or more of the combined voting power of PNC’ s then outstanding securities; provided,

however, that such an acquisition of beneficial ownership representing between twenty percent