PNC Bank 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

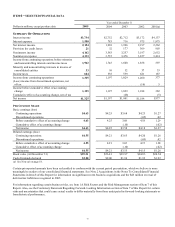

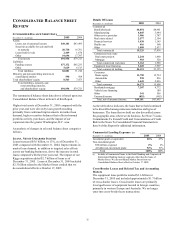

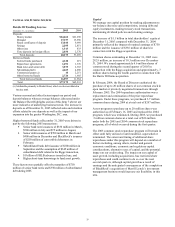

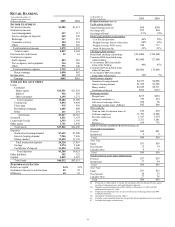

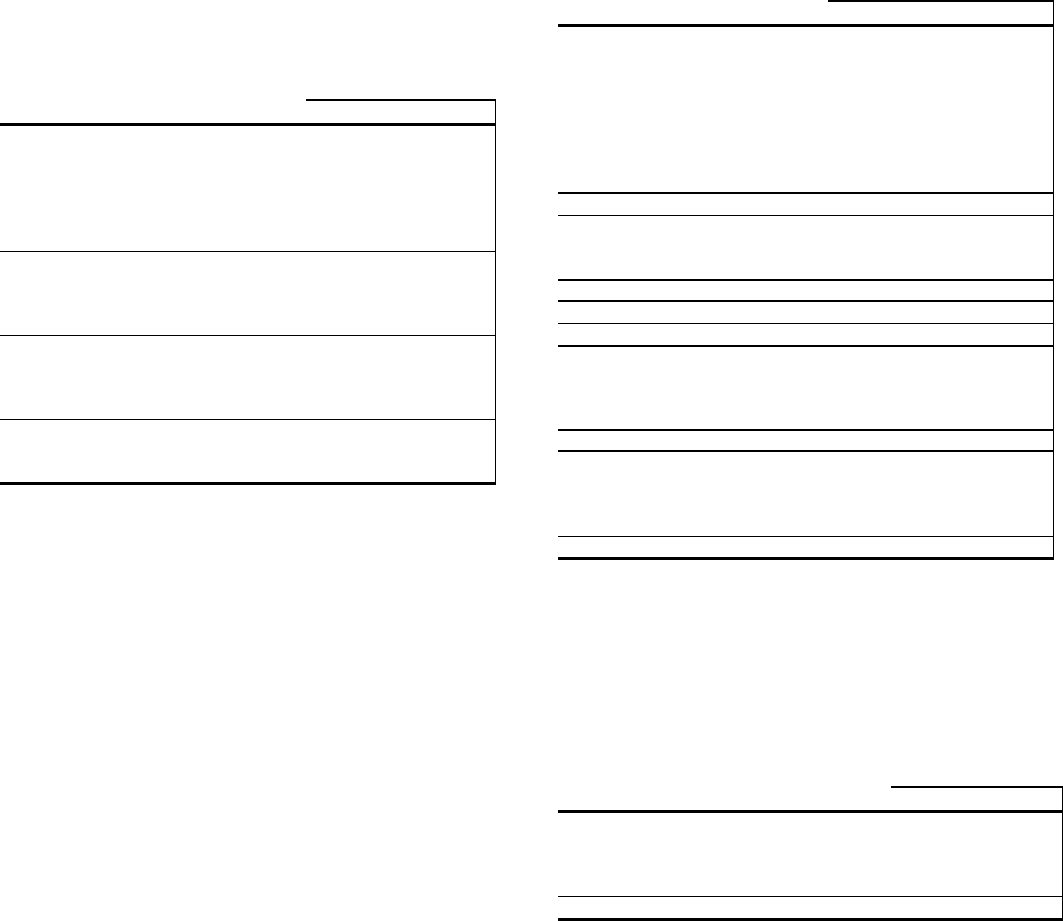

CONSOLIDATED BALANCE SHEET

REVIEW

SUMMARIZED BALANCE SHEET DATA

December 31 - in millions 2005 2004

Assets

Loans, net of unearned income $49,101 $43,495

Securities available for sale and held

to maturity 20,710 16,761

Loans held for sale 2,449 1,670

Other 19,694 17,797

Total assets $91,954 $79,723

Liabilities

Funding sources $77,172 $65,233

Other 5,629 6,513

Total liabilities 82,801 71,746

Minority and noncontrolling interests in

consolidated entities 590 504

Total shareholders' equity 8,563 7,473

Total liabilities, minority and

noncontrolling interests,

and shareholders' equity $91,954 $79,723

The summarized balance sheet data above is based upon our

Consolidated Balance Sheet in Item 8 of this Report.

Higher total assets at December 31, 2005 compared with the

prior year-end were driven by loan growth resulting

primarily from continued improvements in market loan

demand, higher securities balances that reflected normal

portfolio activity, purchases, and the impact of our

expansion into the greater Washington, D.C. area.

An analysis of changes in selected balance sheet categories

follows.

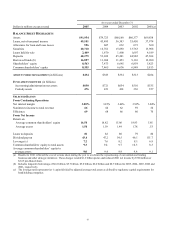

LOANS , NET OF UNEARNED INCOME

Loans increased $5.6 billion, or 13%, as of December 31,

2005 compared with December 31, 2004. Improvements in

market loan demand, in addition to targeted sales efforts

across our banking businesses, drove the increase in total

loans compared with the prior year-end. The impact of our

Riggs acquisition added $2.7 billion of loans as of

December 31, 2005. Loans at December 31, 2004 included

$2.3 billion related to the Market Street conduit that we

deconsolidated effective October 17, 2005.

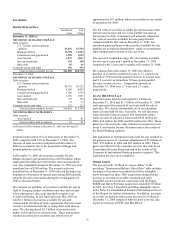

Details Of Loans

December 31 - in millions 2005 2004

Commercial

Retail/wholesale $4,854 $4,961

Manufacturing 4,045 3,944

Other service providers 1,986 1,787

Real estate related 2,577 2,104

Financial services 1,438 1,145

Health care 616 560

Other 3,809 2,937

Total commercial 19,325 17,438

Commercial real estate

Real estate projects 2,244 1,460

Mortgage 918 520

Total commercial real estate 3,162 1,980

Equipment lease financing 3,628 3,907

Total commercial lending 26,115 23,325

Consumer

Home equity 13,790 12,734

Automobile 938 836

Other 1,445 2,036

Total consumer 16,173 15,606

Residential mortgage 7,307 4,772

Vehicle lease financing 189

Other 341 505

Unearned income (835) (902)

Total, net of unearned income $49,101 $43,495

As the table above indicates, the loans that we hold continued

to be diversified among numerous industries and types of

businesses. The loans that we hold are also diversified across

the geographic areas where we do business. See Note 7 Loans,

Commitments To Extend Credit and Concentrations of Credit

Risk in the Notes To Consolidated Financial Statements in

Item 8 of this Report for additional information.

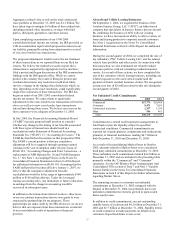

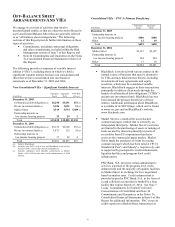

Commercial Lending Exposure (a)

Decemb er 31 - in millions 2005 2004

Investment grade or equivalent 46%

47%

Non-investment grade

$50 million or greater 2%

2%

All other non-investment grade 52%

51%

Total 100%

100%

(a) Includes all commercial loans in the Retail Banking and Corporate &

Institutional Banking business segments other than the loans of

Market Street. We deconsolidated Market Street from our

Consolidated Balance Sheet effective October 17, 2005.

Cross-Border Leases and Related Tax and Accounting

Matters

The equipment lease portfolio totaled $3.6 billion at

December 31, 2005 and included approximately $1.7 billion

of cross-border leases. Cross-border leases are primarily

leveraged leases of equipment located in foreign countries,

primarily in western Europe and Australia. We no longer

enter into cross-border lease transactions.