PNC Bank 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

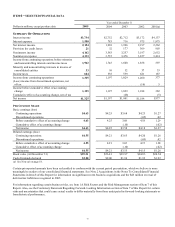

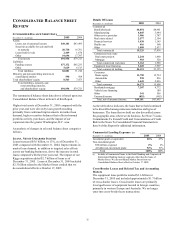

CONSOLIDATED INCOME

STATEMENT REVIEW

NET INTEREST INCOME - OVERVIEW

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-

earning assets and related yields, interest-bearing liabilities

and related rates paid, and noninterest-bearing sources.

See Statistical Information – Analysis of Year-To-Year

Changes in Net Interest Income and Average Consolidated

Balance Sheet and Net Interest Analysis in Item 8 of this

Report for additional information.

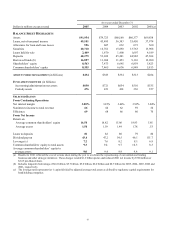

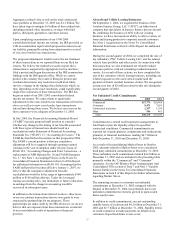

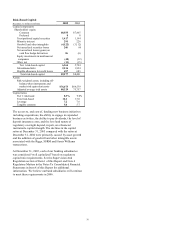

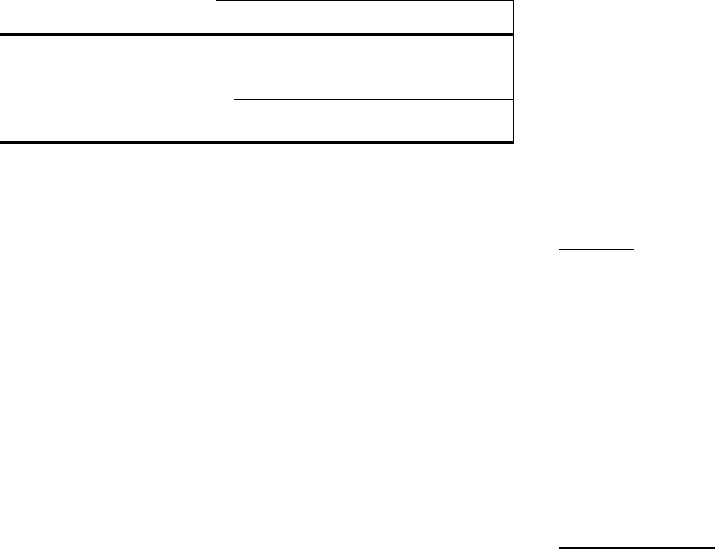

NET INTEREST INCOME - GAAP RECONCILIATION

The interest income earned on certain assets is completely

or partially exempt from federal income tax. As such, these

tax-exempt instruments typically yield lower returns than a

taxable investment. To provide more meaningful

comparisons of yields and margins for all earning assets, we

also provide net interest income on a taxable -equivalent

basis by increasing the interest income earned on tax-

exempt assets to make it fully equivalent to interest income

on other taxable investments. This adjustment is not

permitted under GAAP.

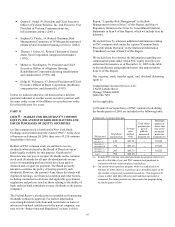

A reconciliation of net interest income as reported in the

Consolidated Income Statement (GAAP basis) to net

interest income on a taxable-equivalent basis follows (in

millions):

For the year ended December 31,

2005 2004 2003

Net interest income, GAAP

basis $2,154 $1,969 $1,996

Taxable-equivalent adjustment 33 20 10

Net interest income, taxable-

equivalent basis $2,187 $1,989 $2,006

Taxable-equivalent net interest income increased $198

million in 2005 compared with 2004 due to strong growth in

earning assets and deposits. Management expects net

interest income to continue to grow and to be higher for full-

year 2006 compared with 2005.

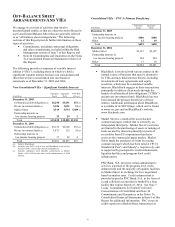

NET INTEREST MARGIN

The net interest margin was 3.00% for 2005, a decline of 22

basis points compared with 2004. The following factors

contributed to the decline in net interest margin in 2005:

• An increase in the average rate paid on deposits of

93 basis points for 2005 compared with 2004. The

average rate paid on money market accounts, the

largest single component of interest-bearing

deposits, increased 130 basis points, reflecting the

increases in short-term interest rates that began in

mid-2004.

• An increase in the average rate paid on borrowed

funds of 131 basis points for 2005 compared with

2004.

• By comparison, the yield on interest-earning assets

increased 68 basis points.

• Higher balances of interest-earning trading assets for

2005, which negatively affected the overall yield on

interest-earning assets.

The factors above were partially offset by the favorable

impact on net interest margin in 2005 of an increase of 15

basis points related to noninterest-bearing sources of

funding. See Consolidated Income Statement Review under

the 2004 Versus 2003 section of Item 7 of this Report for

further information regarding 2003 taxable-equivalent net

interest income and margin.

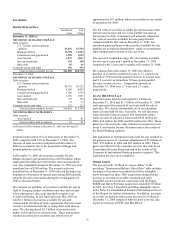

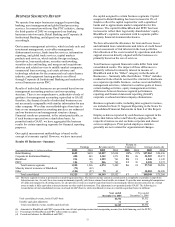

PROVISION FOR CREDIT LOSSES

The provision for credit losses decreased $31 million, to $21

million, for 2005 compared with 2004. The decline in the

provision for credit losses was primarily due to the benefit

of a $53 million loan recovery in the second quarter of 2005

resulting from a litigation settlement, in addition to

continued strong asset quality. The favorable impact of

thes e factors on the provision was partially offset by the

impact of total average loan and loan commitments growth

in 2005 compared with the prior year.

We expect loan and loan commitment growth to continue to

impact the provision during 2006. In addition, we do not

expect to sustain asset quality at its current level and we

expect a higher provision for credit losses in 2006.

However, based on the assets we currently hold and current

business trends and activities, we believe that overall asset

quality will remain strong for at least the near term.

See the Credit Risk Management portion of the Risk

Management section of Item 7 for additional information

regarding factors impacting the provision for credit losses.

Also see Allowances For Loan And Lease Losses And

Unfunded Loan Commitments And Letters of Credit in that

Credit Risk Management section for additional information

regarding factors impacting the provision for credit losses.

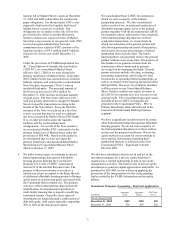

NONINTEREST INCOME

Summary

Noninterest income was $4.162 billion for 2005, an increase

of $599 million compared with 2004. Higher asset

management fees was the largest factor in the increase,

driven largely by BlackRock’ s acquisition of SSRM in

January 2005 and higher performance fees. In addition,

noninterest income in 2005 re flected increases in all other

major categories other than net securities losses in 2005

compared with net gains in 2004. We expect that the

increase in our ownership in the Merchant Services business

and the impact of the Harris Williams acquisition will have

a positive impact on noninterest income in 2006.

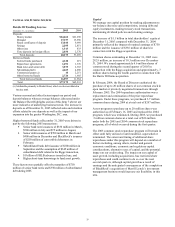

Additional analysis

Combined asset management and fund servicing fees

amounted to $2.313 billion for 2005 compared with $1.811

billion for 2004. The increase reflected the impact of the

first quarter 2005 SSRM acquisition, higher performance