PNC Bank 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

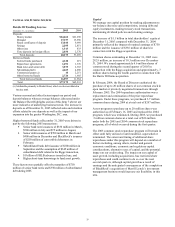

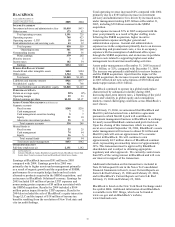

BUSINESS SEGMENTS REVIEW

We operate four major businesses engaged in providing

banking, asset management and global fund processing

services. In connection with our One PNC initiative, during

the third quarter of 2005 we reorganized our banking

businesses into two units, Retail Banking and Corporate &

Institutional Banking, and aligned our reporting

accordingly.

Our treasury management activities, which include cash and

investment management, receivables management,

disbursement services, funds transfer services, information

reporting, and global trade services; capital markets

products and services, which include foreign exchange,

derivatives, loan syndications, securities underwriting,

securities sales and trading, and mergers and acquisitions

advisory and related services to middle-market companies;

commercial loan servicing, real estate advisory and

technology solutions for the commercial real estate finance

industry; and equipment leasing products are offered

through Corporate & Institutional Banking and marketed by

several businesses across PNC.

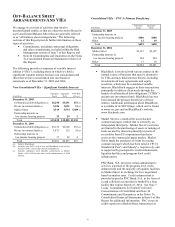

Results of individual businesses are presented based on our

management accounting practices and our operating

structure. There is no comprehensive, authoritative body of

guidance for management accounting equivalent to GAAP;

therefore, the financial results of individual businesses are

not necessarily comparable with similar information for any

other company. We refine our methodologies from time to

time as our management accounting practices are enhanced

and our businesses and management structure change.

Financial results are presented, to the extent practicable, as

if each business operated on a stand-alone basis. As

permitted under GAAP, we have aggregated the business

results for certain operating segments for financial reporting

purposes.

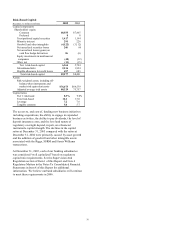

Our capital measurement methodology is based on the

concept of economic capital. However, we have increased

the capital assigned to certain business segments. Capital

assigned to Retail Banking has been increased to 6% of

funds to reflect the capital required for well-capitalized

banks and to approximate market comparables for this

business. The capital for BlackRock and PFPC has been

increased to reflect their legal entity shareholders’ equity.

BlackRock’ s capital is consistent with its separate public

company financial statement disclosures.

We have allocated the allowance for loan and lease losses

and unfunded loan commitments and letters of credit based

on our assessment of risk inherent in the loan portfolios.

Our allocation of the costs incurred by operations and other

support areas not directly aligned with the businesses is

primarily based on the use of services.

Total business segment financial results differ from total

consolidated results. The impact of these differences is

primarily reflected in minority interest in income of

BlackRock and in the “Other” category in the Results of

Businesses – Summary table that follows. “Other” includes

residual activities that do not meet the criteria for disclosure

as a separate reportable business, such as asset and liability

management activities, related net securities gains or losses,

certain trading activities, equity management activities,

differences between business segment performance

reporting and financial statement reporting (GAAP),

corporate overhead and intercompany eliminations.

Business segment results, including inter-segment revenues,

are included in Note 21 Segment Reporting in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

Employee data as reported by each business segment in the

tables that follow reflect staff directly employed by the

respective busines ses and excludes corporate and shared

services employees. Prior period employee statistics

generally are not restated for organizational changes.

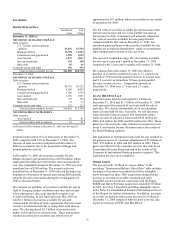

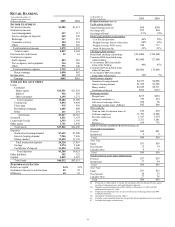

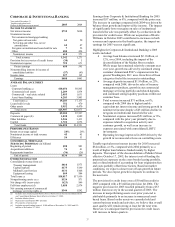

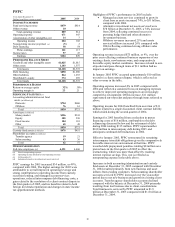

Results Of Businesses - Summary

Return on

Earnings Revenue (a) (b) Capital (c) Average Assets (d)

Year ended December 31 - dollars in millions

2005

2004

2005

2004

2005

2004

2005

2004

Retail Banking $682 $610 $2,857 $2,694

24%

23% $27,862 $24,496

Corporate & Institutional Banking 480 443 1,342 1,271 28 26 25,907 22,073

BlackRock 234 143 1,229 761 28 19 1,848 1,145

PFPC 104 70 846 763 32 30 2,128 2,572

Total business segments 1,500 1,266 6,274 5,489 26 24 57,745 50,286

Minority interest in income of BlackRock (71) (42)

Other (104) (27) 75 63 30,803 24,980

Total consolidated $1,325 $1,197 $6,349 $5,552 17 17 $88,548 $75,266

(a) Business segment revenue is presented on a taxable-equivalent basis. The interest income earned on certain assets is completely or partially exempt from

federal income t ax. As such, these tax-exempt instruments typically yield lower returns than a taxable investment. To provide more meaningful comparisons

of yields and margins for all earning assets, we also provide revenue on a taxable-equivalent basis by increasing the interest income earned on tax-exempt

assets to make it fully equivalent to interest income on other taxable investments. This adjustment is not permitted under GAAP. The following is a

reconciliation of total consolidated revenue on a book (GAAP) basis to total consolidated revenue on a taxable-equivalent basis (in millions):

Year ended

Year ended

December 31, 2005

December 31, 2004

Total consolidated revenue, book (GAAP) basis $6,316

$5,532

Taxable-equivalent adjustment 33

20

Total consolidated revenue, taxable-equivalent basis $6,349

$5,552

(b) Amounts for BlackRock and PFPC represent the sum of total operating revenue and nonoperating income (less debt financing costs for PFPC).

(c) Percentages for BlackRock and PFPC reflect return on equity.

(d) Period-end balances for BlackRock and PFPC.