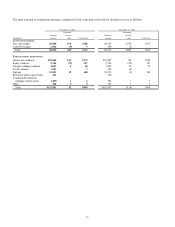

PNC Bank 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

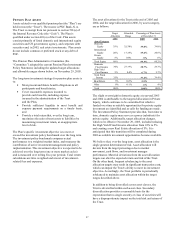

100

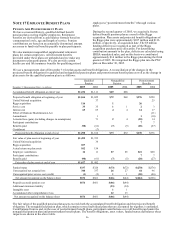

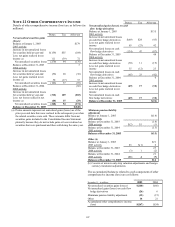

amendment, only participants age 50 or older were permitted to

exercise this diversification option. Employee benefits expense

related to this plan was $47 million in 2005, $48 million in

2004 and $49 million in 2003. We measured employee benefits

expense as the fair value of the shares and cash contributed to

the plan by PNC.

Additionally, Hilliard Lyons sponsors a contributory, qualified

defined contribution plan that covers substantially all of its

employees who are not covered by the plan described above.

Contributions to this plan are made in cash and include a base

contribution for those participants employed at December 31, a

matching of employee contributions, and a discretionary profit

sharing contribution as determined by Hilliard Lyons’

Executive Compensation Committee. Employee benefits

expense for this plan was $6 million in 2005 and $5 million in

both 2004 and 2003.

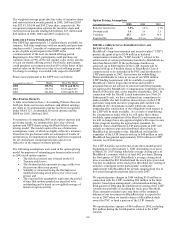

Effective July 1, 2004, we adopted a separate qualified defined

contribution plan that covers substantially all US-based PFPC

employees not covered by our plan. The plan is a 401(k) plan

and includes an ESOP feature. Under this plan, employee

contributions of up to 6% of eligible compensation as defined

by the plan may be matched annually based on PFPC

performance levels. Participants must be employed as of

December 31 of each year to receive this annual contribution.

The performance-based employer matching contribution will be

made primarily in shares of PNC common stock held in

treasury, except in the case of those participants who have

exercised their diversification election rights to have their

matching portion in other investments available within the plan.

Mandatory employer contributions to this plan are made in cash

and include employer basic and transitional contributions.

Employee-directed contributions are invested in a number of

investment options available under the plan, including a PNC

common stock fund and several BlackRock mutual funds, at the

direction of the employee. Effective November 22, 2005, we

amended the plan to provide all participants the ability to

diversify the matching portion of their plan account invested in

shares of PNC common stock into other investments available

within the plan. Prior to this amendment, only participants age

50 or older were permitted to exercise this diversification

option. Employee benefits expense for this plan, which was

effective July 1, 2004, was $12 million in 2005 and $5 million

for 2004. We measured employee benefits expense as the fair

value of the shares and cash contributed to the plan.

We also maintain a nonqualified supplemental savings plan for

certain employees.

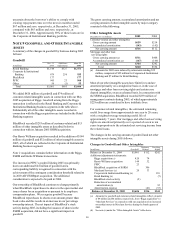

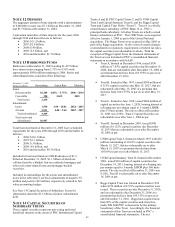

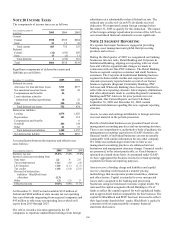

NOTE 18 STOCK-BASED COMPENSATION

PLANS

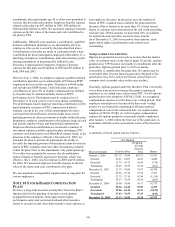

We have a long-term incentive award plan (“Incentive Plan”)

that provides for the granting of incentive stock options,

nonqualified stock options, stock appreciation rights,

performance units, and restricted stock and other incentive

shares to executives and, other than incentive stock options, to

non-employee directors. In any given year, the number of

shares of PNC common stock available for grant under the

Incentive Plan is limited to no more than 3% of total issued

shares of common stock determined at the end of the preceding

calendar year. Of this amount, no more than 20% is available

for restricted stock and other incentive share awards.

As of December 31, 2005 no incentive stock options, stock

appreciation rights or performance unit awards were

outstanding.

NONQUALIFIED STOCK OPTIONS

Options are granted at exercise prices not less than the market

value of common stock on the date of grant. Generally, options

granted since 1999 become exercisable in installments after the

grant date. Options granted prior to 1999 are mainly

exercisable 12 months after the grant date. No option may be

exercisable after 10 years from its grant date. Payment of the

option price may be in cash or previously owned shares of

common stock at market value on the exercise date.

Generally, options granted under the Incentive Plan vest ratably

over a three-year period as long as the grantee remains an

employee or, in certain cases, retires from PNC. For all options

granted prior to the adoption of SFAS 123(R), we recognized

compensation expense over the three-year vesting period. If an

employee retired prior to the end of the three-year vesting

period, we accelerated the expensing of all unrecognized

compensation costs at the retirement date. As required upon

adoption of SFAS 123(R), we will recognize compensation

expense for options granted to retirement-eligible employees

after January 1, 2006 within the first year of the grant date, in

accordance with the service period provisions of the Incentive

Plan.

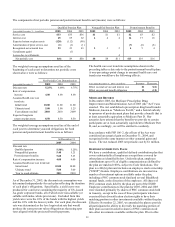

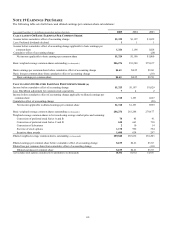

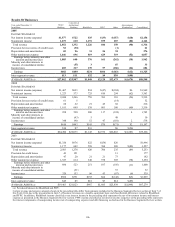

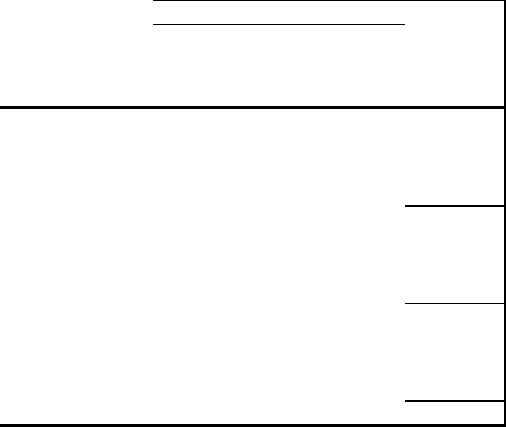

A summary of stock option activity follows:

Per Option

Shares in thousands

Exercise Price

Weighted-

Average

Exercise

Price

Shares

January 1, 2003 $21.75 – 76.00 $55.33 15,541

Granted 43.41 – 54.07 44.41 4,080

Exercised 21.75 – 54.72 36.85 (730)

Terminated 29.25 – 74.59 54.10 (501)

December 31, 2003 21.75 – 76.00 53.67 18,390

Granted 49.66 – 57.42 53.94 2,301

Exercised 21.75 – 57.10 42.44 (1,354)

Terminated 38.17 – 74.59 58.38 (602)

December 31, 2004 29.06 – 76.00 54.37 18,735

Granted 52.36 – 64.26 53.83 2,439

Exercised 29.06 – 63.25 46.31 (2,439)

Terminated 37.43 – 74.59 57.33 (443)

December 31, 2005 31.13 – 76.00 55.30 18,292