PNC Bank 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

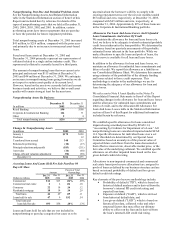

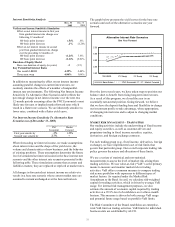

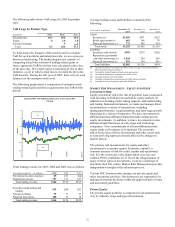

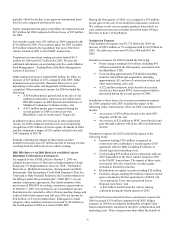

The following table shows VaR usage for 2005 by product

type:

VaR Usage by Product Type

In millions Min. Max. Avg.

Fixed Income $4.1 $9.4 $6.4

Equity .6 1.8 1.0

Foreign Exchange .5

.2

Total 5.1 10.6 $7.6

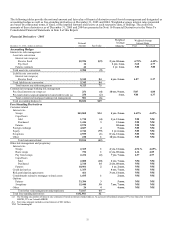

To help ensure the integrity of the models used to calculate

VaR for each portfolio and enterprise-wide, we use a process

known as backtesting. The backtesting process consists of

comparing actual observations of trading-related gains or

losses against the VaR levels that were calculated at the close

of the prior day. We would expect a maximum of two to three

instances a year in which actual losses exceeded the prior day

VaR measure. During the full year of 2005, there were no such

instances at the enterprise-wide level.

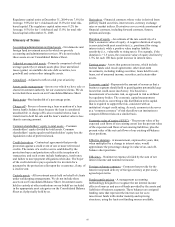

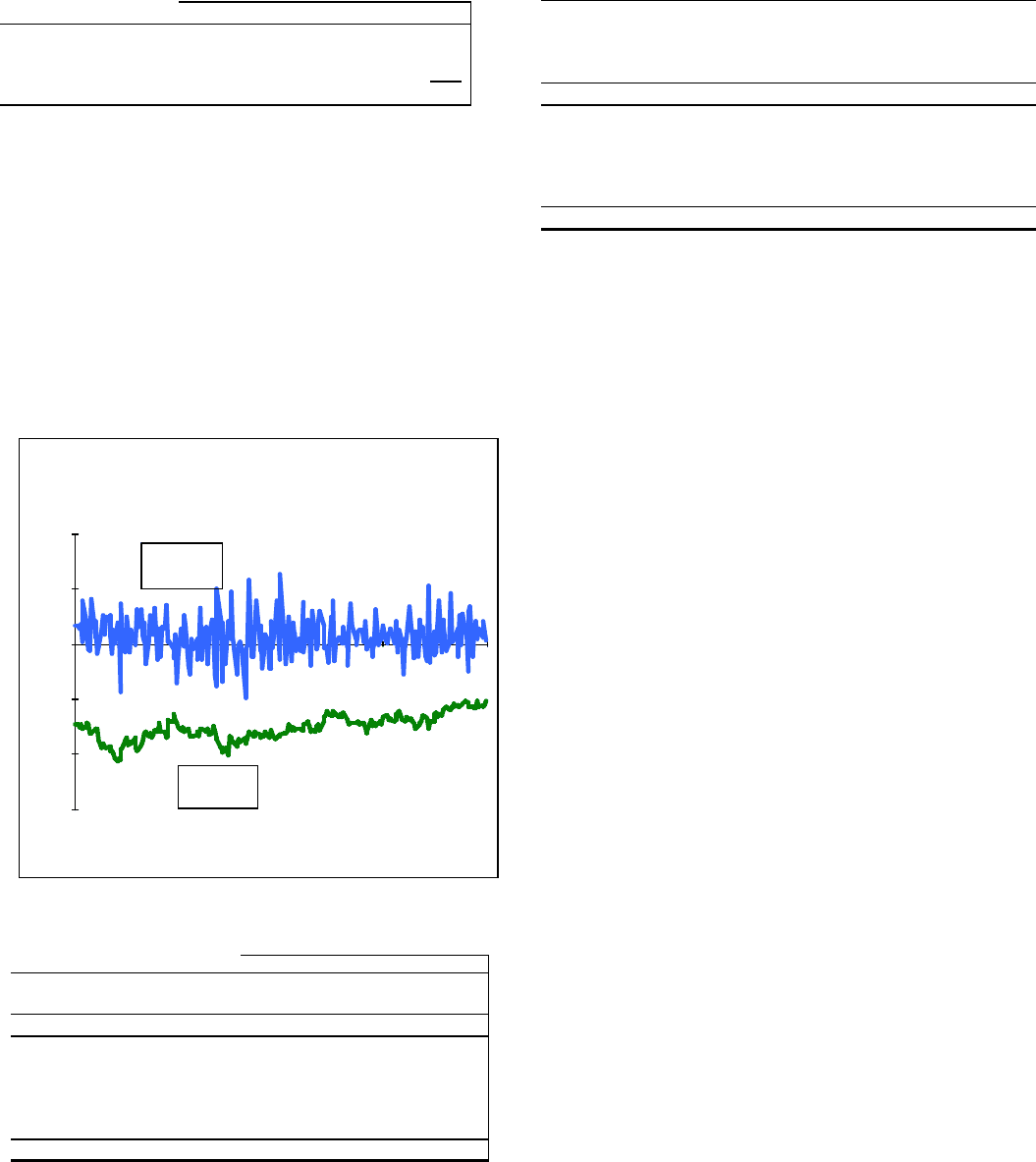

The following graph shows a comparison of enterprise-wide

trading-related gains and losses against prior day VaR for the

period.

Enterprise-Wide Trading-Related Gains/Losses Versus Value at Risk

YTD 2005

(15)

(10)

(5)

0

5

10

12/31/2004

3/31/2005

6/30/2005

9/30/2005

12/31/2005

Millions

VaR

P&L

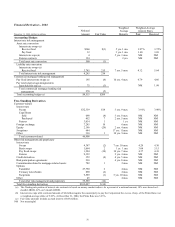

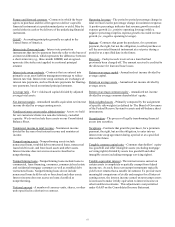

Total trading revenue for 2005, 2004 and 2003 was as follows:

Year end December 31 – in millions 2005 2004 2003

Net interest income (expense) $9 $13 $(2)

Noninterest income 157 113 127

Total trading revenue $166 $126 $125

Securities underwriting and

trading $19 $60 $82

Foreign exchange 39 31 25

Financial derivatives 108 35 18

Total trading revenue $166 $126 $125

Average trading assets and liabilities consisted of the

following:

Year ended - in millions December 31

2005

December 31

2004

December 31

2003

Assets

Securities (a) $1,850 $871 $152

Resale agr eements (b) 663 166 70

Financial derivatives (c) 772 605 914

Total assets $3,285 $1,642 $1,136

Liabilities

Securities sold short (d) $993 $275 $120

Repurchase agreements

and other borrowings (e)

1,044 249 249

Financial derivatives (f) 825 594 545

Total liabilities $2,862 $1,118 $914

(a) Included in Interest-earning assets-Other on the Average Consolidated Balance

Sheet And Net Interest Analysis.

(b) Included in Federal funds sold and resale agreements.

(c) Included in Noninterest-earning assets-Other assets.

(d) Included in Other borrowed funds.

(e) Included in Repurchase agreements and Other borrowed funds.

(f) Included in Accrued expenses and other liabilities.

MARKET RISK MANAGEMENT – EQUITY AND OTHER

INVESTMENT RISK

Equity investment risk is the risk of potential losses associated

with investing in both private and public equity markets. In

addition to extending credit, taking deposits, and underwriting

and trading financial instruments, we make and manage direct

investments in a variety of transactions, including

management buyouts, recapitalizations, and later-stage growth

financings in a variety of industries. We have investments in

affiliated and non-affiliated funds that make similar private

equity investments. In addition, we have investments in non-

affiliated funds that invest in early stage and technology

companies. New commitments to all non-affiliated private

equity funds will continue to be minimal. The economic

and/or book value of these investments and other assets such

as loan servicing rights are directly affected by changes in

market factors.

The primary risk measurement for equity and other

investments is economic capital. Economic capital is a

common measure of risk for credit, market and operational

risk. It is the worst-case value depreciation over one year

within a 99.9% confidence level. Given the illiquid nature of

many of these types of investments, it can be a challenge to

determine their fair values. Market Risk Management provides

independent oversight of the valuation process.

Various PNC business units manage our private equity and

other investment activities. Our businesses are responsible for

making investment decisions within the approved policy limits

and associated guidelines.

Private Equity

The private equity portfolio is comprised of investments that

vary by industry, stage and type of investment.