PNC Bank 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

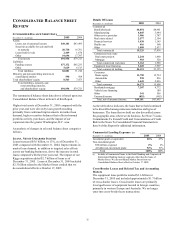

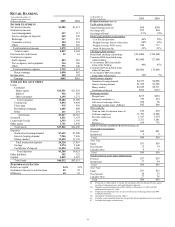

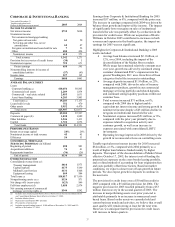

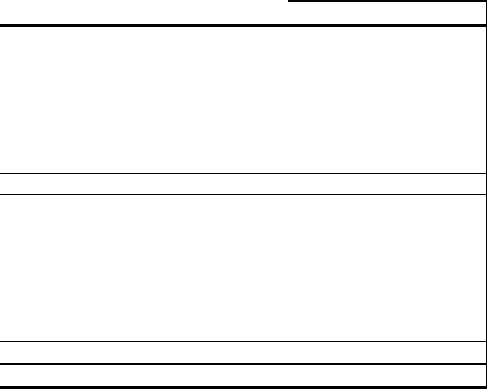

CAPITAL AND FUNDING SOURCES

Details Of Funding Sources

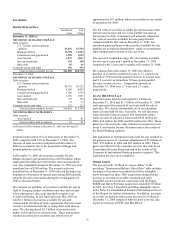

December 31 - in millions 2005 2004

Deposits

Money market $24,462 $21,250

Demand 17,157 15,996

Retail certificates of deposit 13,010 9,969

Savings 2,295 2,851

Other time 1,313 833

Time deposits in foreign offices 2,038 2,370

Total deposits 60,275 53,269

Borrowed funds

Federal funds purchased 4,128 219

Repurchase agreements 1,691 1,376

Bank notes and senior debt 3,875 2,383

Subordinated debt 4,469 4,050

Commercial paper (a) 10 2,251

Other borrowed funds 2,724 1,685

Total borrowed funds 16,897 11,964

Total $77,172 $65,233

(a) Attributable primarily to Market Street, which was deconsolidated in

October 2005.

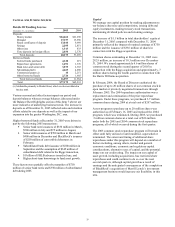

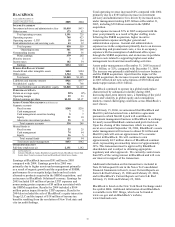

Various seasonal and other factors impact our period-end

deposit balances whereas average balances (discussed under

the Balance Sheet Highlights section of this Item 7 above) are

more indicative of underlying business trends. The increase in

deposits as of December 31, 2005 reflected sales and retention

efforts related to core deposits as well as the impact of our

expansion into the greater Washington, D.C. area.

Higher borrowed funds at December 31, 2005 were driven in

part by the following 2005 transactions:

• Senior bank note issuances of $350 million in March,

$500 million in July and $75 million in August,

• Senior debt issuances of $700 million in March and

$400 million in December and BlackRock’ s issuance

of $250 million of convertible debentures in

February,

• Subordinated bank debt issuance of $500 million in

September and the assumption of $345 million of

subordinated debt related to the Riggs transaction,

• $1 billion of FHLB advances issued in June, and

• Higher short-term borrowings to fund asset growth.

.

These factors were partially offset by maturities of $750

million of senior bank notes and $350 million of subordinated

debt during 2005.

Capital

We manage our capital position by making adjustments to

our balance sheet size and composition, issuing debt and

equity instruments, making treasury stock transactions,

maintaining dividend policies and retaining earnings.

The increase of $1.1 billion in total shareholders’ equity at

December 31, 2005 compared with December 31, 2004

primarily reflected the impact of retained earnings of $750

million and the issuance of $356 million of shares in

connection with the Riggs acquisition.

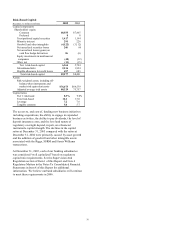

Common shares outstanding at December 31, 2005 were

292.9 million, an increase of 10.3 million over December

31, 2004. We issued approximately 6.6 million shares of

common stock during the second quarter of 2005 in

connection with the Riggs acquisition and approximately .7

million shares during the fourth quarter in connection with

the Harris Williams acquisition.

In February 2004, the Board of Directors authorized the

purchase of up to 20 million shares of our common stock in

open market or privately negotiated transactions through

February 2005. The 2004 repurchase authorization was a

replacement and continuation of the prior repurchase

program. Under these programs, we purchased 3.7 million

common shares during 2004 at a total cost of $207 million.

A new program to purchase up to 20 million shares was

authorized as of February 16, 2005 and replaced the 2004

program, which was terminated. During 2005, we purchased

.5 million common shares at a total cost of $26 million

under both the 2005 and 2004 common stock repurchase

programs, all of which occurred during the first quarter.

The 2005 common stock repurchase program will remain in

effect until fully utilized or until modified, superseded or

terminated. The extent and timing of additional share

repurchases under this program will depend on a number of

factors including, among others, market and general

economic conditions, economic and regulatory capital

considerations, alternative uses of capital, and the potential

impact on our credit rating. The impact on our capital of

asset growth, including acquisitions, has restricted share

repurchases and could continue to do so over the next

several quarters, although capital growth as a result of

earnings and the anticipated consequences of the completion

of BlackRock’ s acquisition of Merrill Lynch’ s investment

management business would increase our flexibility in this

area.