Nokia 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

90

NOKIA SHARES AND SHAREHOLDERS

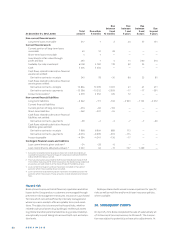

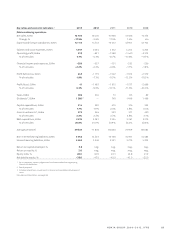

Key ratios December 31, 2013, IFRS (calculation see page 98) 2013 2012 2011 2010 2009

Earnings per share for profi t attributable

to equity holders of the parent, EUR

Earnings per share, basic – 0.17 -0.84 – 0.31 0.50 0.24

Earnings per share, diluted – 0.17 -0.84 – 0.31 0.50 0.24

P/E ratio neg. neg. neg. 15.48 37.17

(Nominal) dividend per share, EUR 0.37 0.00 0.20 0.40 0.40

Total dividends paid, EURm 2 1 386 0.00 749 1 498 1 498

Payout ratio neg. 0.00 neg. 0.80 1.67

Dividend yield, % 6.36 0.00 5.30 5.17 4.48

Shareholders’ equity per share, EUR 3 1.74 2.14 3.20 3.88 3.53

Market capitalization, EURm 3 21 606 10 873 13 987 28 709 33 078

Dividend to be proposed by the Board of Directors for fiscal year for shareholders’ approval at the Annual General Meeting convening on June , .

Calculated for all the shares of the company as of the applicable year-end.

Shares owned by the Group companies are not included.

SHARES AND SHARE CAPITAL

Nokia has one class of shares. Each Nokia share entitles the

holder to one vote at General Meetings of Nokia.

On December , , the share capital of Nokia Corpora-

tion was EUR . and the total number of shares

issued was . On December , , the total

number of shares included shares owned by Group

companies representing approximately .% of the share

capital and the total voting rights.

Under the Articles of Association of Nokia, Nokia Corpo ra-

tion does not have minimum or maximum share capital or a par

value of a share.

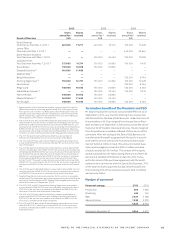

Share capital and shares December 31, 2013 2013 2012 2011 2010 2009

Share capital, EURm 246 246 246 246 246

Shares (1 000) 3 744 994 3 744 956 3 744 956 3 744 956 3 744 956

Shares owned by the Group (1 000) 32 568 33 971 34 767 35 826 36 694

Number of shares excluding shares owned by the Group (1 000) 3 712 427 3 710 985 3 710 189 3 709 130 3 708 262

Average number of shares excluding shares

owned by the Group during the year (1 000), basic 3 712 079 3 710 845 3 709 947 3 708 816 3 705 116

Average number of shares excluding shares

owned by the Group during the year (1 000), diluted 3 712 079 3 710 845 3 709 947 3 713 250 3 721 072

Number of registered shareholders 1 225 587 250 799 229 096 191 790 156 081

Each account operator is included in the figure as only one registered shareholder.

AUTHORIZATIONS

Authorization to increase the share capital

At the Annual General Meeting held on May , , Nokia share-

holders authorized the Board of Directors to issue a maximum

of million shares through one or more issues of shares

or special rights entitling to shares, including stock options.

The Board of Directors may issue either new shares or shares

held by the Company. The authorization includes the right for

the Board to resolve on all the terms and conditions of such

issuances of shares and special rights, including to whom the

shares and the special rights may be issued. The authorization

may be used to develop the Company’s capital structure, di-

versify the shareholder base, fi nance or carry out acquisitions

or other arrangements, settle the Company’s equity-based

incentive plans, or for other purposes resolved by the Board.

The authorization is eff ective until June , .

At the end of , the Board of Directors had no other

authorizations to issue shares, convertible bonds, warrants or

stock options.

Other authorizations

At the Annual General Meeting held on May , , Nokia

shareholders authorized the Board of Directors to repurchase

a maximum of million Nokia shares by using funds in the

unrestricted equity. Nokia did not repurchase any shares on

the basis of this authorization. This authorization would have

been eff ective until June , as per the resolution of the

Annual General Meeting on May , , but it was terminated

by the resolution of the Annual General Meeting on May , .

At the Annual General Meeting held on May , , Nokia

shareholders authorized the Board of Directors to repurchase

a maximum of million Nokia shares by using funds in the

unrestricted equity. The amount of shares corresponds to

less than % of all the shares of the Company. The shares

may be repurchased under the buyback authorization in order

to develop the capital structure of the Company. In addition,

shares may be repurchased in order to fi nance or carry out

acquisitions or other arrangements, to settle the Company’s