Nokia 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

132

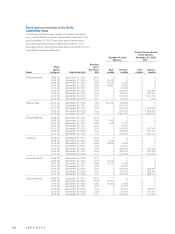

Planned maximum number of

shares available for grants

Plan type under the Equity Program 2014

Restricted shares 2 million

Performance shares at maximum 1 29.7 million

Employee share purchase plan 2 0.42 million

The number of Nokia shares to be delivered at minimum is a quarter of

maximum performance, i.e., a total of . million Nokia shares.

The calculation for the Employee Share Purchase Plan is based on the

closing share price EUR . on February , , the day prior to board

approval.

As at December , , the total dilutive eff ect of all

Nokia’s stock options, performance shares and restricted

shares outstanding, assuming full dilution, was approximately

.% in the aggregate. The potential maximum eff ect of the

Equity Program would be approximately another .%.

Due to the Sale of D&S Business to Microsoft shares will be

forfeited when employees transfer to Microsoft. The impact

to dilution is .%, and, consequently, overall expected maxi-

mum dilution of outstanding equity programs is .%.

NSN EQUITY INCENTIVE PLAN

Networks established a share-based incentive plan in

under which options over Networks shares were granted to

selected employees (“NSN Equity Incentive Plan”). The options

generally become exercisable on the fourth anniversary of the

grant date or, if earlier, on the occurrence of certain corporate

transactions such as an initial public off ering (“Corporate

Transaction”).

The exercise price of the options is based on a Networks

share value on grant as determined for the purposes of the

NSN Equity Incentive Plan. The options will be cash-settled

at exercise, unless an initial public off ering has taken place,

at which point they would be converted into equity-settled

options. If the options are cash-settled, the holder will be en-

titled to half of the share appreciation based on the exercise

price and the estimated value of shares on the exercise date,

unless there has been a change of control, as specifi ed in the

plan terms, in which case the holder will be entitled to all of the

share appreciation. If a Corporate Transaction has not taken

place by the sixth anniversary of the grant date, the options

will be cashed out. If an initial public off ering has taken place,

equity-settled options remain exercisable until the tenth an-

niversary of the grant date. The gains that may be made under

the NSN Equity Plan are also subject to a cap.

As a consequence of (i) Networks having become a wholly

owned subsidiary of Nokia, and (ii) Nokia being in the process

of the Sale of the D&S business, the Board of Directors ap-

proved on February , a modifi cation to the NSN Equity

Incentive Plan to allow % of the options to vest on the third

anniversary of the grant date, with the remainder of the op-

tions continuing to become exercisable on the fourth anniver-

sary of the grant date, or earlier, in the event of a Corporate

Transaction.

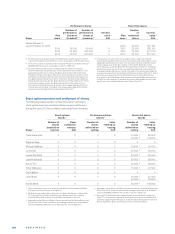

SHARE OWNERSHIP

General

The following section describes the ownership or potential

ownership interest in the company of the members of our

Board of Directors and the Nokia Leadership Team as at

December , , either through share ownership or, with

respect to the Nokia Leadership Team, through holding of

equity-based incentives, which may lead to share ownership in

the future.

With respect to the Board of Directors, approximately %

of director compensation is paid in the form of Nokia shares

that are purchased from the market or alternatively by us-

ing own shares held by the company. It is also Nokia’s current

policy that the Board members retain all Nokia shares received

as director compensation until the end of their board mem-

bership (except for those shares needed to off set any costs

relating to the acquisition of the shares, including taxes). In

addition, it is Nokia’s policy that non-executive members of

the Board do not participate in any of Nokia’s equity programs

and do not receive stock options, performance shares, re-

stricted shares or any other equity based or otherwise vari-

able compensation for their duties as Board members.

For a description of the compensation for our Board of

Directors, please see “Compensation of the Board of Directors

in ”.

The Nokia Group Leadership Team members have received

equity-based compensation in the form of performance

shares, restricted shares, stock options and equity awards

under the Networks Equity Incentive Plan. For a description of

our equity-based compensation programs for employees and

executives, see “Equity-based incentive programs”.

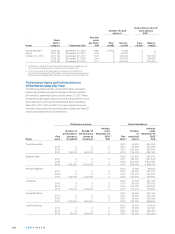

Share ownership of the Board of Directors

At December , , the members of our Board of Direc-

tors held the aggregate of shares and ADSs in Nokia,

which represented .% of our outstanding shares and total

voting rights excluding shares held by Nokia Group at that date.

Each member of the Board of Directors owns less than % of

Nokia shares.

The following table sets forth the number of shares and

ADSs held by the members of the Board of Directors as at

December , .

Name 1 Shares 2 ADSs 2

Risto Siilasmaa 809 809 —

Bruce Brown — 53 528

Elizabeth Doherty 11 499 —

Henning Kagermann 200 708 —

Jouko Karvinen 48 653 —

Helge Lund 57 274 —

Mårten Mickos 99 028 —

Elisabeth Nelson — 68 053

Kari Stadigh 110 678 —

Isabel Marey-Semper did not stand for re-election in the Annual General

Meeting held on May , , and she held shares at that time. Mar-

jorie Scardino did not stand for re-election in the Annual General Meeting

held on May , and she held shares at that time. Stephen Elop

stepped down from the board as of September , , and held

shares at that time.

The number of shares or ADSs includes not only shares or ADSs received

as director compensation, but also shares or ADSs acquired by any other

means. Stock options or other equity awards that are deemed as being

beneficially owned under the applicable SEC rules are not included. For

the number of shares or ADSs received as director compensation, see

Note to our consolidated financial statements.