Nokia 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

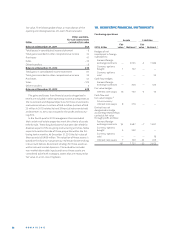

For information about the valuation of items measured at fair value see

Note . The fair value is set to carrying amount for available-for-sale

investments carried at cost less impairment for which no reliable fair

value has been possible to estimate as there is no active market for these

investments in private funds. Impairment testing of these assets is based

on a discounted cash flow analysis of expected cash distributions. The fair

value of loan receivables and payables is estimated based on the current

market values of similar instruments. The fair value is estimated to be

equal to the carrying amount for short-term financial assets and financial

liabilities due to limited credit risk and short time to maturity.

The fair value of EUR Convertible Bonds (total of EUR million matur-

ing -) is based on bonds being redeemed at par plus accrued

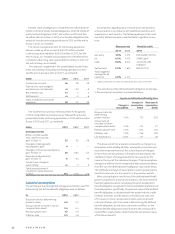

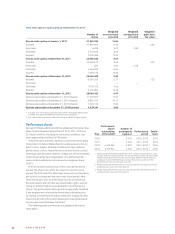

Instruments Valuation Valuation

withquoted technique technique

prices in using using non-

active markets observable observable

(Level 1) data (Level 2) data (Level 3) Total

At December31, 2013, EURm

Available-for-sale investments, publicly quoted equity shares 11 — — 11

Available-for-sale investments, carried at fair value 56 18 429 503

Other current fi nancial assets, derivatives 1 — 191 — 191

Investments at fair value through profi t and loss, liquid assets 382 — — 382

Available-for-sale investments, liquid assets carried at fair value 945 11 — 956

Available-for-sale investments, cash equivalents carried at fair value 3957 — — 3957

Total assets 5351 220 429 6000

Derivative liabilities 1 — 35 — 35

Total liabilities — 35 — 35

At December31, 2012, EURm

Available-for-sale investments, publicly quoted equity shares 11 — — 11

Available-for-sale investments, carried at fair value 57 20 370 447

Other current fi nancial assets, derivatives 1 — 448 — 448

Investments at fair value through profi t and loss, liquid assets 415 — — 415

Available-for-sale investments, liquid assets carried at fair value 532 10 — 542

Available-for-sale investments, cash equivalents carried at fair value 5448 — — 5448

Total assets 6463 478 370 7311

Derivative liabilities 1 — 90 — 90

Total liabilities — 90 — 90

interest at the close of Sale of the D&S business to Microsoft (level ).

The fair values of other long-term interest bearing liabilities are based on

discounted cash flow analysis (level ) or quoted prices (level).

At the end of each reporting period Nokia categorizes its fi nan-

cial assets and liabilities to the appropriate level of fair value

hierarchy. The following table presents the valuation methods

used to determine fair values of fi nancial instruments that are

measured at fair value on a recurring basis:

Note includes the split of hedge accounted and non-hedge accounted

derivatives.

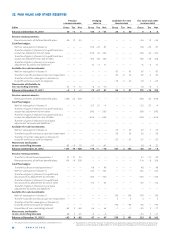

Level category includes fi nancial assets and liabilities that

are measured in whole or in signifi cant part by reference to

published quotes in an active market. A fi nancial instrument

is regarded as quoted in an active market if quoted prices are

readily and regularly available from an exchange, dealer, bro-

ker, industry group, pricing service or regulatory agency and

those prices represent actual and regularly occurring market

transactions on an arm’s length basis. This category includes

listed bonds and other securities, listed shares and exchange

traded derivatives.

Level category includes fi nancial assets and liabilities

measured using a valuation technique based on assumptions

that are supported by prices from observable current market

transactions. These include assets and liabilities for which

pricing is obtained via pricing services, but where prices have

not been determined in an active market, fi nancial assets with

fair values based on broker quotes and assets that are valued

using the Group’s own valuation models whereby the mate-

rial assumptions are market observable. The majority of the

Nokia Continuing operations’ over-the-counter derivatives

and certain other instruments not traded in active markets fall

within this category.

Level category includes fi nancial assets and liabilities

measured using valuation techniques based on non market

observable inputs. This means that fair values are determined

in whole or in part using a valuation model based on assump-

tions that are neither supported by prices from observable

current market transactions in the same instrument nor are

they based on available market data. However, the fair value

measurement objective remains the same, that is, to estimate

an exit price from the perspective of the Nokia Continuing op-

erations. The main asset classes in this category are unlisted

equity investments as well as unlisted funds.

Level investments mainly include a large number of unlist-

ed equities and unlisted funds where fair value is determined

based on relevant information such as operating performance,

recent transactions and available market data on peer compa-

nies. No individual input has a signifi cant impact on the total