Nokia 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOKIA IN 2013

130

Beneath the executive and director levels restricted shares

were used on a selective basis to ensure retention and recruit-

ment of individuals with functional mastery and other employ-

ees deemed critical to Nokia’s future success.

All of our restricted share plans have a restriction period of

three years after grant. Until the shares are delivered, the par-

ticipants will not have any shareholder rights, such as voting

or dividend rights, associated with the restricted shares. The

restricted share grants are generally forfeited if the employ-

ment relationship terminates with Nokia prior to vesting.

Employee share purchase plan

During , Nokia launched for the fi rst time an Employee

Share Purchase Plan (so called Share in Success). Under the

Employee Share Purchase Plan, eligible Nokia employees could

elect to make monthly contributions from their salary to

purchase Nokia shares. The contribution per employee cannot

exceed EUR per year. The share purchases are made at

market value on pre-determined dates on a monthly basis dur-

ing a -month savings period. Nokia will off er one matching

share for every two purchased shares the employee still holds

after the last monthly purchase has been made in June .

In addition, free shares were delivered to employees who

made the fi rst three consecutive monthly share purchases.

The participation in the plan was voluntary to the employees.

Nokia equity-based incentive program 2014

On February , , the Board of Directors approved the

scope and design of the Nokia Equity Program . The Board

of Directors decided not to propose stock options for the

Annual General Meeting. Similarly to the earlier equity incen-

tive programs, the Equity Program is designed to support

the participants’ focus and alignment with Nokia’s long term

success. Nokia’s use of the performance-based plan as the

main long-term incentive vehicles is planned to eff ectively con-

tribute to the long-term value creation and sustainability of

the company and to align the interests of the employees with

those of the shareholders. It is also designed to ensure that

the overall equity-based compensation is based on perfor-

mance, while also ensuring the recruitment and retention of

talent vital to the future success of Nokia. Shares under the

Nokia Restricted Share Plan are intended to be granted

only for exceptional retention and recruitment purposes as

to ensure Nokia is able to retain and recruit talent vital to the

future success of the group. In addition, the Employee Share

Purchase Plan continues to be off ered to encourage employee

share ownership, commitment and engagement.

The primary equity instruments for the executive em-

ployees and directors below executive level are performance

shares. Below the director level, performance shares are used

on a selective basis to ensure retention and recruitment of

individuals with functional mastery and other employees

deemed critical to Nokia’s future success. These equity-based

incentive awards are generally forfeited if the employee leaves

Nokia prior to vesting. Shares under Nokia Restricted Share

Plan are intended to be granted only for exceptional

retention and recruitment purposes as to ensure Nokia is able

to retain and recruit talent vital to the future success of the

group. The Employee Share Purchase Plan will be off ered to all

employees in selected jurisdictions (excluding Networks’ em-

ployees for ), to the extent there are no local regulatory or

administrative obstacles for the off er. The participation in the

plan will be voluntary to eligible employees.

Performance shares

The Nokia Performance Share Plan has a two-year perfor-

mance period ( through ) and a subsequent one-year

restriction period. Therefore, the amount of shares based on

the fi nancial performance during – will vest after

. The performance criteria for the performance period are

as follows:

For Nokia Group employees (excluding HERE employees):

■ Nokia Group average annual non-IFRS net sales

■ Nokia Group average annual non-IFRS EPS

For HERE employees:

■ Nokia Group average annual non-IFRS EPS

■ HERE average annual non-IFRS net sales

■ HERE average annual non-IFRS operating profi t

The number of shares to be settled after the restriction

period will start at % of the granted amount and any payout

beyond this will be determined with reference to the fi nancial

performance against the established performance criteria

during the two-year performance period.

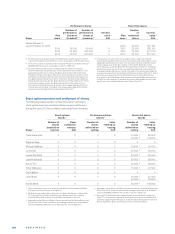

The threshold and maximum levels for the Nokia

Performance Share Plan are as follows: