Nokia 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOKIA IN 2013

60

terminated by the resolution of the Annual General Meeting on

May , .

On October , Nokia issued a EUR million convert-

ible bond on the basis of the authorization granted by the

Annual General Meeting held on May , . The bonds have

maturity of years and a .% per annum coupon payable

semi-annually with an initial conversion price of EUR ..

The maximum number of shares which may be issued by Nokia

upon conversion of all the bonds (based on the initial conver-

sion price) is approximately . million shares. The right to

convert the bonds into shares commenced on December ,

, and ends on October , . On March , EUR .

million of the bond was converted into shares resulting in issu-

ance of shares.

At the Annual General Meeting held on May , , Nokia

shareholders authorized the Board of Directors to issue a

maximum of million shares through one or more issues

of shares or special rights entitling to shares, including stock

options. The Board of Directors may issue either new shares

or shares held by the Parent Company. The authorization

includes the right for the Board to resolve on all the terms

and conditions of such issuances of shares and special rights,

including to whom the shares and the special rights may be

issued. The authorization may be used to develop the Parent

Company’s capital structure, diversify the shareholder base,

fi nance or carry out acquisitions or other arrangements, settle

the Parent Company’s equity-based incentive plans, or for

other purposes resolved by the Board. The authorization is

eff ective until June , .

On September , Nokia issued three EUR million

tranches of convertible bonds on the basis of the authoriza-

tion granted by the Annual General Meeting held on May ,

. First EUR million bonds had maturity of years and a

.% per annum coupon payable semi-annually with an initial

conversion price of EUR .. The second EUR million

bonds had maturity of years and a .% per annum coupon

payable semi-annually with an initial conversion price of EUR

.. The third EUR million bonds had maturity of years

and a .% per annum coupon payable semi-annually with

an initial conversion price of EUR ..

The maximum number of shares which might have been

issued by Nokia upon conversion of all the bonds (based on

the initial conversion price of each tranche) was approximately

. million. [At the closing of the Sale of the D&S business,

the bonds were redeemed and the principal amount and

accrued interest netted against the Sale of the D&S business

proceeds.]

At the end of , the Board of Directors had no other

authorizations to issue shares, convertible bonds, warrants or

stock options.

OTHER AUTHORIZATIONS

At the Annual General Meeting held on May , , Nokia

shareholders authorized the Board of Directors to repurchase

a maximum of million Nokia shares by using funds in the

unrestricted equity. Nokia did not repurchase any shares on

the basis of this authorization. This authorization would have

been eff ective until June , as per the resolution of the

Annual General Meeting on May , , but it was terminated

by the resolution of the Annual General Meeting on May , .

At the Annual General Meeting held on May , , Nokia

shareholders authorized the Board of Directors to repurchase

a maximum of million Nokia shares by using funds in the

unrestricted equity. The amount of shares corresponds to less

than % of all the shares of the Parent Company. The shares

may be repurchased under the buyback authorization in order

to develop the capital structure of the Parent Company. In ad-

dition, shares may be repurchased in order to fi nance or carry

out acquisitions or other arrangements, to settle the Parent

Company’s equity-based incentive plans, to be transferred for

other purposes, or to be cancelled. The authorization is eff ec-

tive until June , .

AUTHORIZATIONS PROPOSED TO THE ANNUAL GENERAL

MEETING 2014

On April , , Nokia announced that the Board of Directors

will propose that the Annual General Meeting convening on

June , authorize the Board to resolve to repurchase a

maximum of million Nokia shares. The proposed maximum

number of shares that may be repurchased corresponds to

less than % of all the shares of the Company. The shares

may be repurchased in order to develop the capital structure

of the Company and are expected to be cancelled. In addition,

shares may be repurchased in order to fi nance or carry out

acquisitions or other arrangements, to settle the Company’s

equity-based incentive plans, or to be transferred for other

purposes. The shares may be repurchased either through a

tender off er made to all shareholders on equal terms, or in

such marketplaces the rules of which allow companies to trade

with their own shares. The authorization would be eff ective

until December , and terminate the current authoriza-

tion for repurchasing of the Company’s shares resolved at the

Annual General Meeting on May , .

Nokia also announced on April , that the Board of

Directors will propose to the Annual General Meeting to be

held on June , that the Annual General Meeting author-

ize the Board to resolve to issue a maximum of million

shares through issuance of shares or special rights entitling to

shares in one or more issues. The Board may issue either new

shares or shares held by the Company. The Board proposes

that the authorization may be used to develop the Company’s

capital structure, diversify the shareholder base, fi nance

or carry out acquisitions or other arrangements, settle the

Company’s equity-based incentive plans, or for other purpos-

es resolved by the Board. The proposed authorization includes

the right for the Board to resolve on all the terms and condi-

tions of the issuance of shares and special rights entitling to

shares, including issuance in deviation from the shareholders’

pre-emptive rights. The authorization would be eff ective until

December , and terminate the current authorization

granted by the Annual General Meeting on May , .

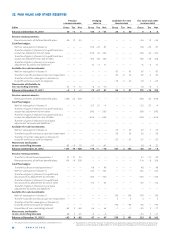

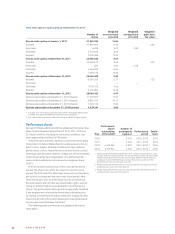

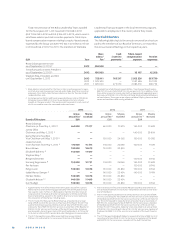

25. SHARE-BASED PAYMENT

The Group has several equity-based incentive programs for

employees. The plans include performance share plans, stock

option plans and restricted share plans. Both executives and

employees participate in these programs. In years presented

Nokia global equity-based incentive programs have been

off ered to employees of Devices & Services business, HERE,