Nokia 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOKIA IN 2013

34

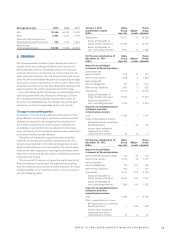

quently at amortized cost less impairment using the eff ective

interest method. Loans are subject to regular and thorough

review as to their collectability and available collateral. In the

event that a loan is deemed not fully recoverable, a provision is

made to refl ect the shortfall between the carrying amount and

the present value of the expected cash fl ows. Loan interest is

recognized in interest income. The long-term portion of loans

receivable is included on the consolidated statement of fi nan-

cial position under long-term loans receivable and the current

portion under current portion of long-term loans receivable.

BANK AND CASH

Bank and cash consist of cash at bank and in hand.

ACCOUNTS RECEIVABLE

Accounts receivable are carried at the original amount due

from customers less allowances for doubtful accounts, which

is considered to be fair value. Allowances for doubtful accounts

are based on a monthly review of all outstanding amounts

where signifi cant doubt about collectability exists. Monthly

review includes an analysis of historical bad debt, customer

concentrations, customer creditworthiness, current economic

trends and changes in our customer payment terms. Allowance

for doubtful accounts is included in other operating expenses.

Financial liabilities

COMPOUND FINANCIAL INSTRUMENTS

Compound fi nancial instruments have both a fi nancial liability

and an equity component from the issuers’ perspective. The

components are defi ned based on the terms of the fi nancial

instrument and presented and measured separately accord-

ing to their substance. At initial recognition of a compound

fi nancial instrument, the fi nancial liability component is

recognized at fair value and residual amount is allocated to the

equity component. This allocation is not revised subsequently.

The Group has issued convertible bonds, which are compound

fi nancial instruments, and their fi nancial liability component is

accounted for as a loan payable.

LOANS PAYABLE

Loans payable are recognized initially at fair value, net of

transaction costs incurred. In subsequent periods loans

payable are measured at amortized cost using the eff ective

interest method. Transaction costs and loan interest are rec-

ognized in fi nancial income and expenses over the life of the

instrument. The long-term portion of loans payable is included

on the consolidated statement of fi nancial position under

long-term interest-bearing liabilities and the current portion

under current portion of long-term loans.

ACCOUNTS PAYABLE

Accounts payable are carried at the original invoiced amount,

which is considered to be fair value due to the short-term

nature of the Group’s accounts payable.

Derivative fi nancial instruments

All derivatives are initially recognized at fair value on the date

a derivative contract is entered into and are subsequently

remeasured at their fair value. The method of recognizing the

resulting gain or loss varies according to whether the derivatives

are designated under and qualify for hedge accounting or not.

Generally, the cash fl ows of a hedge are classifi ed as cash

fl ows from operating activities in the consolidated state-

ments of cash fl ows as the underlying hedged items relate to

the Group’s operating activities. When a derivative contract is

accounted for as a hedge of an identifi able position relating to

fi nancing or investing activities, the cash fl ows of the contract

are classifi ed in the same manner as the cash fl ows of the

position being hedged.

DERIVATIVES NOT DESIGNATED IN HEDGE ACCOUNTING

RELATIONSHIPS CARRIED AT FAIR VALUE THROUGH PROFIT

AND LOSS

Forward foreign exchange contracts are valued at the market

forward exchange rates. Changes in fair value are measured by

comparing these rates with the original contract forward rate.

Currency options are valued at each balance sheet date by us-

ing the Garman & Kohlhagen option valuation model. Changes

in the fair value on these instruments are recognized in profi t

and loss.

Fair values of forward rate agreements, interest rate op-

tions, futures contracts and exchange traded options are cal-

culated based on quoted market rates at each balance sheet

date. Discounted cash fl ow analyses are used to value interest

rate and cross-currency interest rate swaps. Changes in the

fair value of these contracts are recognized in profi t and loss.

For derivatives not designated under hedge accounting but

hedging identifi able exposures such as anticipated foreign

currency denominated sales and purchases, the gains and

losses are recognized in other operating income or expenses.

The gains and losses on all other derivatives are recognized in

fi nancial income and expenses.

Embedded derivatives are identifi ed and monitored by the

Group. Embedded derivatives are measured at fair value at

each balance sheet date with changes in the fair value recog-

nized in profi t and loss.

Hedge accounting

The Group applies hedge accounting on certain forward foreign

exchange contracts, certain options or option strategies and

certain interest rate derivatives. Qualifying options and option

strategies have zero net premium or a net premium paid. For

option structures the critical terms of the bought and sold op-

tions are the same and the nominal amount of the sold option

component is no greater than that of the bought option.

CASH FLOW HEDGES: HEDGING OF FORECAST FOREIGN

CURRENCY DENOMINATED SALES AND PURCHASES

The Group applies hedge accounting for “Qualifying hedges”.

Qualifying hedges are those properly documented cash fl ow