Nokia 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

56

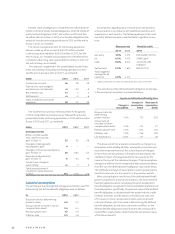

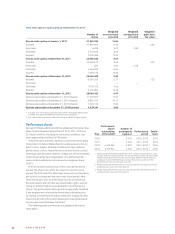

fair value. The following table shows a reconciliation of the

opening and closing balances of Level fi nancial assets:

Otheravailable-

for-sale investments

EURm carried at fair value

Balance at December31, 2011 346

Total losses in consolidated income statement – 8

Total gains recorded in other comprehensive income 34

Purchases 41

Sales – 35

Other transfers – 8

Balance at December31, 2012 370

Total gains in consolidated income statement 81

Total gains recorded in other comprehensive income 52

Purchases 47

Sales – 123

Other transfers 2

Balance at December31, 2013 429

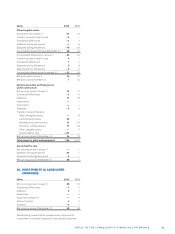

The gains and losses from fi nancial assets categorized in

level are included in other operating income and expenses as

the investment and disposal objectives for these investments

are business driven. A net loss of EUR million (net loss of EUR

million in ) related to level fi nancial instruments held

at December , , was included in the profi t and loss dur-

ing .

In the fourth quarter management has concluded

that certain real estate properties meet the criteria of assets

held for sale. These long lived assets have been identifi ed for

disposal as part of the on-going restructuring activities. Nokia

expects to realize the sale of these properties within the fol-

lowing twelve months. At December , the fair value of

these assets is EUR million. The valuation of these assets is

based on third-party evaluations by real estate brokers taking

into account Nokia’s divestment strategy for these assets as

well as relevant market dynamics. This evaluation includes

non-market observable inputs and hence these assets are

considered to be level category assets that are measured at

fair value on a non-recurring basis.

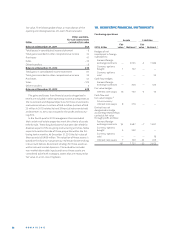

18. DERIVATIVE FINANCIAL INSTRUMENTS

Continuing operations

Assets Liabilities

Fair Fair

2013, EURm value 1 Notional 2 value 1 Notional 2

Hedges of net

investment in foreign

subsidiaries:

Forward foreign

exchange contracts — 2 035 – 3 1 086

Currency options

bought 1 152 — —

Currency options

sold — — — 53

Cash fl ow hedges:

Forward foreign

exchange contracts — 308 — 453

Fair value hedges

Interest rate swaps 76 750 – 3 73

Cash fl ow and

fair value hedges: 3

Cross currency

interest rate swaps 8 378 — —

Derivatives not

designated in hedge

accounting relationships

carried at fair value

through profi t and loss:

Forward foreign

exchange contracts 94 3 687 – 7 1 691

Currency options

bought 5 332 — —

Currency options

sold — — — 18

Interest rate swaps 7 109 – 22 249

191 7 751 – 35 3 623