Nokia 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOKIA IN 2013

36

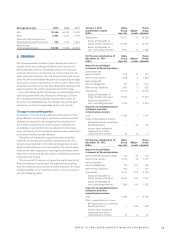

Income taxes

The income tax expense comprises current tax and deferred tax.

Current taxes are based on the results of the Group companies

and are calculated according to local tax rules. Taxes are recog-

nized in the consolidated income statements, except to the ex-

tent that it relates to items recognized in other comprehensive

income or directly in equity, in which case, the tax is recognized

in other comprehensive income or equity, respectively.

Management periodically evaluates positions taken in tax

returns with respect to situations in which applicable tax

regulation is subject to interpretation. It adjusts the amounts

recorded where appropriate on the basis of amounts expected

to be paid to the tax authorities. The amount of current

income tax liabilities is adjusted when, despite management’s

belief that tax return positions are supportable, it is more

likely than not that certain tax positions will be challenged

and may not be fully sustained upon review by tax authorities.

The amounts recorded are based upon the estimated future

settlement amount at each reporting date. Current income tax

assets and liabilities are presented separately in the consoli-

dated statements of fi nancial position and amounts recorded

in respect of uncertain tax positions are presented as part of

current income tax liabilities.

Deferred tax assets and liabilities are determined, for all

temporary diff erences arising between tax bases of assets

and liabilities and their carrying amounts in the consolidated

fi nancial statements using the liability method. Deferred tax

assets are recognized to the extent that it is probable that fu-

ture taxable profi t will be available against which the tax losses,

unused tax credits or deductible temporary diff erences can be

utilized. Each reporting period deferred tax assets are assessed

for realizability and when circumstances indicate it is no longer

probable that deferred tax assets will be utilized, they are ad-

justed as necessary. Deferred tax liabilities are recognized for

temporary diff erences that arise between the amounts initially

recognized and the tax base of identifi able net assets acquired

in business combinations. Deferred tax assets and liabilities are

off set when there is a legally enforceable right to off set current

tax assets against current tax liabilities and when the deferred

tax assets and liabilities relate to income taxes levied by the

same taxation authority on either the same taxable entity or

diff erent taxable entities where there is an intention to settle

the balances on a net basis.

Deferred tax liabilities are not recognized if they arise from

the initial recognition of goodwill. Deferred income tax liabili-

ties are provided on taxable temporary diff erences arising

from investments in subsidiaries, associates and joint ar-

rangements, except for deferred income tax liability where the

timing of the reversal of the temporary diff erence is controlled

by the Group and it is probable that the temporary diff erence

will not reverse in the foreseeable future.

The enacted or substantively enacted tax rates as of each

balance sheet date that are expected to apply in the period

when the asset is realized or the liability is settled are used in

the measurement of deferred tax assets and liabilities.

Provisions

Provisions are recognized when the Group has a present legal

or constructive obligation as a result of past events, it is prob-

able that an outfl ow of resources will be required to settle

the obligation and a reliable estimate of the amount can be

made. When the Group expects a provision to be reimbursed,

the reimbursement is recognized as an asset only when the

reimbursement is virtually certain. The Group assesses the ad-

equacy of its pre-existing provisions and adjusts the amounts

as necessary based on actual experience and changes in facts

and circumstances at each balance sheet date.

RESTRUCTURING PROVISIONS

The Group provides for the estimated cost to restructure when

a detailed formal plan of restructuring has been completed,

the restructuring plan has been announced by the Group and a

reliable estimate of the amount can be made.

PROJECT LOSS PROVISIONS

The Group provides for onerous contracts based on the lower

of the expected cost of fulfi lling the contract and the expected

cost of terminating the contract.

WARRANTY PROVISIONS

The Group provides for the estimated liability to repair or

replace products under warranty at the time revenue is

recognized. The provision is an estimate calculated based on

historical experience of the level of volumes, product mix and

repair and replacement cost.

MATERIAL LIABILITY

The Group recognizes the estimated liability for non-can-

cellable purchase commitments for inventory in excess of

forecasted requirements at each balance sheet date.

INTELLECTUAL PROPERTY RIGHTS (IPR) PROVISIONS

The Group provides for the estimated future settlements

related to asserted and unasserted past alleged IPR infringe-

ments based on the probable and estimable outcome of

potential infringement.

OTHER PROVISIONS

The Group provides for other contractual and other obliga-

tions based on the expected cost of executing any such

contractual and other commitments.

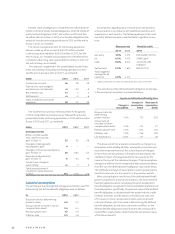

Share-based compensation

The Group off ers three types of global equity settled share-

based compensation schemes for employees: stock options,

performance shares and restricted shares.

Employee services received, and the corresponding in-

crease in equity, are measured by reference to the fair value

of the equity instruments as of the date of grant, excluding

the impact of any non-market vesting conditions. Non-market

vesting conditions attached to the performance shares are