Nokia 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOKIA IN 2013

102

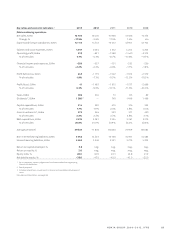

CRITICAL ACCOUNTING POLICIES

Our accounting policies aff ecting our fi nancial condition and

results of operations are more fully described in Note to our

consolidated fi nancial statements included in Item of this

annual report. Some of our accounting policies require the

application of judgment by management in selecting appropri-

ate assumptions for calculating fi nancial estimates, which

inherently contain some degree of uncertainty. Management

bases its estimates on historical experience and various other

assumptions that are believed to be reasonable under the

circumstances. The related results form the basis for making

judgments about reported carrying values of assets and li-

abilities and reported amounts of revenues and expenses that

may not be readily apparent from other sources. The Group

will revise material estimates if changes occur in the circum-

stances on which an estimate was based or as a result of new

information or more experience. Actual results may diff er from

current estimates under diff erent assumptions or conditions.

The estimates aff ect all our businesses equally unless other-

wise indicated.

The following paragraphs discuss critical accounting policies

and related judgments and estimates used in the preparation

of our consolidated fi nancial statements. We have discussed

the application of these critical accounting estimates with our

Board of Directors and Audit Committee.

REVENUE RECOGNITION

Revenues within the Group are generally recognized when the

signifi cant risks and rewards of ownership have transferred to

the buyer, continuing managerial involvement usually associ-

ated with ownership and eff ective control have ceased, the

amount of revenue can be measured reliably, it is probable that

economic benefi ts associated with the transaction will fl ow to

the Group and the costs incurred or to be incurred in respect

of the transaction can be measured reliably. When manage-

ment determines that such criteria have been met, revenue is

recognized.

At NSN, transactions are also entered into involving multi-

ple components consisting of any combination of hardware,

services and software. Within these arrangements, separate

components are identifi ed and accounted for based on the

nature and fair value of those components and considering

the economic substance of the entire arrangement. Revenue

is allocated to each separately identifi able component based

on the relative fair value of each component. The fair value of

each component is determined by taking into consideration

factors such as the price of the component when sold sepa-

rately and the component cost plus a reasonable margin when

price references are not available. This determination of the

fair value and allocation thereof to each separately identifi able

component of a transaction requires the use of estimates and

judgment which may have a signifi cant impact on the timing

and amount of revenue recognized for the period. Service rev-

enue, which typically includes managed services and mainte-

nance services, is generally recognized on a straight-line basis

over the specifi ed period unless there is evidence that some

other method better represents the rendering of services.

Also at NSN, certain revenue is recognized from contracts

involving solutions achieved through the modifi cation of

complex telecommunications equipment on the percentage

of completion basis when the outcome of the contract can be

estimated reliably. Recognized revenues and profi t estimates

are subject to revisions during the project in the event that

the assumptions regarding the overall project outcome are

revised. Current sales and profi t estimates for projects may

materially change due to the early stage of a long-term pro-

ject, new technology, changes in the project scope, changes in

costs, changes in timing, changes in customers’ plans, realiza-

tion of penalties, and other corresponding factors.

Within the HERE business, a substantial majority of revenue

is derived from the licensing of the HERE database. Revenue

which consists of license fees from usage (including license

fees in excess of the nonrefundable minimum fees), are rec-

ognized in the period in which the license fees are estimable.

Nonrefundable minimum annual licensing fees are generally

received upfront and represent a minimum guarantee of fees

to be received from the licensee during the period of the

arrangement. The total up-front fee paid by the customer

is generally amortized ratably over the term of the arrange-

ment. When it is determined that the actual amount of licens-

ing fees earned exceeds the cumulative revenue recognized

under the amortization method, we recognize the additional

licensing revenue. Furthermore, within the HERE business,

some licensing arrangements contain multiple elements, that

could include data, software, services and updates. Revenue is

allocated to each element based on its relative fair value and

is recognized as the element is delivered and the obligation is

fulfi lled.

Advance Technologies’ patent license agreements are multi-

year arrangements usually covering both a licensee’s past

and future sales until a certain agreed date, when the license

expires. Typically, when a patent license agreement is signed

it includes an agreement or settlement on past royalties that

the licensor is entitled to. Such income for past periods is

recognized immediately. The license payments relating to the

future royalties are recognized over the remaining contract

period, typically to years. Licensees often pay a fi xed

license fee in one or more installments and running royalties

based on their sales of licensed products. Licensees gener-

ally report and pay their running royalties on a quarterly basis

after the end of each quarter and Nokia revenue recognition

takes place accordingly at the time the royalty reports are

received.

Within Devices & Services, the sale of devices can include

multiple components consisting of a combination of hardware,

services and software. The commercial eff ect of each sepa-

rately identifi able element of the transaction is evaluated in

order to determine the appropriate accounting treatment for

each component of the transaction. The total amount re-

ceived is allocated to individual components based on their es-

timated fair value. Fair value of each component is determined

by taking into consideration factors such as the price when the

component is sold separately, the price when a similar compo-

nent is sold separately by a third party and cost plus a reason-

able margin when pricing references are not available. The es-

timated fair values are allocated fi rst to software and services,

with the residual amount allocated to hardware. Application

of the recognition criteria described above generally results in

recognition of hardware related revenue at the time of deliv-

ery with software and services related revenue recognized on

a straight-line basis over their respective terms.