Nokia 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

26

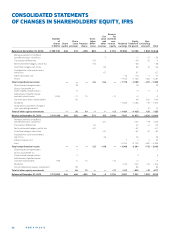

CONSOLIDATED STATEMENTS

OF CHANGES IN SHAREHOLDERS’ EQUITY, IFRS

Reserve

Fair for

Number Trans- value invested

of Share lation and non- Equity Non-

shares Share issue Treasury diff er- other restrict. Retained holders of controlling

(1 000’s) capital premium shares ences reserves equity earnings the parent interests Total

Balance at December31, 2010 3709130 246 312 – 663 825 9 3161 10500 14390 1858 16248

Remeasurement on defi ned

benefi t pensions, net of tax – 7 – 7 – 17 – 24

Translation diff erences – 26 – 26 35 9

Net investment hedges, net of tax – 28 – 28 – 28

Cash fl ow hedges, net of tax 84 84 10 94

Available-for-sale investments,

net of tax 67 67 67

Other decrease, net – 16 – 16 – 1 – 17

Profi t – 1163 – 1163 – 324 – 1487

Total comprehensive income — — — – 54 144 — – 1179 – 1089 – 297 – 1386

Share-based compensation 18 18 18

Excess tax benefi t on

share-based compensation – 3 – 3 – 1 – 4

Settlement of performance

and restricted shares 1059 – 11 19 – 13 – 5 – 5

Contributions from shareholders 46 46 500 546

Dividend – 1484 – 1484 – 39 – 1523

Acquisitions and other change in

non-controlling interests — 15 15

Total of other equity movements — 50 19 — — – 13 – 1484 – 1428 475 – 953

Balance at December31, 2011 3710189 246 362 – 644 771 153 3148 7837 11873 2036 13909

Remeasurement on defi ned

benefi t pensions, net of tax – 127 – 127 – 79 – 206

Translation diff erences 42 42 – 2 40

Net investment hedges, net of tax – 67 – 67 – 67

Cash fl ow hedges, net of tax – 67 – 67 47 – 20

Available-for-sale investments,

net of tax 36 36 36

Other increase, net 7 7 3 10

Loss – 3105 – 3105 – 681 – 3786

Total comprehensive income — — — – 25 – 158 — – 3098 – 3281 – 712 – 3993

Share-based compensation 1 1 1

Excess tax benefi t on

share-based compensation 3 3 3

Settlement of performance

and restricted shares 796 – 5 15 – 12 – 2 – 2

Dividend – 742 – 742 – 22 – 764

Convertible bond – equity component 85 85 85

Total of other equity movements — 84 15 — — – 12 – 742 – 655 – 22 – 677

Balance at December31, 2012 3710985 246 446 – 629 746 – 5 3136 3997 7937 1302 9239