Nokia 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Investment strategies

The objective of investment activities is to maximize the ex-

cess of plan assets over the projected benefi t obligations and

to achieve asset performance at least in line with the interest

costs in order to minimize required future employer contribu-

tions. To achieve these goals, the Group uses an asset-liability

matching framework, which forms the basis for its strategic

asset allocation of the respective plans. The Group also takes

into consideration other factors in addition to the discount

rate, such as infl ation and longevity. The results of the asset-

liability matching framework are implemented on a plan level.

The Group’s pension governance does not allow direct

investments and requires all investments to be placed either

in funds or by professional asset managers. Derivative instru-

ments are permitted and are used to change risk characteris-

tics as part of the German plan assets. The performance and

risk profi le of investments is constantly monitored on a stand-

alone basis as well as in the broader portfolio context. One

major risk is a decline in the plan`s funded status as a result of

the adverse development of plan assets and/or defi ned ben-

efi t obligations. The application of the Asset-Liability-Model

study focuses on minimizing such risks.

There has been no change in the process used by the Group

to manage its risk from prior periods.

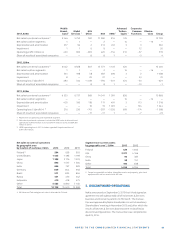

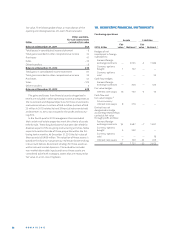

Disaggregation of plan assets

Pension assets are comprised as follows:

2013 2012

Quoted Unquoted Total Quoted Unquoted Total

EURm EURm EURm % EURm EURm EURm %

Asset category

Equity securities 300 — 300 24% 397 — 397 22%

Debt securities 564 121 685 54% 973 116 1089 60%

Insurance contracts — 70 70 6% — 137 137 8%

Real estate — 57 57 5% — 62 62 3%

Short-term investments 92 — 92 7% 49 — 49 3%

Others — 57 57 4% — 74 74 4%

Total 956 305 1261 100% 1419 389 1 808 100%

All short term investments, equity and nearly all fi xed in-

come securities have quoted market prices in active markets.

Equity securities represent investments in equity funds and

direct investments, which have quoted market prices in an ac-

tive market. Debt securities represent investments in govern-

ment and corporate bonds, as well as investments in bond

funds, which have quoted market prices in an active market.

Debt securities may also comprise investments in funds and

direct investments. Real estate investments are investments

into real estate funds which invest in a diverse range of real

estate properties. Insurance contracts are customary pen-

sion insurance contracts structured under domestic law in the

respective countries. Short-term investments are liquid assets

or cash which are being held for a short period of time, with

the primary purpose of controlling the tactical asset alloca-

tion. The other category includes commodities as well as alter-

native investments, including derivative fi nancial instruments.

The pension plan assets include a self investment through a

loan provided to Nokia by the Group’s German pension fund of

EUR million (EUR million in ). See Note .

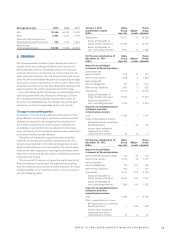

Future cash fl ows

Employer contributions expected to be paid to the post-

employment defi ned benefi t plans relating to continued

operations in are EUR million and the weighted average

duration of the defi ned benefi t obligations was . years at

December , .

Expected maturity analysis of undiscounted payments from

the defi ned benefi t plans of the continued operations:

Pension benefi ts, EURm

Within1year 34

Between1 and5years 150

Between5 and10years 264

Between10 and20years 826

Over20years 1 840

Total 3114

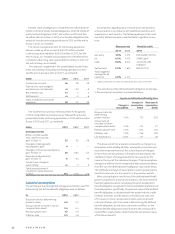

7. EXPENSES BY NATURE

EURm 2013 2012 2011

Continuing operations

Cost of material 2 835 3 820 4 201

Personnel expenses 3 857 4 108 4 510

Subcontracting costs 2 427 3 070 2 742

Real estate costs 351 446 408

Depreciation and amortization 560 1 088 1 318

Warranty costs 52 21 59

Other costs and expenses 1 572 2 431 2 847

Total of cost of sales,

research and development,

selling and marketing and

administrative and

general expenses 11654 14984 16085