Nokia 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

78

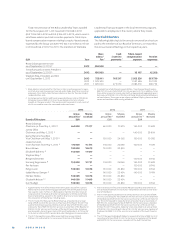

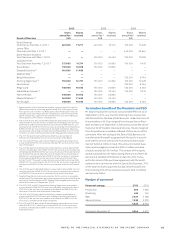

As of December , Group’s interest bearing liabilities consisted of:

2013 2012

Issuer/Borrower FinalMaturity EURm EURm

Nokia

Revolving Credit Facility (EUR1500million) NokiaCorporation March2016 — —

USD Bond 2039 (USD 500million 6.625%) Nokia Corporation May 2039 364 381

EUR Convertible Bond 2020 (EUR500million 3.625%) Nokia Corporation September2020 500 —

EUR Convertible Bond 2019 (EUR500million 2.5%) Nokia Corporation September2019 500 —

USD Bond 2019 (USD 1000million 5.375%) Nokia Corporation May 2019 727 761

EUR Bond 2019 (EUR 500million 6.75%) Nokia Corporation February 2019 500 500

EUR Convertible Bond 2018 (EUR500million 1.125%) Nokia Corporation September2018 500 —

EUR Convertible Bond 2017 (EUR750million 5%) Nokia Corporation October 2017 750 750

EUR Bond 2014 (EUR 1 250million 5.5%) Nokia Corporation February 2014 1250 1250

EUR EIB R&D Loan Nokia Corporation February 2014 500 500

Diff erences between Bond nominal

and carrying values 1 Nokia Corporation – 164 55

Other interest-bearing liabilities Nokia Corporation and

various subsidiaries 144 209

Total Nokia 5 571 4 406

NSN

Revolving Credit Facility (EUR750million) Nokia Solutions and

Networks Finance B.V. June 2015 — —

EUR Bond 2020 (EUR 350million 7.125%) Nokia Solutions and

Networks Finance B.V. April 2020 350 —

EUR Bond 2018 (EUR 450million 6.75%) Nokia Solutions and

Networks Finance B.V. April 2018 450 —

EUR Finnish Pension Loan Nokia Solutions and

Networks Finance Oy October 2015 88 132

EUR Nordic Investment Bank Nokia Solutions and

Networks Finance B.V. March 2015 20 80

EUR EIB R&D Loan Nokia Solutions and

Networks Finance B.V. January 2015 50 150

EUR Bank Term Loan (EUR 750 million) Nokia Solutions and

Networks Finance B.V. Prepaid March 2013 — 600

Diff erences between Bond nominal

and carrying values 1 Nokia Solutions and

Networks Finance B.V. – 18 —

Other liabilities 2 Nokia Solutions and

Networks Finance B.V. and

various subsidiaries 151 181

Total NSN 1 091 1 143

Total Nokia Group 6662 5549

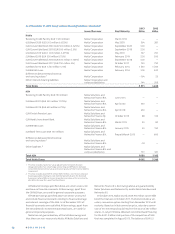

This line includes mainly fair value adjustments for bonds that are

designated under fair value hedge accounting and difference between

convertible bond nominal value and carrying value of the financial liability

component.

This line includes also EUR million (EUR million, in ) non-interest

bearing payables relating to cash held temporarily due to the divested

businesses where NSN continues to perform services within a contractu-

ally defined scope for a specified timeframe.

All Nokia borrowings specifi ed above are senior unsecured

and have no fi nancial covenants. All borrowings, apart from

the EIBR&D loan, are used for general corporate purposes.

All NSN borrowings specifi ed above are senior unsecured

and include fi nancial covenants relating to fi nancial leverage

and interest coverage of the NSN. As of December all

fi nancial covenants were satisfi ed. All borrowings, apart from

the EIB and Nordic Investment bank R&D loans, are used for

general corporate purposes.

Nokia has not guaranteed any of the NSN borrowings and

thus these are non-recourse to Nokia. All Nokia Solutions and

Networks Finance B.V. borrowings above are guaranteed by

Nokia Solutions and Networks Oy and/or Nokia Solutions and

Networks B.V.

In October , Nokia issued a EUR million convertible

bond that matures in October . The bond includes a vol-

untary conversion option starting from December until

maturity. Based on initial conversion price, voluntary conver-

sion of the entire bond would result in the issue of million

shares. In July Nokia obtained committed bank fi nancing

for the EUR . billion cash portion of the acquisition of NSN

that was completed in August . The balance of EUR .