Nokia 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOKIA IN 2013

32

the consolidated income statements so as to spread the cur-

rent service cost over the service lives of employees. Pension

obligation is measured as the present value of the estimated

future cash outfl ows using interest rates on high quality

corporate bonds with appropriate maturities. Actuarial gains

and losses arising from experience adjustments and changes

in actuarial assumptions are charged or credited to equity in

other comprehensive income in the period in which they arise.

Past service costs and settlement gains and losses are rec-

ognized immediately in income as part of service cost, when

the plan amendment or settlement occurs. Curtailment gains

and losses are accounted for as past service costs.

The liability (or asset) recognized in the consolidated state-

ments of fi nancial position is the pension obligation at the

closing date less the fair value of plan assets including eff ects

of asset ceilings (if any).

Remeasurement, comprising actuarial gains and losses, the

eff ect of changes to the asset ceiling and the return on plan

assets (excluding interest), are recognized immediately in the

consolidated statements of fi nancial position with the cor-

responding change to retained earnings recognized through

other comprehensive income in the period in which they occur.

Remeasurements are not reclassifi ed to profi t and loss in

subsequent periods.

Actuarial valuations for the Group’s defi ned benefi t pension

plans are performed annually. In addition, actuarial valuations

are performed when a curtailment or settlement of a defi ned

benefi t plan occurs.

TERMINATION BENEFITS

Termination benefi ts are payable when employment is ter-

minated before the normal retirement date, or whenever an

employee accepts voluntary redundancy in exchange for these

benefi ts. The Group recognizes termination benefi ts when it is

demonstrably committed to either terminating the employ-

ment of current employees according to a detailed formal plan

without possibility of withdrawal, or providing termination

benefi ts as a result of an off er made to encourage voluntary

redundancy.

Property, plant and equipment

Property, plant and equipment are stated at cost less accumu-

lated depreciation. Depreciation is recorded on a straight-line

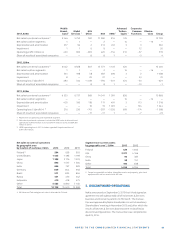

basis over the expected useful lives of the assets as follows:

Buildings and constructions – years

Light buildings and constructions – years

Production machinery,

measuring and test equipment – years

Other machinery and equipment – years

Land and water areas are not depreciated. Assets held for

sale are not depreciated as they are carried at the lower of car-

rying value or fair value less cost to sell.

Maintenance, repairs and renewals are generally charged to

expense during the fi nancial period in which they are incurred.

However, major renovations are capitalized and included in the

carrying amount of the asset when it is probable that future

economic benefi ts in excess of the originally assessed stand-

ard of performance of the existing asset will fl ow to the Group.

Major renovations are depreciated over the remaining useful

life of the related asset. Leasehold improvements are depreci-

ated over the shorter of the lease term or useful life.

Gains and losses on the disposal of fi xed assets are included

in operating profi t/loss.

Leases

The Group has entered into various operating lease contracts.

The related payments are treated as rentals and recognized in

the consolidated income statements on a straight-line basis

over the lease terms unless another systematic approach is

more representative of the pattern of the user’s benefi t.

Inventories

Inventories are stated at the lower of cost or net realizable

value. Cost is determined using standard cost, which approxi-

mates actual cost on a FIFO (First-in First-out) basis. Net realiz-

able value is the amount that can be realized from the sale of

the inventory in the normal course of business after allowing

for the costs of realization.

In addition to the cost of materials and direct labor, an ap-

propriate proportion of production overhead is included in the

inventory values.

An allowance is recorded for excess inventory and obsoles-

cence based on the lower of cost or net realizable value.

Fair value measurement

Many fi nancial instruments are measured at fair value at each

reporting date after initial recognition. Fair value is the price

that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants

at the measurement date. The fair value of an asset or a liabil-

ity is measured using the assumptions that market partici-

pants would use when pricing the asset or liability, assuming

that market participants act in their economic best interest by

using quoted market rates, discounted cash fl ow analyses and

other appropriate valuation models. The Group uses valua-

tion techniques that are appropriate in the circumstances and

for which suffi cient data are available to measure fair value,

maximizing the use of relevant observable inputs and minimiz-

ing the use of unobservable inputs. All assets and liabilities

for which fair value is measured or disclosed in the fi nancial

statements are categorized within the fair value hierarchy,

described as follows, based on the lowest level input that is

signifi cant to the fair value measurement as a whole:

■ Level – Quoted (unadjusted) market prices in active markets

for identical assets or liabilities