Nokia 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

mance. Volume of other guarantees has decreased mainly due

to expired guarantees.

Contingent liabilities on behalf of other companies were EUR

million in (EUR million in ). The increase in vol-

ume is mainly due to the transfer of guarantees in connection

with the disposal of certain businesses where contractual risks

and revenues have been transferred, but some of the com-

mercial guarantees have not yet been re-assigned legally.

Financing commitments of EUR million in (EUR

million in ) are available under loan facilities negotiated

mainly with NSN’s customers. Availability of the amounts is

dependent upon the borrower’s continuing compliance with

stated fi nancial and operational covenants and compliance with

other administrative terms of the facility. The loan facilities

are primarily available to fund capital expenditure relating to

purchases of network infrastructure equipment and services.

Venture fund commitments of EUR million in

(EUR million in ) are fi nancing commitments to a

number of funds making technology related investments.

Asalimited partner in these funds Nokia is committed to

capital contributions and also entitled to cash distributions ac-

cording to respective partnership agreements and underlying

fund activities.

As of December , , Nokia continuing operations had

purchase commitments of EUR million (Nokia Group EUR

million in ) relating to inventory purchase obliga-

tions, service agreements and outsourcing arrangements,

primarily for purchases in .

The Group is party to routine litigation incidental to the nor-

mal conduct of business, including, but not limited to, several

claims, suits and actions both initiated by third parties and

initiated by Nokia relating to infringements of patents, viola-

tions of licensing arrangements and other intellectual proper-

ty related matters, as well as actions with respect to products,

contracts and securities. Based on the information currently

available, in the opinion of management the outcome of and

liabilities in excess of what has been provided for related to

these or other proceedings, in the aggregate, are not likely to

be material to the fi nancial condition or result of operations.

See also Note .

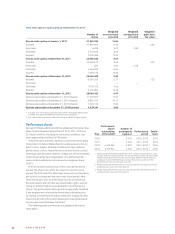

31. LEASING CONTRACTS

The Group leases offi ce, manufacturing and warehouse space

under various non-cancellable operating leases. Certain con-

tracts contain renewal options for various periods of time.

The future costs for non-cancellable leasing contracts are

as follows:

Continuing operations

Leasing payments, EURm Operating leases

2014 139

2015 98

2016 66

2017 51

2018 45

Thereafter 151

Total 550

Rental expense amounted to EUR million in (EUR

million in and EUR million in ).

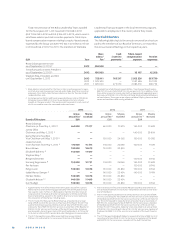

32. RELATED PARTY TRANSACTIONS

At December , , the Group had borrowings amounting

to EUR million (EUR million in ) from Nokia Unterstüt-

zungsgesellschaft mbH, the Group’s German pension fund,

which is a separate legal entity. The loan bears interest at %

annum and its duration is pending until further notice by the

loan counterparties who have the right to terminate the loan

with a day notice. The loan is included in long-term interest-

bearing liabilities in the consolidated statement of fi nancial

position.

There were no loans granted to the members of the Nokia

Leadership Team and the Board of Directors at December ,

, or .

EURm 2013 2012 2011

Transactions with associated companies

Share of results of

associated companies 4 – 1 – 23

Dividend income 5 — —

Share of shareholders’ equity

of associated companies 53 46 47

Sales to associated companies 6 12 37

Purchases from

associated companies 178 150 91

Receivables from

associated companies — 1 —

Liabilities to associated companies 12 32 14

At December , , the Group has guaranteed a loan of

EUR million (EUR million in ) for an associated com-

pany of the Group.

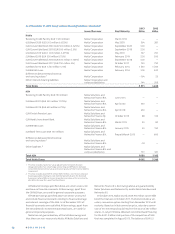

Management compensation

Nokia announced on September , that it had entered

into a transaction agreement whereby Nokia will sell substan-

tially all of its Devices & Services business to Microsoft. As a

result of the proposed transaction, Nokia announced changes

to its leadership. These changes were designed to provide

an appropriate corporate governance structure during the

interim period following the announcement of this transaction.

Stephen Elop stepped down from his positions as President

and CEO and Nokia’s Chairman of the Board Risto Siilasmaa and

Chief Financial Offi cer of Nokia Timo Ihamuotila assumed ad-

ditional responsibilities as Interim CEO and Interim President,

respectively, from September , .

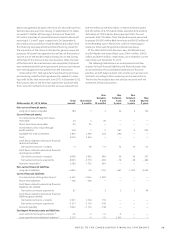

The following table sets forth the salary and cash incentive

information awarded and paid or payable by the Group to the

Chief Executive Offi cer and President of Nokia Corporation for

fi scal years – , share-based compensation expense

relating to equity-based awards, expensed by the Group as

well as the pension expenses, expensed by the Group. The ta-

ble includes compensation for the time in-role or the compen-

sation for the role related responsibilities, only.