Nokia 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

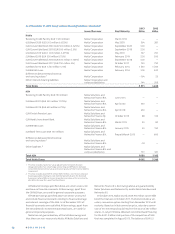

billion was agreed to be paid in the form of a secured loan from

Siemens due one year from closing. In September , Nokia

issued EUR . billion of fi nancing in the form of three EUR

million tranches of convertible bonds issued to Microsoft

maturing in , and years, respectively. On September ,

, Nokia announced that it had decided to draw down all of

this fi nancing to prepay aforementioned fi nancing raised for

the acquisition of the shares in NSN and for general corporate

purposes. Microsoft has agreed not to sell any of the bonds or

convert any of the bonds to Nokia shares prior to the closing

of the Sale of the Devices & Services business. When the Sale

of the Devices & Services business was completed, the bonds

were redeemed and the principal amount and accrued interest

were netted against the proceeds from the transaction.

In December , NSN signed a forward starting term loan

and revolving credit facilities agreement to replace its revolv-

ing credit facility that matured in June . In December ,

the maturity date of the term loan agreement was extended

from June to March and the size was reduced from

EUR million to EUR million. In March NSN issued

EUR million of .% Senior Notes due April and EUR

million of .% Senior Notes due April . The net

proceeds, EUR million, from the bond issuance were used

to prepay EUR million Bank term loan and EUR million of

the EUR EIB R&D loan in March , and the remaining pro-

ceeds are to be used for general corporate purposes.

Of the NSN’s EUR Finnish Pension Loan, EUR EIB R&D Loan

and EUR Nordic Investment Bank Loan, EUR million, EUR

million and EUR million, respectively, are included in current

maturities as of December , .

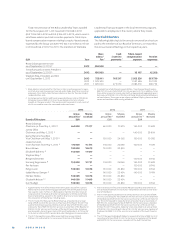

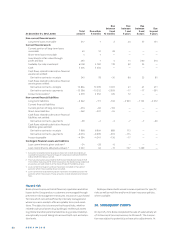

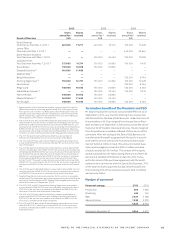

The following table below is an undiscounted cash fl ow

analysis for both fi nancial liabilities and fi nancial assets that

are presented on the consolidated statement of fi nancial

position, and off -balance sheet instruments such as loan com-

mitments according to their remaining contractual maturity.

The line-by-line analysis does not directly reconcile with the

statement of fi nancial position.

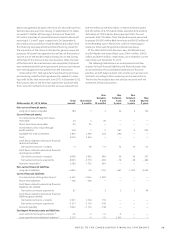

Due Due Due

between between between Due

Total Duewithin 3 and 1 and 3 and beyond

At December 31, 2013, EURm amount 3months 12months 3years 5years 5 years

Non-current fi nancial assets

Long-term loans receivable 189 1 3 34 6 145

Current fi nancial assets

Current portion of long-term loans

receivable 30 4 26 — — —

Short-term loans receivable 94 94 — — — —

Investments at fair value through

profi t and loss 478 1 5 261 9 202

Available-for-sale investment 4 935 4 392 253 290 — —

Cash 3 676 3 676 — — — —

Cash fl ows related to derivative fi nancial

assets net settled:

Derivative contracts – receipts – 3 39 – 11 13 13 – 57

Cash fl ows related to derivative fi nancial

assets gross settled:

Derivative contracts – receipts 6 985 5 835 699 39 39 373

Derivative contracts – payments – 6853 – 5776 – 659 – 18 – 18 – 382

Accounts receivable

1 2 286 1 722 564 — — —

Non-current fi nancial liabilities

Long-term liabilities – 4894 – 35 – 161 – 561 – 1505 – 2632

Current fi nancial liabilities

Current portion of long-term loans 2 – 3431 – 1844 – 1 587 — — —

Short-term liabilities – 185 – 185 — — — —

Cash fl ows related to derivative fi nancial

liabilities net settled:

Derivative contracts – payments 62 — 3 5 5 49

Cash fl ows related to derivative fi nancial

liabilities gross settled:

Derivative contracts – receipts 3 301 3 146 155 — — —

Derivative contracts – payments – 3311 – 3155 – 156 — — —

Accounts payable – 1842 – 1704 – 138 — — —

Contingent fi nancial assets and liabilities

Loan commitments given undrawn 3 – 25 – 7 – 13 – 5 — —

Loan commitments obtained undrawn 4 2 227 – 4 – 10 2 241 — —