Nokia 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

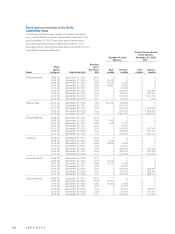

Total intrinsicvalue of

stock options,

Number of stock December31, 2013

options 1 EUR 2

Exercise

Stock price

option per share Exer- Unexer- Exer- Unexer-

Name category Expiration date EUR cisable cisable cisable 3 cisable

Henry Tirri 2008 2Q December 31, 2013 19.16 0 0 0 0

2009 2Q December 31, 2014 11.18 12 000 0 0 0

2010 2Q December 31, 2015 8.86 16 250 3 750 0 0

2011 2Q December 27, 2017 6.02 0 27 000 0 0

2011 4Q December 27, 2017 4.84 0 168 000 0 164 640

2012 2Q December 27, 2018 2.44 0 115 000 0 388 700

2013 2Q December 27, 2019 2.71 0 220 000 0 684 200

Timo Toikkanen 2008 2Q December 31, 2013 19.16 0 0 0 0

2009 2Q December 31, 2014 11.18 12 000 0 0 0

2010 2Q December 31, 2015 8.86 20 308 4 692 0 0

2011 2Q December 27, 2017 6.02 0 27 000 0 0

2012 2Q December 27, 2018 2.44 0 28 500 0 96 330

2012 3Q December 27, 2018 2.18 0 75 000 0 273 000

2013 2Q December 27, 2019 2.71 0 350 000 0 1 088 500

Chris Weber 2011 2Q December 27, 2017 6.02 0 25 000 0 0

2012 2Q December 27, 2018 2.44 0 40 000 0 135 200

2012 3Q December 27, 2018 2.18 0 63 500 0 231 140

2013 2Q December 27, 2019 2.71 0 350 000 0 1 088 500

Juha Äkräs 2008 2Q December 31, 2013 19.16 0 0 0 0

2009 2Q December 31, 2014 11.18 12 000 0 0 0

2010 2Q December 31, 2015 8.86 32 500 7 500 0 0

2011 2Q December 27, 2017 6.02 0 45 000 0 0

2011 3Q December 27, 2017 3.76 0 150 000 0 309 000

2012 2Q December 27, 2018 2.44 0 115 000 0 388 700

2013 2Q December 27, 2019 2.71 0 250 000 0 777 500

Kai Öistämö 2008 2Q December 31, 2013 19.16 0 0 0 0

2009 2Q December 31, 2014 11.18 60 000 0 0 0

2010 2Q December 31, 2015 8.86 56 875 13 125 0 0

2011 2Q December 27, 2017 6.02 0 45 000 0 0

2011 3Q December 27, 2017 3.76 0 150 000 0 309 000

2012 2Q December 27, 2018 2.44 0 90 000 0 304 200

2013 2Q December 27, 2019 2.71 0 220 000 0 684 200

Stock options held by the members of the

Nokia Leadership Team on December31, 2013,

Total 4 791078 9480422 55176056

All outstanding stock option plans

(global plans), Total 4242 226 23660 851

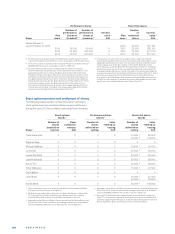

COMPENSATION OF THE BOARD OF DIRECTORS AND THE NOKIA GROUP LEADERSHIP TEAM

Number of stock options equals the number of underlying shares

represented by the option entitlement. Stock options granted under

and Stock Option Plans have different vesting schedules. The

Group’s global Stock Option Plan has a vesting schedule with a %

vesting one year after grant, and quarterly vesting thereafter, each of

the quarterly lots representing .% of the total grant. The grants vest

fully in four years. The Group’s global Stock Option Plan has a vesting

schedule with % of stock options vesting three years after grant and

the remaining % vesting four years from grant.

The intrinsic value of the stock options is based on the difference

between the exercise price of the options and the closing market price

of Nokia shares on NASDAQ OMX Helsinki as at December , of

EUR..

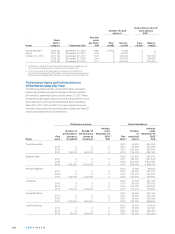

For gains realized upon exercise of stock options for the members of the

Group Executive Board, see the table in “Stock Option Exercises and Set-

tlement of Shares” below.

During , Marko Ahtisaari stepped down from the Nokia Leadership

Team. The information related to stock options Mr. Ahtisaari held is as of

the date of resignation from the Nokia Leadership Team and is presented

in the table below.