Nokia 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.125

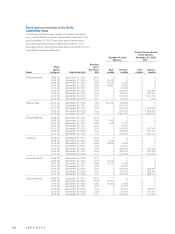

COMPENSATION OF THE BOARD OF DIRECTORS AND THE NOKIA GROUP LEADERSHIP TEAM

■ Termination by Mr. Suri for any reason. Mr. Suri may termi-

nate his service contract at any time with six months’ prior

notice. Nokia may choose to pay a lump sum payment in lieu

of his service during the notice period or ask Mr. Suri to con-

tinue his service through all or part of this notice period. In

either event, Mr. Suri is entitled to six months compensation

(including annual base salary, benefi ts, and target incentive),

and his unvested equity awards will be forfeited.

■ Termination by Mr. Suri for Nokia’s material breach of the

service contract. In the event that Mr. Suri terminates his

service contract based on a fi nal arbitration award dem-

onstrating Nokia’s material breach of the service contract,

he is entitled to a severance payment equaling to up to

months of compensation (including annual base salary,

benefi ts, and target incentive), and all his unvested equity

awards will be forfeited.

■ Termination based on specifi ed events. Mr. Suri’s service

contract includes special severance provisions on a termina-

tion following change of control events. These change of

control provisions are based on a double trigger structure,

which means that both a change of control event and the

termination of the individual’s employment within a defi ned

period of time must take place for any change of control

based severance payment to become due. More specifi -

cally, if a change of control event, as defi ned in the service

contract, has occurred, and Mr. Suri’s service with the com-

pany is terminated either by Nokia or its successor without

cause, or by Mr. Suri for “good reason”, in either case within

months from such change of control event, Mr.Suri will

be entitled to a severance payment equaling to up to

months of compensation (including annual base salary,

benefi ts, and target incentive) and cash payment(or pay-

ments) for the pxro-rated value of his outstanding unvested

equity awards, including equity awards under the NSN Equity

Incentive Plan, restricted shares, performance shares and

stock options (if any), payable pursuant to the terms of the

service contract. “Good reasons” referred to above include

amaterial reduction of Mr. Suri’s compensation and a mate-

rial reduction of his duties and responsibilities, as defi nedin

the service contract and as determined by the Board of

Directors.

In addition, the service contract defi nes a specifi c, limited

termination event that applies until June , . Upon this

event, if. Mr. Suri’s service with Nokia is terminated as a result

of the circumstances specifi ed in the service contract, he is

entitled to, in addition to normal severance payment payable

upon his termination by Nokia for reasons other than cause,

to a pro-rated value of unvested equity awards under the NSN

Equity Incentive Plan, provided that the termination of his

service takes place within six months from the defi ned termi-

nation event (and on or before June , ). Subject to this

limited time treatment of unvested equity awards under the

NSN Executive Incentive Plan, all of Mr. Suri’s other unvested

equity will be forfeited.

Subject to his continued employment, Mr. Suri is also

expected to receive payments in the future pursuant to op-

tions granted under the NSN Equity Incentive Plan. This plan

was established in prior to Nokia’s acquisition of full

ownership of NSN. The plan had two objectives: () increasing

the value of NSN and () creating incentives relating to an exit

option for its parent companies. With the signifi cantly im-

proved performance of NSN, the fi rst objective has been met.

The second objective has not occurred and given the change

in Nokia’s strategy, the likelihood of a sale or IPO has reduced.

Accordingly, the value of the payouts under the NSN Equity

Incentive Plan are expected to be reduced by %.

The actual payments, if any, under the NSN Equity Incentive

Plan will be determined based on the value of the Networks

business and could ultimately decline to zero if the value of

the business falls below a certain level. There is also a cap that

limits the upside for all plan participants, and if an IPO or sale

has not occurred, the maximum total payment to Mr. Suri pur-

suant to the plan would be limited to EUR . million. In the

unlikely event of an IPO or exit event the value of the options

could exceed this maximum.

These equity awards were originally intended to vest upon

the sale or IPO of NSN, or upon the fourth anniversary of

the grant date. Given the change in Nokia’s strategy and the

signifi cant improvement in the performance of NSN, the Nokia

Board of Directors has determined that % of the options

will vest on the third anniversary of grant (June , ) and

% will continue to vest on the fourth anniversary of grant

(June , )

Mr. Suri is subject to a -month non-competition obliga-

tion that applies after the termination of the service contract

or the date when he is released from his obligations and

responsibilities, whichever occurs earlier.

Executive arrangements with the

Leadership Team

Nokia has entered into executive agreements with all members

of the Nokia Leadership Team (valid through April , ) and

the Nokia Group Leadership Team (valid as from May , ).

The below description of employment arrangements refers

to Nokia Group Leadership Team but is valid for both Nokia

Leadership Team and Nokia Group Leadership Team, unless

otherwise specifi cally mentioned. The contracts of Mr. Elop,

Mr.Ihamuotila and Mr. Suri are described above.

Under the terms of their executive agreements with Nokia,

Nokia Group Leadership Team members are entitled to a sev-

erance payment of up to months of compensation inclusive

of annual base salary, management incentive at target under

the Nokia short-term cash incentive program and benefi ts.

In case of termination by a Nokia Group Leadership Team

member, the notice period is six months and such member is

entitled to a payment for such notice period inclusive of an-

nual base salary, annual management incentive at target and

benefi ts. All equity will be forfeited. In case of termination by

Nokia for cause, Nokia Group Leadership Team member will

not be entitled to any notice period or additional compensa-

tion and all equity will be forfeited. In case of termination by

the Nokia Group Leadership Team member for cause, such

member is entitled to a severance payment equivalent of up

to months’ compensation inclusive of annual base salary,

annual management incentive at target and benefi ts. Nokia

Group Leadership Team members are subject to a -month

non-competition obligation after termination of the contract.

Unless the contract is terminated by Nokia for cause, the