Nokia 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

COMPENSATION OF THE BOARD OF DIRECTORS AND THE NOKIA GROUP LEADERSHIP TEAM

In employees of Networks were excluded from Nokia’s

equity incentive programs.

For a more detailed description of all of our equity-based

incentive plans, see Note to our consolidated fi nancial

statements.

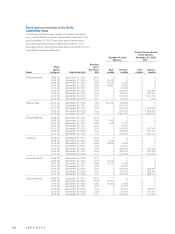

Performance shares

During , we administered four global performance share

plans: the Performance Share Plans of , , and

, each of which, including its terms and conditions, has

been approved by the Board of Directors.

The performance shares represent a commitment by Nokia

Corporation to deliver Nokia shares to employees at a future

point in time, subject to Nokia’s fulfi llment of pre-defi ned

performance criteria. No Nokia shares will be delivered unless

the Group’s performance reaches at least one of the threshold

levels measured by two independent, pre-defi ned perfor-

mance criteria. The below table illustrates the performance

criteria of the Performance Share Plans from through

.

Performance share plan

Performance criteria 2012 2011 2010 2009

Average annual net sales

growth (Nokia Group) — — yes yes

EPS at the end of

performance period

(Nokia Group) — — — yes

Average annual net sales

(Nokia Group excluding

Networks) yes 1 yes — —

Average annual net sales

(Nokia Group) yes 2 — — —

Average annual EPS

(Nokia Group) yes yes yes —

Specific to year, of the two-year performance period ( – ),

only.

Specific to year, of the two-year performance period ( – ),

only to reflect the change in ownership structure of Networks.

The and plans have a three-year performance pe-

riod. The shares vest after the respective performance period.

The and plans have a two-year performance period

and a subsequent one-year restriction period, after which the

shares vest. The shares will be delivered to the participants as

soon as practicable after they vest. No shares will be deliv-

ered if Nokia’s performance does not reach the performance

criteria. The below table summarizes the relevant periods and

settlements under the plans.

Performance

Plan period Settlement

2010 1 2010 – 2012 2013

2011 2 2011 – 2013 2014

2012 2 2012 – 2013 3 2015

2013 2013 – 2014 3 2016

No Nokia shares were delivered under the Nokia Performance Share Plan

as Nokia’s performance did not reach the requisite threshold level

with respect to the applicable performance criteria under the plan.

No Nokia shares will be delivered under the Nokia Performance Share

Plans and as Nokia’s performance did not reach the requisite

threshold level with respect to the applicable performance criteria for

either plan.

Nokia Performance Share Plans and have a one-year restriction

period after the two-year performance period.

Until the shares are delivered, the participants will not have

any shareholder rights, such as voting or dividend rights, as-

sociated with the performance shares. The performance share

grants are generally forfeited if the employment relationship

terminates with Nokia prior to vesting.

Similar to the previous , and plans, there

was no payout from the Nokia Performance Share Plan .

There will also be no payout from Nokia Performance Share

Plan as the threshold level under the applicable perfor-

mance criteria was not reached.

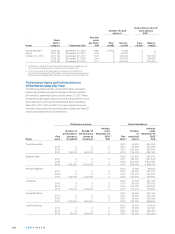

Stock options

During we administered two global stock option plans:

the Stock Option Plans and , each of which, includ-

ing its terms and conditions, has been approved by the Annual

General Meeting in the year when the plan was launched.

Each stock option entitles the holder to subscribe for one

new Nokia share. The stock options are non-transferable

and may be exercised for shares only. All of the stock options

granted under the Stock Option Plan have a vesting

schedule with % of the options vesting one year after grant

and .% each quarter thereafter. The stock options granted

under the plan have a term of approximately fi ve years.

The stock options granted under the Stock Option Plan

have a vesting schedule with % of stock options vesting

three years after grant and the remaining % vesting four

years from grant. The stock options granted under the

plan have a term of approximately six years.

The exercise price of the stock options is determined at

the time of grant, on a quarterly basis, in accordance with

a pre-agreed schedule after the release of Nokia’s periodic

fi nancial results. The exercise prices are based on the trade

volume weighted average price of a Nokia share on NASDAQ

OMX Helsinki during the trading days of the fi rst whole week

of the second month of the respective calendar quarter (i.e.,

February, May, August or November). With respect to the Stock

Option Plan , should an ex-dividend date take place during

that week, the exercise price shall be determined based on the

following week’s trade volume weighted average price of the

Nokia share on NASDAQ OMX Helsinki. Exercise prices are deter-

mined on a one-week weighted average to mitigate any day-

specifi c fl uctuations in Nokia’s share price. The determination

of exercise price is defi ned in the terms and conditions of the

stock option plans, which were approved by the shareholders

at the Annual General Meetings and . The Board of

Directors does not have the right to change how the exercise

price is determined.

Shares will be eligible for dividend for the fi nancial year in

which the share subscription takes place. Other shareholder

rights will commence on the date on which the subscribed

shares are entered in the Trade Register. The stock option

grants are generally forfeited if the employment relationship

terminates with Nokia.

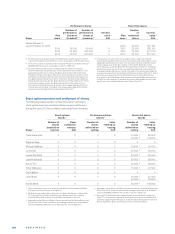

Restricted shares

During , we administered four global restricted share

plans: the Nokia Restricted Share Plans , , and

, each of which, including its terms and conditions, has

been approved by the Board of Directors.