Nokia 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

88

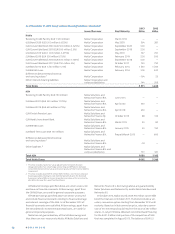

11. LEASING CONTRACTS

At December 31, 2013 the leasing contracts of the Parent

Company amounted to EUR 22 million (EUR 37 million in 2012).

EUR 8 million will expire in 2014 (EUR 12 million in 2013).

12. LOANS GRANTED TO THE MANAGEMENT

OF THE COMPANY

There were no loans granted to the members of the Group

Executive Board and Board of Directors at December , .

13. NOTES TO CASH FLOW STATEMENTS

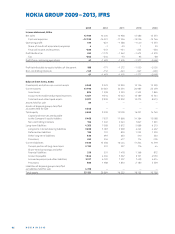

EURm 2013 2012

Adjustments for:

Depreciation 126 164

Income taxes 23 471

Financial income and expenses – 1504 – 2694

Impairment of intangible assets 1 12

Impairment of non-current

available-for-sale investments 1277 150

Other operating income and expenses – 114 – 234

Adjustments, total – 191 – 2131

Change in net working capital

Short-term trade receivables,

increase (–), decrease (+) 1005 2190

Inventories, increase (–), decrease (+) – 25 167

Interest-free short-term liabilities,

increase (+), decrease (–) – 688 – 726

Change in net working capital 292 1631

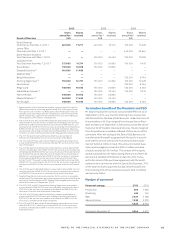

14. PRINCIPAL NOKIA GROUP COMPANIES

ON DECEMBER 31, 2013

See note to Notes to the consolidated fi nancial statements.

15. NOKIA SHARES AND SHAREHOLDERS

See Nokia shares and shareholders p. 90–94.

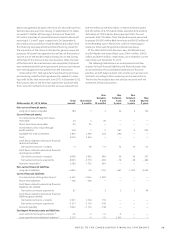

16. ACCRUED INCOME

EURm 2013 2012

Taxes 7 58

Other 1931 2169

Total 1938 2227

9. LONG-TERM LIABILITIES

EURm 2013 2012

Bonds 1645 3036

Convertible bond 745 743

Loans from fi nancial institutions — 500

Liabilities from Group companies 200 200

Long-term liabilities, total 2590 4479

Long-term liabilities repayable after 5 years

Bonds 1645 1749

Convertible bond — —

Loans from fi nancial institutions — —

Long-term liabilities, total 1645 1749

Bonds Million Interest, %

2009 – 2014 1250 EUR 5.534 * — 1287

2009 – 2019 1000 USD 5.572 747 805

2009 – 2019 500 EUR 6.792 545 558

2009 – 2039 500 USD 6.775 353 386

1645 3036

Convertible bond Million Interest, %

2012 – 2017 750 EUR 7.920 745 743

2013 – 2018 500 EUR 1.125 * — —

2013 – 2019 500 EUR 2.500 * — —

2013 – 2020 500 EUR 3.625 * — —

745 743

* Included in short-term liabilities.

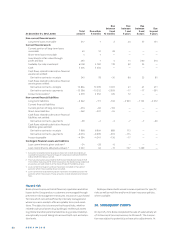

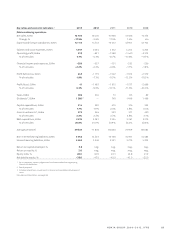

10. COMMITMENTS AND CONTINGENCIES

EURm 2013 2012

Collateral for own commitments

Assets pledged 3 3

Contingent liabilities on behalf

of Group companies

Guarantees for loans 2 1

Leasing guarantees 143 168

Other guarantees 55 43

Contingent liabilities on behalf

of associated companies

Guarantees for loans 16 11

Contingent liabilities on behalf

of other companies

Guarantees for loans 12 12

Other guarantees 24 27