Nokia 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

may, from time to time, have investments in public equity.

Such investments have not been included in the aforemen-

tioned number.

B) CREDIT RISK

Credit risk refers to the risk that a counterparty will default

on its contractual obligations resulting in fi nancial loss to the

Group. Credit risk arises from credit exposures to custom-

ers, including outstanding receivables, fi nancial guarantees

and committed transactions as well as fi nancial institutions,

including bank and cash, fi xed income and money-market

investments and derivative fi nancial instruments. Credit risk

is managed separately for business related and fi nancial credit

exposures.

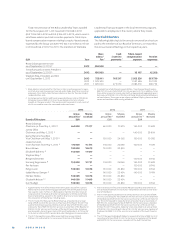

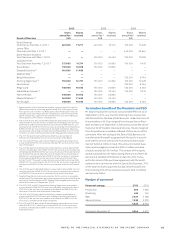

Except as detailed in the following table, the maximum

exposure to credit risk is limited to the book value of the

fi nancial assets as included in the consolidated statement of

fi nancial positions:

‘

EURm 2013 2012

Financial guarantees given on behalf of

customers and other third parties 12 12

Loan commitments given but not used 25 34

37 46

Business related credit risk

The Company aims to ensure the highest possible quality in

accounts receivable and loans due from customers and other

third parties. Nokia and NSN Credit Policies, both approved by

the respective Leadership Teams, lay out the framework for

the management of the business related credit risks in Nokia

and NSN.

Nokia and NSN Credit Policies provide that credit decisions

are based on credit evaluation including credit rating for larger

exposures. Nokia and NSN Rating Policy defi nes the rating prin-

ciples. Ratings of material exposures are approved by Nokia’s

Rating Committee and NSN’s Rating Committee. Credit risks

are approved and monitored according to the credit policy of

each business entity. When appropriate, credit risks are miti-

gated with the use of approved instruments, such as letters of

credit, collateral or insurance and sale of selected receivables.

Credit exposure is measured as the total of accounts receiv-

able and loans outstanding due from customers and commit-

ted credits.

The accounts receivable do not include any major concen-

trations of credit risk by customer. The top three customers

account for approximately .%, .% and .% (.%, .%

and .% in ) of Group accounts receivable and loans due

from customers and other third parties as at December ,

, while the top three credit exposures by country amount-

ed to .%, .% and .% (.%, .% and .% in ),

respectively with China being the biggest exposure.

The Group has provided allowances for doubtful accounts as

needed on accounts receivable and loans due from customers

and other third parties not past due, based on the analysis of

debtors’ credit quality and credit history. The Group estab-

lishes allowances for doubtful accounts that represent an

estimate of incurred losses as of the end of reporting period.

All receivables and loans due from customers are considered

on an individual basis in establishing the allowances for doubt-

ful accounts.

As at December , , the carrying amount before

deducting any allowances for doubtful accounts as well as

amounts expected to be uncollectible for acquired receivables

relating to customers for which an allowance was provided or

an uncollectible amount has been identifi ed amounted to EUR

million (EUR million in ). The amount of allow-

ance recognized against that portion of these receivables

considered to be impaired as well as the amount expected to

be uncollectible for acquired receivables was a total of EUR

million (EUR million in ) (see also Note and Note ).

These aforementioned sums are relative to total net accounts

receivable and loans due from customers of EUR in

(EUR million in ).

An amount of EUR million (EUR million in )

relates to past due receivables from customers for which no

allowances for doubtful accounts were recognized. The aging

of these receivables is as follows:

EURm 2013 2012

Past due 1 – 30 days 53 250

Past due 31 – 180 days 43 70

More than 180 days 13 45

109 365

Financial credit risk

Financial instruments contain an element of risk resulting from

changes in market price of such instruments due to counter-

parties becoming less credit worthy or risk of loss due to coun-

terparties being unable to meet their obligations. This risk is

measured and monitored centrally by Treasury departments in

Nokia and NSN. Financial credit risk is managed actively by lim-

iting counterparties to a suffi cient number of major banks and

fi nancial institutions and monitoring the credit worthiness and

exposure sizes continuously as well as through entering into

netting arrangements (which gives Nokia the right to off set in

the event that the counterparty would not be able to fulfi ll the

obligations) with all major counterparties and collateral agree-

ments (which require counterparties to post collateral against

derivative receivables) with certain counterparties.

Nokia’s investment decisions are based on strict creditwor-

thiness and maturity criteria as defi ned in Treasury related

policies and procedures. As a result of this investment policy

approach and active management of outstanding investment

exposures, Nokia has not been subject to any material credit

losses in its fi nancial investments in the years presented.

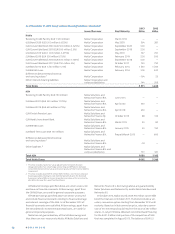

The table below presents the breakdown of the outstanding

fi xed income and money market investments by sector and

credit rating grades ranked as per Moody’s rating categories.