Nokia 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

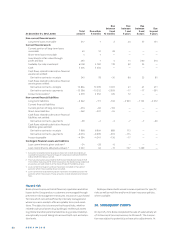

NOTES TO THE FINANCIAL STATEMENTS OF THE PARENT COMPANY

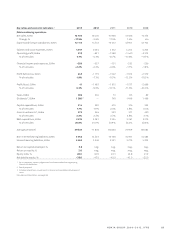

8. DISTRIBUTABLE EARNINGS

EURm 2013 2012

Reserve for invested non-restricted equity 3099 3120

Fair value reserve – 19 – 46

Retained earnings from previous years 2773 2927

Net profi t for the year – 569 – 154

Retained earnings, total 5284 5847

Treasury shares – 608 – 634

Distributable earnings, December 31 4676 5213

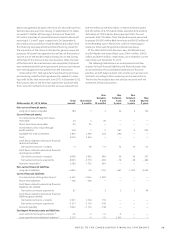

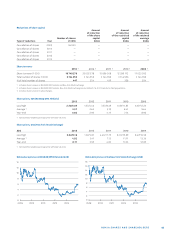

7. SHAREHOLDERS’ EQUITY

Reserve

Share for invested

Share issue Treasury Fair value non-restricted Retained

Parent Company, EURm capital premium shares reserve equity earnings Total

Balance at December 31, 2010 246 — – 669 — 3145 3612 6334

Other contribution from shareholders 46 46

Settlement of performance and restricted shares 20 – 13 7

Fair value reserve increase 68 68

Dividend – 1484 – 1484

Net profi t 1542 1542

Balance at December 31, 2011 246 46 – 649 68 3132 3670 6513

Settlement of performance and restricted shares 15 -12 3

Fair value reserve decrease – 114 – 114

Dividend – 743 – 743

Net profi t – 154 – 154

Balance at December 31, 2012 246 46 – 634 – 46 3120 2773 5505

Settlement of performance and restricted shares 26 – 21 5

Fair value reserve decrease 27 27

Dividend — —

Net profi t – 569 – 569

Balance at December 31, 2013 246 46 – 608 – 19 3099 2204 4968

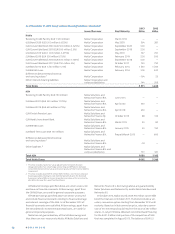

NOTES TO THE FINANCIAL STATEMENTS OF THE PARENT COMPANY

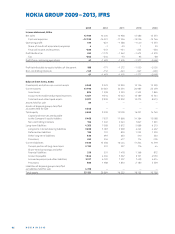

6. INVESTMENTS

EURm 2013 2012

Investments in subsidiaries

Acquisition cost January 1 11548 11199

Additions 354 3127

Impairments – 1240 – 740

Disposals – 37 – 2038

Net carrying amount December 31 10625 11548

Investments in associated companies

Acquisition cost January 1 3 11

Additions — 1

Impairments — – 8

Disposals — – 1

Net carrying amount December 31 3 3

Investments in other shares

Acquisition cost January 1 105 85

Additions 7 23

Impairments — – 2

Disposals – 4 – 1

Net carrying amount December 31 108 105