Nokia 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOKIA IN 2013

38

impact future profi ts. From time to time the Group endeavors

to mitigate this risk through transfer of its rights to the cash

collected from these arrangements to third party fi nancial in-

stitutions on a non-recourse basis in exchange for an upfront

cash payment.

ALLOWANCES FOR DOUBTFUL ACCOUNTS

The Group maintains allowances for doubtful accounts for es-

timated losses resulting from subsequent inability of custom-

ers to make required payments. If the fi nancial conditions of

customers were to deteriorate, reducing their ability to make

payments, additional allowances may be required.

INVENTORY-RELATED ALLOWANCES AND PROVISIONS

The Group periodically reviews inventory for excess amounts,

obsolescence and declines in net realizable value below cost

and records an allowance against the inventory balance for any

such declines. These reviews require management to estimate

future demand for products. Possible changes in these esti-

mates could result in revisions to the valuation of inventory in

future periods. The Group recognizes the estimated liability

for non-cancellable purchase commitments for inventory in

excess of forecasted requirements at each balance sheet date.

RESTRUCTURING PROVISIONS

The Group provides for the estimated future cost related to

restructuring programs. The provision made for restructuring

is based on management’s best estimate. Changes in esti-

mates of timing or amounts of costs to be incurred may be-

come necessary as the restructuring program is implemented.

PROJECT LOSS PROVISIONS

The Group provides for onerous contracts based on the lower

of the expected cost of fulfi lling the contract and the expected

cost of termination the contract. Due to the long-term nature

of customer projects, changes in estimates of costs to be

incurred, and therefore project loss estimates, may become

necessary as the projects are executed.

WARRANTY PROVISIONS

The Group provides for the estimated cost of product warran-

ties at the time revenue is recognized. The Group’s warranty

provision is established based upon best estimates of the

amounts necessary to settle future and existing claims on

products sold as of each balance sheet date. As new prod-

ucts incorporating complex technologies are continuously

introduced, and as local laws, regulations and practices may

change, changes in these estimates could result in additional

allowances or changes to recorded allowances being required

in future periods.

PROVISION FOR INTELLECTUAL PROPERTY RIGHTS (IPR)

INFRINGEMENTS

The Group provides for the estimated past costs related to al-

leged asserted IPR infringements. The provision is an estimate

calculated based on a probable outcome of potential future

settlement. IPR infringement claims can last for varying periods

of time, resulting in irregular movements in the IPR infringe-

ment provision. The ultimate outcome or actual cost of settling

an individual infringement may materially vary from estimates.

LEGAL CONTINGENCIES

Legal proceedings covering a wide range of matters are

pending or threatened in various jurisdictions against the

Group. Provisions are recorded for pending litigation when it is

determined that an unfavorable outcome is probable and the

amount of loss can be reasonably estimated. Due to the inher-

ent uncertain nature of litigation, the ultimate outcome or

actual cost of settlement may materially vary from estimates.

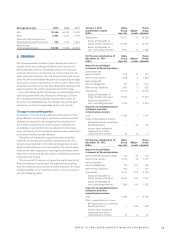

BUSINESS COMBINATIONS

The Group applies the acquisition method of accounting to

account for acquisitions of businesses. The consideration

transferred in a business combination is measured as the ag-

gregate of the fair values of the assets transferred, liabilities

incurred towards the former owners of the acquired business

and equity instruments issued. Identifi able assets acquired

and liabilities assumed by the Group are measured separately

at their fair value as of the acquisition date. Non-controlling

interests in the acquired business are measured separately

based on their proportionate share of the identifi able net

assets of the acquired business. The excess of the cost of the

acquisition over Nokia’s interest in the fair value of the identifi -

able net assets acquired is recorded as goodwill.

The allocation of fair values to the identifi able assets

acquired and liabilities assumed is based on various valuation

assumptions requiring management judgment. Actual results

may diff er from the forecasted amounts and the diff erence

could be material. See also Note .

ASSESSMENT OF THE RECOVERABILITY OF LONG-LIVED

ASSETS, INTANGIBLE ASSETS AND GOODWILL

The recoverable amounts for long-lived assets, intangible

assets and goodwill have been determined based on the ex-

pected future cash fl ows attributable to the asset or cash-gen-

erating unit discounted to present value. The key assumptions

applied in the determination of recoverable amount include

discount rate, length of an explicit forecast period, estimated

growth rates, profi t margins and level of operational and capi-

tal investment. Amounts estimated could diff er materially from

what will actually occur in the future. See also Note .

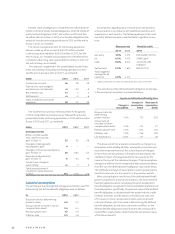

INCOME TAXES

Management judgment is required in determining current

tax expense, uncertain tax positions, deferred tax assets and

liabilities and the extent to which deferred tax assets can be

recognized. Each reporting period deferred tax assets are

assessed for realizability and when circumstances indicate it

is no longer probable that deferred tax assets will be utilized,

they are adjusted as necessary. In the event any deferred

tax assets are to be re-recognized, they would be subject to