Nokia 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

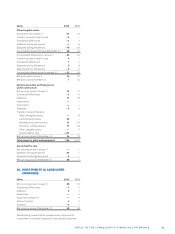

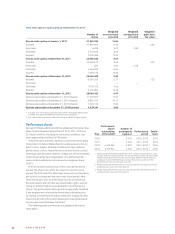

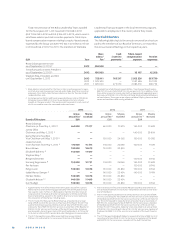

Performance shares outstanding as at December ,

Number of Weighted

performance averagegrant

shares at datefairvalue

threshold EUR 2

Performance shares

at January1, 2011 5 720 123

Granted 5 410 211 3.66

Forfeited 1 538 377

Vested 3 2 009 423

Performance shares

at December31, 2011 7 582 534

Granted 5 785 875 1.33

Forfeited 2 718 208

Vested 4 2 076 116

Performance shares

at December31, 2012 8 574 085

Granted 6 696 241 2.96

Forfeited 1 512 710

Vested 5 2 767 412

Performance shares

at December31, 2013 10990204

Includes also performance shares granted under other than global equity

plans. For further information see “Other equity plans for employees”

below.

The fair value of performance shares is estimated based on the grant

date market price of the Nokia share less the present value of dividends

expected to be paid during the vesting period.

Includes performance shares under Performance Share Plan that

vested on December , . There was no settlement under this plan as

neither of the threshold performance criteria was met.

Includes performance shares under Performance Share Plan that

vested on December , . Includes shares receivable through the

one-time special CEO incentive program that vested on December ,

, there was no settlement under the one-time special CEO incentive

program as the performance criteria were not met.

Includes performance shares under Performance Share Plan that

vested on December , .

There was no settlement under the Performance Share Plan and

there will be no settlement under the Performance Share Plan as

neither of the threshold performance criteria linked to EPS and Average

Annual Net Sales Revenue of these plans were met.

Restricted shares

During , Nokia administered four global restricted share

plans, the Restricted Share Plan , , and ,

each of which, including its terms and conditions, has been

approved by the Board of Directors.

Restricted Shares are used on a selective basis to ensure re-

tention and recruitment of individuals with functional mastery

and other employees deemed critical to Nokia’s future success.

All of the Group’s restricted share plans have a restriction

period of three years after grant. Until the Nokia shares are

delivered, the participants will not have any shareholder rights,

such as voting or dividend rights, associated with the restrict-

ed shares. The restricted share grants are generally forfeited

if the employment relationship terminates with Nokia prior

to vesting. Unvested restricted shares for employees who

have transferred to Microsoft following the sale of Devices &

Services business have been forfeited.

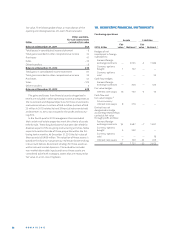

Restricted shares outstanding as at December ,

Weighted

Number of average

restricted grant date fair

shares value EUR 2

Restricted shares

at January1, 2011 12359896

Granted 8024880 3.15

Forfeited 2063518

Vested 1735167

Restricted shares

at December31, 2011 3 16586091

Granted 12999131 1.76

Forfeited 4580182

Vested 1324508

Restricted shares

at December31, 2012 4 23680532

Granted 12347931 3.05

Forfeited 3490913

Vested 2180700

Restricted shares

at December31, 2013 5 30356850

Includes also restricted shares granted under other than global equity

plans.

The fair value of restricted shares is estimated based on the grant date

market price of the Nokia share less the present value of dividends, if any,

expected to be paid during the vesting period.

Includes restricted shares granted in Q under Restricted

Share Plan that vested on January , .

Includes restricted shares granted in Q under Restricted

Share Plan that vested on January , .

Includes restricted shares granted in Q under Restricted

Share Plan that vested on January , .

Other equity plans for employees

During – , Nokia had a one-time special CEO incen-

tive program designed to align Mr. Elop’s compensation to

increased shareholder value and to link a meaningful portion

of CEO’s compensation directly to the performance of Nokia’s

share price over the period of – . Mr. Elop had the op-

portunity to earn – Nokia shares at the end of

based on two independent criteria: Total Shareholder Re-

turn relative to a peer group of companies over the two-year

period and Nokia’s absolute share price at the end of . As

the minimum performance for neither of the two performance

criterion was reached, no share delivery took place.

NSN established a share-based incentive program in

under which options for Nokia Solutions and Networks B.V.

shares are granted to selected NSN’s senior management and

key employees. The options generally become exercisable on

the fourth anniversary of the grant date or, if earlier, on the

occurrence of certain corporate transactions, such as an initial

public off ering. The exercise price of the options is based on

a per share value on grant as determined for the purposes of

the incentive program. The options will be cash-settled at ex-

ercise unless an IPO has taken place, at which point they would

be converted into equity-settled options. The options are

accounted for as a cash-settled share-based payment liability

based on the circumstances at December, . The fair

value of the liability is determined based on the estimated fair

value of shares less the exercise price of the options on the