Nokia 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

44

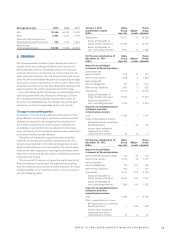

The Group’s most signifi cant defi ned benefi t pension plans

are in Germany, UK, India and Switzerland. Together they

account for % (% in ) of the Group’s total defi ned

benefi t obligation and % (% in ) of the Group’s total

plan assets.

Germany

The majority of active employees in Germany participate in the

cash balance plan BAP (Beitragsorientierter Alterversorgungs

Plan), formerly known as Beitragsorientierte Siemens Alterver-

sorgung (“BSAV”). Individual benefi ts are generally dependent

on eligible compensation levels, ranking within the Group and

years of service. This plan is a partly funded defi ned benefi t

pension plan, the benefi ts of which are subject to a minimum

return guaranteed by the Group. The funding vehicle for the BAP

plan is the NSN Pension Trust e.V. The trust is legally separate

from the Group and manages the plan assets in accordance with

the respective trust agreements with the Group. The risks spe-

cifi c to the German defi ned benefi t plans are related to changes

in mortality of covered members and investment return of the

plan assets. Curtailments were recognized in service costs for

German pension plans during as a result of reduction in

workforce in and the planned reduction in .

United Kingdom

The Group has a UK defi ned benefi t plan divided into two sec-

tions: the money purchase section and the fi nal salary section,

both being closed to future contributions and accruals as of

April , . Individual benefi ts are generally dependent on

eligible compensation levels and years of service for the de-

fi ned benefi t section of the plan and on individual investment

choices for the defi ned contribution section of the plan. The

funding vehicle for the pension plan is the NSN Pension Plan

that is run on a trust basis.

India

Government mandated gratuity and provident plans provide

benefi ts based on years of service and projected salary levels

at the date of separation for the Gratuity Plan and through

an interest rate guarantee on existing investments in a

government prescribed Provident Fund Trust. Gratuity Fund

plan assets are invested and managed through an insurance

policy. Provident Fund Assets are managed by NSN PF Trustees

through a pattern prescribed by the Government in various

fi xed income securities.

Switzerland

The Group’s Swiss pension plans are governed by the Swiss

Federal Law on Occupational Retirements, Survivors’ and

Disability Pension plans (BVG), which stipulates that pension

plans are to be managed by an independent, legally autono-

mous unit. In Switzerland, individual benefi ts are provided

through the collective foundation Profond. The plan’s benefi ts

are based on age, years of service, salary and an individual

old age account. The funding vehicle for the pension scheme

is the Profond Vorsorgeeinrichtung. During fi scal year ,

the collective foundation Profond has decided to decrease

their conversion rates (pension received as a percentage of

retirement savings) in fi ve years gradually from .% to .%,

which will reduce the expected benefi ts at retirement for all

employees. This event qualifi es as a plan amendment and the

past service gain of EUR million arising from this amendment

was recognized immediately in the service cost of the year.

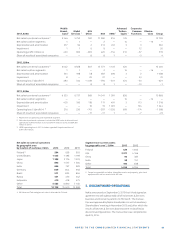

The following table presents the defi ned benefi t obliga-

tions, the fair value of plan assets, the eff ects of the asset

ceiling and the net defi ned benefi t balance at December ,

for continuing operations and at December , for

the Group, as restated.

Defi ned benefi t Fair value of Eff ects of Net defi ned

obligation plan assets asset ceiling benefi t balance

EURm 2013 2012 2013 2012 2013 2012 2013 2012

Germany – 1062 – 1305 904 996 — — – 158 – 309

UK – 98 – 405 108 527 — — 10 122

India – 85 – 115 82 110 – 1 — – 4 – 5

Switzerland – 78 – 91 63 57 — — – 15 – 34

Other – 130 – 157 104 118 – 6 – 3 – 32 – 42

Nokia Group Total – 1453 – 2073 1261 1808 – 7 – 3 – 199 – 268