Nokia 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

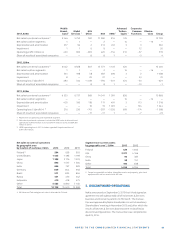

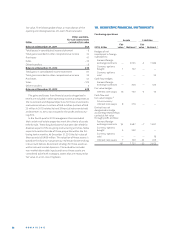

EURm 2013 2012 2011

Smart Devices 1 — 899 862

Mobile Phones 1 — 530 502

Devices& Services

(discontinued operations) 1 1 417 — —

HERE 3 219 3 270 3 274

Radio Access Networks

in Mobile Broadband 2 88 — —

Global Services 2 91 — —

NSN 2 — 183 173

Total 4815 4882 4811

Smart Devices and Mobile Phones CGUs have been combined to a single

Devices & Services CGU in .

NSN has two groups of CGUs to which goodwill has been allocated in .

The recoverable values of the Smart Devices and Mobile

Phones CGUs, were previously valued on a value in use basis.

Value in use was based on reasonable and supportable as-

sumptions that represented management’s best estimate of

the economic circumstances that will prevail over the remain-

ing life of an asset (“steady state”). During , the Devices

& Services CGU recoverable value was estimated based on the

fair value less cost of disposal based on the agreed purchase

price defi ned for the Sale of the D&S business, excluding any

consideration attributable to patents or patent applications.

The recoverable amounts for the HERE CGU, Radio Access

Networks and Global Services group of CGUs are based on

fair value less cost of disposal and were EUR million, EUR

million and EUR million, respectively, at the date

of the annual impairment testing. The valuation meth-

odologies have remained consistent from previous years. Fair

value less cost of disposal was estimated using a discounted

cash fl ow calculation. The cash fl ow projections employed in

the discounted cash fl ow calculation have been determined by

management based on the information available to refl ect the

amount that an entity could obtain from separate disposal of

each of the CGUs, in an orderly transaction between market

participants at the measurement date after deducting the

estimated costs of disposal. The estimates of fair value less

cost of disposal are categorized in the level of the fair value

hierarchy.

Discounted cash fl ows for the NSN groups of CGUs and HERE

CGU were modeled over ten annual periods. The growth rates

used in transitioning to terminal year refl ect estimated long-

term stable growth which do not exceed long-term average

growth rates for the industry and economies in which the CGUs

operate. All cash fl ow projections are consistent with external

sources of information, wherever possible.

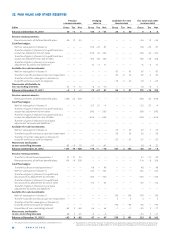

The key assumptions applied in the impairment test-

ing analysis for each CGU are presented in the table below.

No information has been included for the Devices & Services

CGU as the recoverable amount was not determined using a

discounted cash fl ow analysis and the CGU is attributable to

discontinued operations:

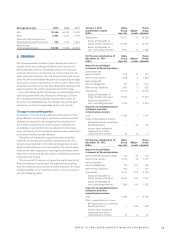

Cash-generating unit

RadioAccess Global

Networksgroup Services

ofCGUsinMobile group

HERE Broadband

1 ofCGUs 1 NSN

% 2013 2012 2013 2012 2013 2012 2013 2012

Terminal growth rate 1.7 1.7 1.5 — 0.5 — — 0.7

Post-tax discount rate 10.6 9.9 10.8 — 10.1 — — 10.3

NSN CGU is divided into two groups of CGUs in : Radio Access Net-

works group of CGUs within the Mobile Broadband operating segment and

the Global Services group of CGUs.

Fair value less cost of disposal for the HERE CGU and Radio

Access Networks and Global Services group of CGUs are

determined using post-tax valuation assumptions including

projected cash fl ows and the discount rate.

The discount rates applied in the impairment testing for the

above noted CGUs or groups of CGUs refl ect current assess-

ments of the time value of money and relevant market risk

premiums. Risk premiums included in the determination of

the discount rate refl ect risks and uncertainties for which the

future cash fl ow estimates have not been adjusted.

In the fourth quarter of the Group recorded an impair-

ment loss of EUR million to reduce the carrying amount

of the HERE CGU to its recoverable amount at that time. The

impairment loss was allocated in its entirety to the carrying

amount of goodwill. The Group’s goodwill impairment test-

ing did not result in impairment charges for the years ended

December, or .

The recoverable amount of the HERE CGU exceeds its carry-

ing amount by a small margin at the testing date. The related

valuation is deemed most sensitive to the changes in both

discount and long-term growth rates. A discount rate increase

in excess of . percentage point or long-term growth decline

in excess of . percentage point would result in impairment

loss in the HERE CGU. Management’s estimates of the overall

automotive volumes and market share, customer adoption of

the new location-based platform and related service off er-

ings, projected value of the services sold to Microsoft and

assumptions regarding pricing as well as continued focus on

cost effi ciency are the main drivers for the HERE net cash fl ow

projections. The Group’s cash fl ow forecasts refl ect the cur-

rent strategic views that license fee based models will remain

important in both near and long term. Management expects

that license fee based models which are augmented with soft-

ware and services and monetized via license fees, transactions