Nokia 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

10

to the exiting of certain customer contracts and countries as

part of NSN’s strategy to focus on more profi table business as

well as a decline in network roll-outs in Japan and Europe.

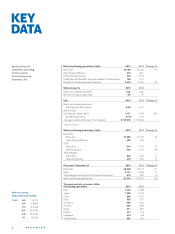

The following table sets forth the distribution by geographi-

cal area of our net sales for the fi scal years and .

NSN net sales by geographic area

YoY

EURm 2013 2012 Change

Europe 3 041 3 896 – 22%

Middle East & Africa 1 111 1 287 – 14%

Greater China 1 185 1 278 – 7%

Asia–Pacifi c 3 354 4 347 – 23%

North America 1 334 1 294 3%

Latin America 1 257 1 677 – 25%

Total 11 282 13 779 – 18%

GROSS MARGIN

NSN’s gross margin was .% in , compared to .%

in , driven by improved effi ciency in Global Services, an

improved product mix with a greater share of higher margin

products, and the divestment of less profi table businesses.

In Mobile Broadband, gross margin improved in driven

by an increased software share in the product mix, off set by

costs incurred in anticipation of a technology shift to TD-LTE.

In Global Services, gross margin improved signifi cantly in

due to the increase in effi ciencies as part of our restruc-

turing program and the exit of certain customer contracts and

countries as part of NSN’s strategy to focus on more profi table

business.

OPERATING EXPENSES

NSN’s research and development expenses decreased %

year-on-year in to EUR million from EUR million

in , primarily due to business divestments and reduced

investment in business activities not in line with NSN’s focused

strategy as well as increased research and development ef-

fi ciency, partially off set by higher investments in business

activities that are in line with NSN’s focused strategy, most

notably LTE.

NSN’s sales and marketing expenses decreased % year-

on-year in to EUR million from EUR million in ,

primarily due to structural cost savings from NSN’s restruc-

turing program and a decrease in purchase price accounting

related items arising from the formation of NSN, which were

fully amortized at the end of the fi rst quarter of .

NSN’s administrative and general expenses increased %

year-on-year in to EUR million from EUR million in

, primarily due to consultancy fees related to fi nance and

information technology related projects, partially off set by

structural cost savings.

NSN’s other income and expenses decreased in to

an expense of EUR million from an expense of EUR

million in . In other income and expenses included

restructuring charges of EUR million, including EUR mil-

lion related to country and contract exits and EUR million

related to divestments to businesses, and in included

restructuring charges and associated charges of EUR mil-

lion, including EUR million related to country and contract

exits, divestment of businesses EUR million, impairments of

assets of EUR million, a negative adjustment of EUR million

to purchase price allocations related to the fi nal payment from

Motorola, as well as amortization of acquired intangible assets

of EUR million.

OPERATING PROFIT (LOSS)

NSN’s operating profi t in was EUR million, compared

with an operating loss of EUR million in . NSN’s operat-

ing margin in was .%, compared with a negative .% in

. The increase in operating profi t was primarily a result of

an increase in the contribution of Global Services and a reduc-

tion in costs associated with NSN’s transformation, consisting

mainly of restructuring charges. Further, the purchase price

accounting related items arising from the formation of NSN,

which were fully amortized at the end of the fi rst quarter of

.

The contribution of Mobile Broadband declined from EUR

million in to EUR million in , primarily as a

result of lower net sales, which was partially off set by an im-

proved gross margin and a reduction in operating expenses.

The contribution of Global Services increased from EUR

million in to EUR million in , as the increase in

gross margin more than compensated for the decline in net

sales, and the contribution in was further supported by a

reduction in operating expenses.

STRATEGY AND RESTRUCTURING PROGRAM

In November , NSN announced its strategy to focus on

mobile broadband and services, and also launched an exten-

sive global restructuring program, targeting the reduction of

its annualized operating expenses and production overhead,

excluding special items and purchase price accounting related

items, by EUR billion by the end of , compared to the end

of . In January , this target was raised to EUR . billion,

and in July this target was further raised to “more than

EUR . billion”. While these savings were expected to come

largely from organizational streamlining, the program also

targeted areas such as real estate, information technology,

product and service procurement costs, overall general and

administrative expenses, and a signifi cant reduction of suppli-

ers in order to further lower costs and improve quality. In ,

NSN achieved its target to reduce operating expenses and

production overhead, excluding special items and purchase